Decentralized lending protocol Aave has successfully processed $210 million in liquidations without adding to its existing bad debt.

Data from Chaos Labs shows that following Monday’s flash crash, which wiped out roughly $2.2 billion in crypto market value, the extreme market volatility led to a sudden spike in liquidations across the protocol. The liquidations summed up to $210 million, the largest such single-day liquidation total since the Aug. 5 crash.

Typically, periods of high volatility create the circumstances for bad debts because the perfect storm of multiple liquidation requests, steep price declines and low demand create lengthy liquidation queues that a protocol may struggle to clear up.

Facing this situation on Monday, Aave managed to scale through what amounted to a stress test without adding any fresh debt, and even reducing its existing bad debt total by 2.7 percent due to a reduction in value of the bad debt assets.

Analysing the successful liquidation, Chaos Labs said in a post on X:

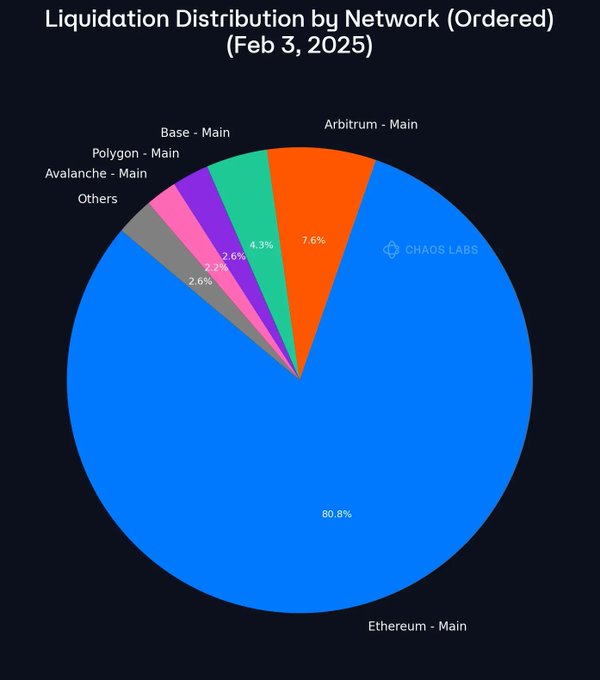

Liquidations were executed efficiently across the protocol, most of which were performed on the Ethereum Main instance. The robust risk management mechanisms within Aave ensured that the collateralized positions were settled as intended, minimizing protocol losses.

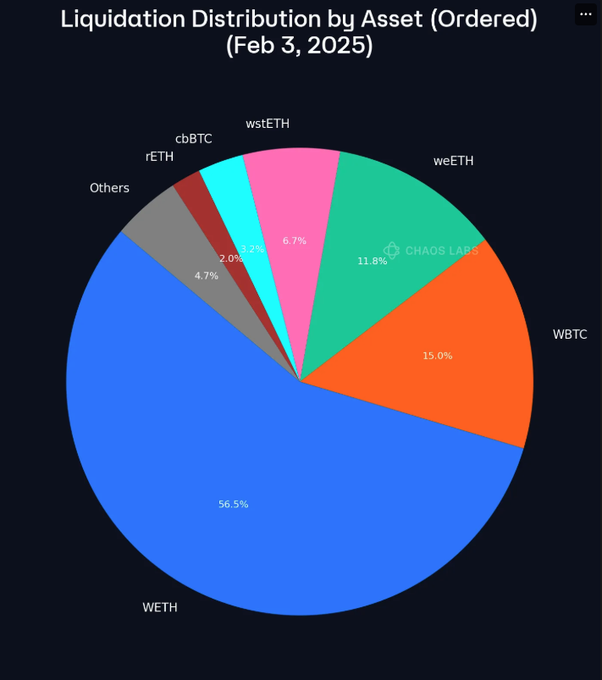

A breakdown of the liquidations shows that WETH accounted for $96 million, while WBTC accounted for $25 million. $20 million worth of weETH was also liquidated, as $11 million worth of wstETH. A basket of smaller assets including rETH and cbBTC made up the remaining recorded liquidations.

The market’s response to Aave’s performance was full of praise, with analysts including Bitwise cio Matt Hougan commending the protocol for holding up to scrutiny.

On Jan. 7, Aave confirmed its deployment on the Aptos testnet, its first-ever non-EVM deployment, as part of its ambitious plan to expand deployment to 6 new chains including Aptos, Botanix Labs’ Spider Chain, Linea, Mantle, and Sonic.