Decentralized Exchange (DEX) trading is the new norm in cryptocurrency trading with it’s ability to swap assets without intermediaries. Whether you’re trading meme coins, yield farming, or executing complex DeFi strategies dex platforms can do it all.

Many different kinds of decentralized platforms are available in the market each having it’s own usp.

In this article, we’ll explore the top 5 apps every DEX trader needs for faster, smarter, and more profitable trades!

For on-demand analysis of any cryptocurrency, join our Telegram channel.

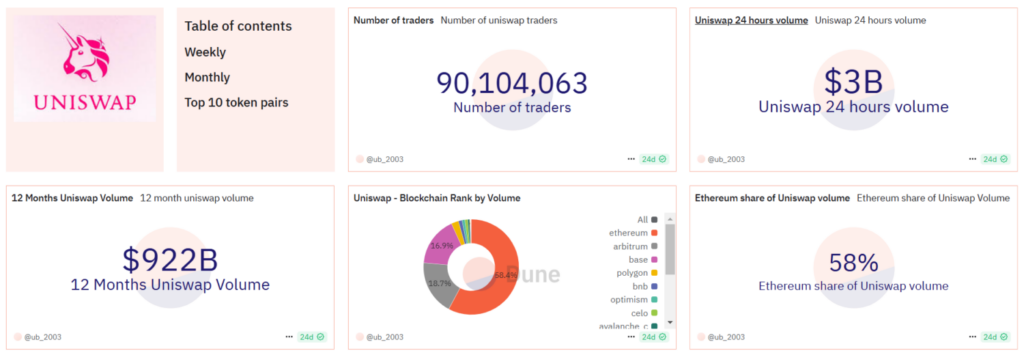

🏆 1. Uniswap – The King of Ethereum DEXs

Uniswap is the most popular decentralized exchange on Ethereum. Uniswap offers seamless token swaps and deep liquidity. It uses smart contracts to create liquidity pools for easy trading.

Uniswap is the second largest decentralized exchange by daily trading volume. It was created by Hayden Adams in 2018.

Main Features

✅ Massive Liquidity – Most ERC-20 tokens are available for trading

✅ No Registration Needed – Trade directly from your wallet

✅ Constant Innovation – Supports V3 concentrated liquidity for better efficiency

✅ Ethereum & Layer 2 Support – Optimized for Arbitrum and Optimism

How It Helps DEX Traders

- Best for swapping Ethereum-based tokens

- Simple and efficient trading experience

- Earn passive income by providing liquidity

💡 Pro Tip: Use Uniswap V3 liquidity positions to maximize returns with concentrated liquidity!

Also Read, Calculating Uniswap V2 Fees

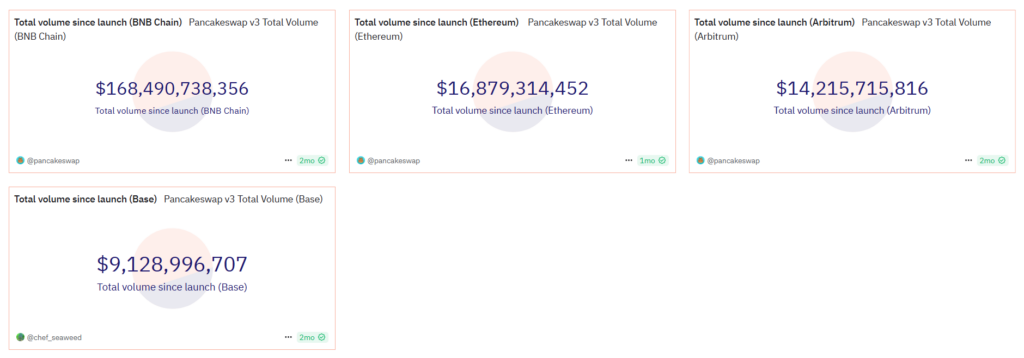

🏆 2. PancakeSwap – The BSC Powerhouse

PancakeSwap dominates Binance Smart Chain (BSC) with low fees and high-speed transactions. The platform makes use of Automated market maker(AMM) to trade BEP-20 tokens.

Pancakeswap was launched in September 2020 by a group of developers known by the name “Pancake Squad”. It has more than $2.3 billion in total locked volume.

Main Features

✅ Extremely Low Fees – Much cheaper than Ethereum-based DEXs

✅ Yield Farming & Syrup Pools – Stake and earn passive rewards

✅ Lottery & NFTs – Engage in gamified DeFi experiences

✅ IDO Launchpad – Access early-stage crypto projects

How It Helps DEX Traders

- Best DEX for BSC ecosystem

- Offers multiple ways to earn passive income

- Lower fees compared to Ethereum-based alternatives

💡 Pro Tip: Stake CAKE tokens to maximize your earnings with auto-compounding pools!

