Uniswap’s price has retreated over the past few months, and a recently formed death cross pattern suggests the potential for further losses.

Uniswap (UNI) token was trading at $10 on Tuesday, down over 50% from its peak in November. This decline coincided with Bitcoin’ (BTC) stalled rally and a broader altcoin bear market.

Uniswap has been losing market share in the decentralized exchange industry, where it was once the dominant player. According to DeFi Llama, Uniswap has handled $100 billion in trading volume, now trailing PancakeSwap’s $109 billion. Additionally, Uniswap has lost market share to Raydium, the largest DEX on Solana (SOL).

Meanwhile, the recently launched Unichain mainnet is off to a slow start. Data from DeFi Llama, Unichain has attracted 12 DeFi networks and a total value locked of $8.62 million. The biggest dApps in the ecosystem are Stargate, Uniswap, Venus, and DyorSwap.

Uniswap aims to position Unichain as the primary network for user transactions due to its lower fees and multi-chain compatibility.

Despite these challenges, Uniswap remains the most profitable player in the DEX industry. According to TokenTerminal, Uniswap has generated $186 million in fees this year, significantly higher than PancakeSwap’s $71 million.

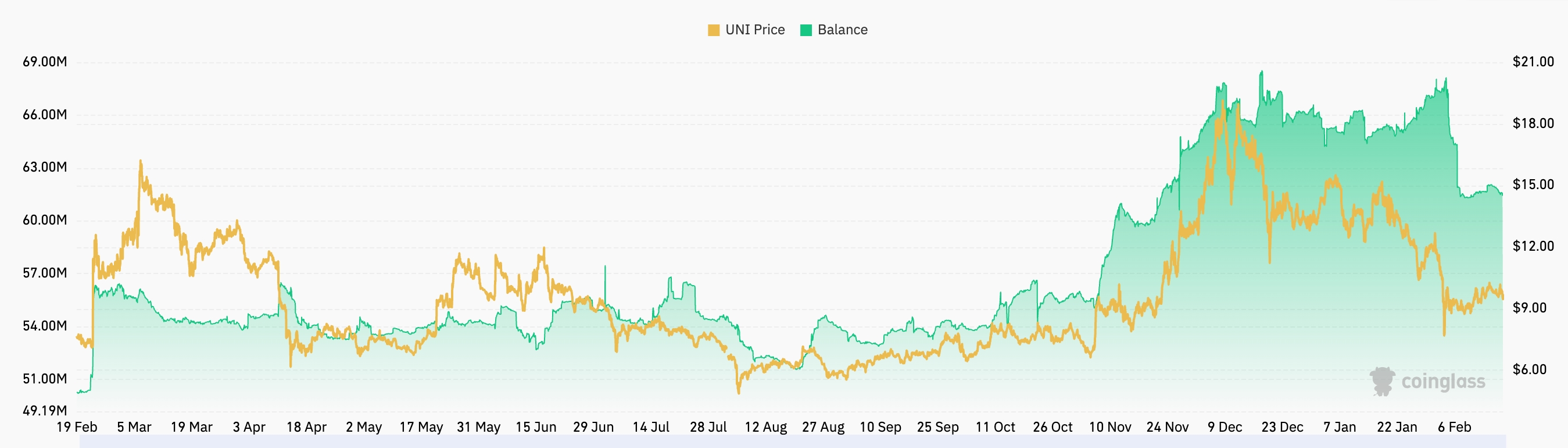

Another positive indicator is the decline in UNI token balances on centralized exchanges. The number of UNI tokens held on exchanges has dropped from 67 million earlier this month to 61 million. A decline in exchange balances suggests reduced sell pressure and increased investor confidence.

Uniswap price has formed a death cross pattern

The daily chart shows that UNI peaked at $19.44 late last year before crashing to $10. The token has now formed a death cross, where the 50-day and 200-day Weighted Moving Averages have flipped, a key bearish continuation signal in technical analysis.

Additionally, Uniswap has formed a bearish flag pattern, which consists of a sharp decline followed by consolidation. The token has also fallen below the 61.8% Fibonacci Retracement level, a key zone where rebounds often occur.

Given these bearish signals, the next key support level to watch is $7, its lowest level this month. However, the bearish outlook would be invalidated if UNI rises above the 200-day moving average at $11.20.