Also Read, A Complete Guide to PancakeSwap

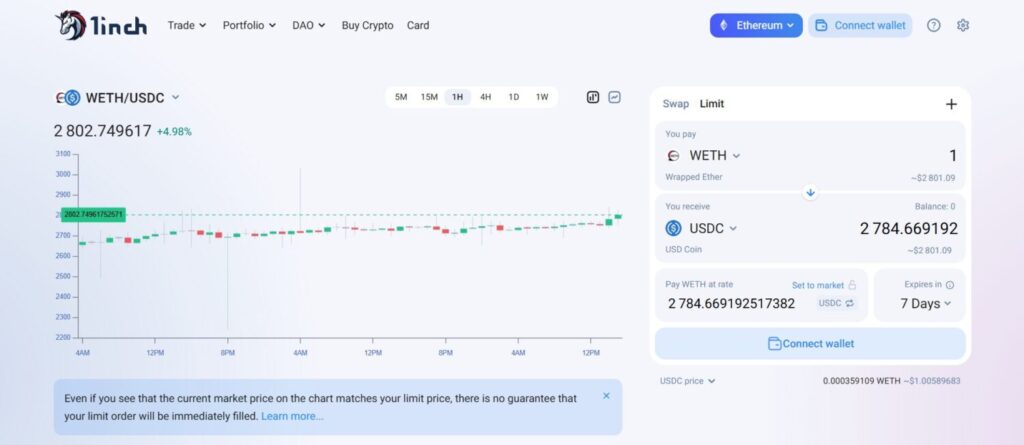

🏆 3. 1inch – The Ultimate DEX Aggregator

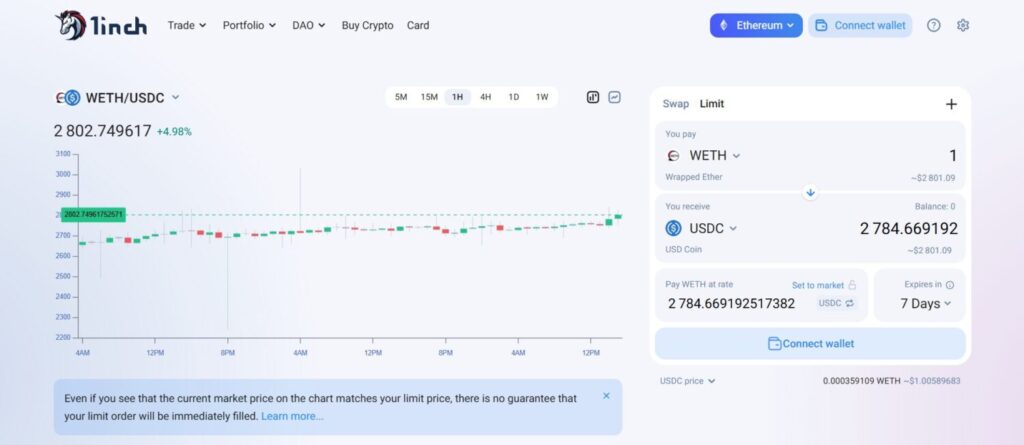

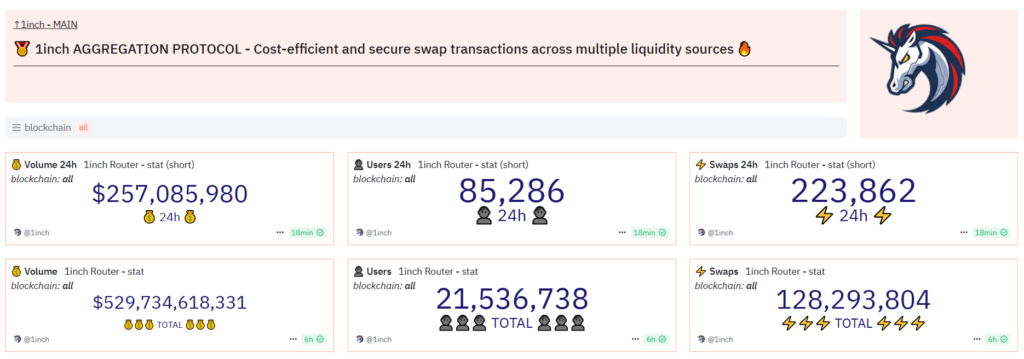

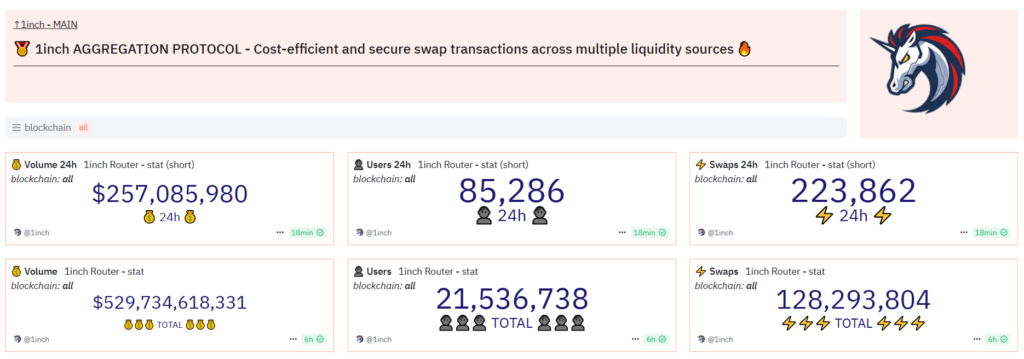

1inch is a DEX aggregator that scans multiple liquidity pools to get traders the best possible swap rates.

It uses smart contracts to automatically route orders to the most liquid pools. It has support for multiple trading options like swaps and limit orders. The 1inch Network was founded in May 2019 by at the ETHGlobal hackathon by Sergez Kunz and Anton Bukov.

Main Features

✅ Smart Routing – Finds the most efficient trading paths

✅ Multi-Chain Support – Works across Ethereum, BSC, Polygon, and more

✅ Gas Fee Optimization – Reduces trading costs

✅ Limit Orders & DeFi Tools – Advanced trading options

How It Helps DEX Traders

- Guarantees the lowest possible fees and best rates

- Lets traders set limit orders on decentralized platforms

- Integrates with multiple DeFi protocols for enhanced flexibility

💡 Pro Tip: Use 1inch’s “Chi Gas Token” to save even more on gas fees!

Also Read, How to Swap on 1inch?

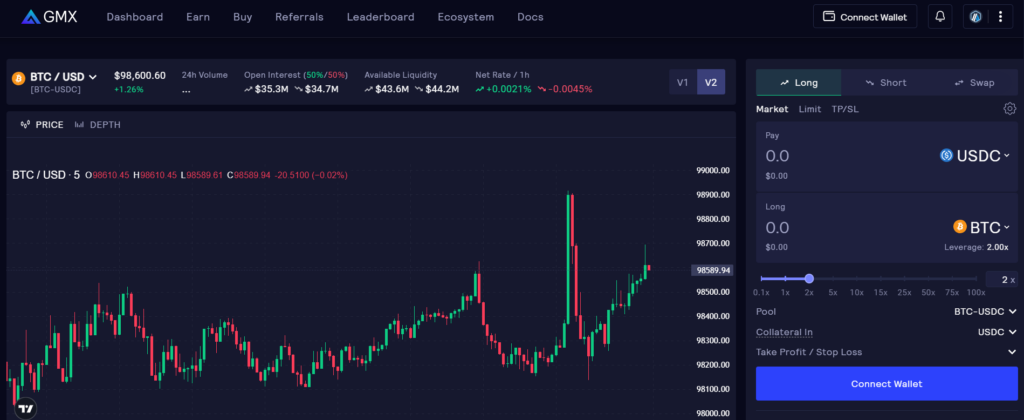

🏆 4. GMX – The Decentralized Perpetuals Exchange

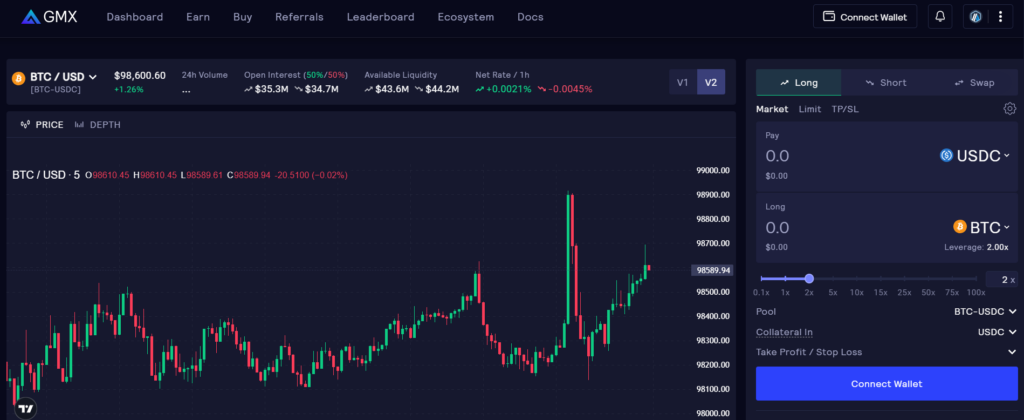

GMX is a decentralized futures trading platform which is perfect for traders looking for leverage and perpetual contracts. It offers features like trading leverage, protection against liquidations, and a user-friendly interface.

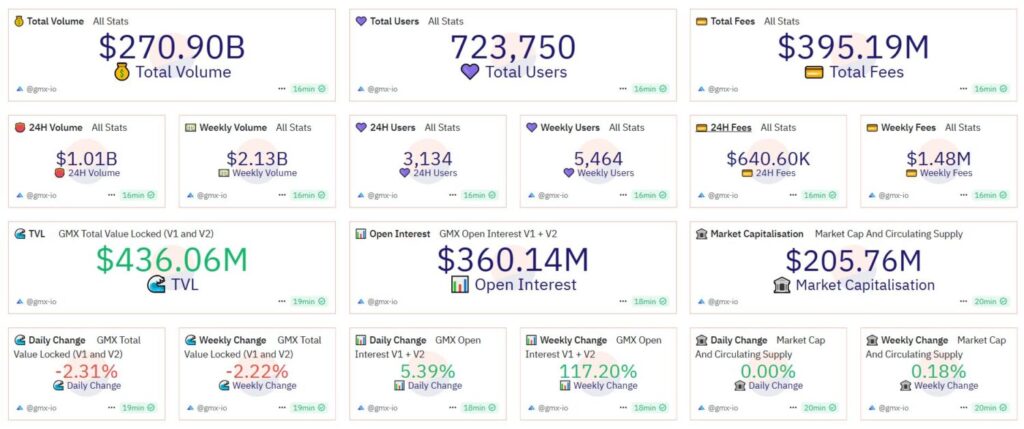

Gmx was founded in Sept 2021 as Gambit exchange by an anonymous team. It has over daily trading volume of $1billion and has over 700k total users.

Main Features

✅ Low Swap Fees – Cost-effective perpetual trading

✅ Leverage Trading – Up to 50x leverage on crypto assets

✅ Decentralized & Non-Custodial – Trade directly from your crypto wallet

✅ Multi-Chain Support – Available on Arbitrum and Avalanche

How It Helps DEX Traders

- Trade crypto with leverage in a decentralized way

- Earn trading fees by providing liquidity

- Avoid the risks of centralized exchanges

💡 Pro Tip: Stake GMX tokens to earn a share of trading fees!

Also Read, GMX.io Review – Trading Perpetuals on DEX

🏆 5. dYdX – The Leading Derivatives DEX

dYdX is a decentralized derivatives exchange specializing in perpetual contracts for advanced traders. dYdX has migrated to its own blockchain by leveraging Layer-2 scaling solutions like StarkWare.

dYdX was founded in July 2017 by Antonio Juliano who used to work at Coinbase. It is one of most popular and liked exchange platform by users.

Also Read, dYdX Emerges as the Largest Decentralized Exchange, Surpasses Uniswap

Main Features

✅ Zero Gas Fees – Thanks to its Layer 2 scaling solution

✅ High-Speed Perpetual Trading – Trade with leverage

✅ Liquidity Mining Rewards – Earn DYDX tokens by trading

✅ Non-Custodial & Secure – Retain full control of your assets

How It Helps DEX Traders

- Best for perpetual contract trading in DeFi

- High-speed transactions without network congestion

- Advanced charting and risk management tools

💡 Pro Tip: Use dYdX’s Layer 2 integration to avoid high gas fees on Ethereum!

Also Read, Top 5 crypto Margin trading exchanges | Trading on Margin

🎯 Final Thoughts

If you’re serious about DEX trading then these apps will level up your game by offering the best swaps, lowest fees, and advanced trading strategies then these platforms are best suited for your following needs and wants

🔥 Best for Ethereum-based Trading: Uniswap

🔥 Best for Low-Fee Trading on BSC: PancakeSwap

🔥 Best for Finding Best Swap Rates: 1inch

🔥 Best for Leverage Trading: GMX

🔥 Best for Perpetual Contracts: dYdX

This article provided a list of some of the most popular Dex trading apps. For more such amazing content do check out our full coincodecap website.

For on-demand analysis of any cryptocurrency, join our Telegram channel.