Stellar lumens price declined for the third consecutive day as fear spread across the cryptocurrency market.

Stellar (XLM) fell to $0.2740, its lowest level since Feb. 3, and is now 57% below its peak in November.

Its crash coincided with most cryptocurrencies as Bitcoin (BTC) and Ethereum (ETH) have moved into a bear market.

Stellar may be at risk after Ripple (XRP) price retreated and formed the risky head and shoulders pattern, as we wrote on Monday. A H&S pattern is made up of a head, two shoulders, and a neckline. It is one of the most bearish chart patterns in technical analysis, meaning that XRP price may dive soon.

Stellar and ripple have historically been highly correlated due to their roles in the cryptocurrency industry and their shared origins. Jed McCaleb, Stellar’s founder, was one of ripple’s original creators. Both networks focus on payments and have high odds of securing approval for their respective exchange-traded funds from the Securities and Exchange Commission. As a result, a decline in ripple’s price could further weaken Stellar.

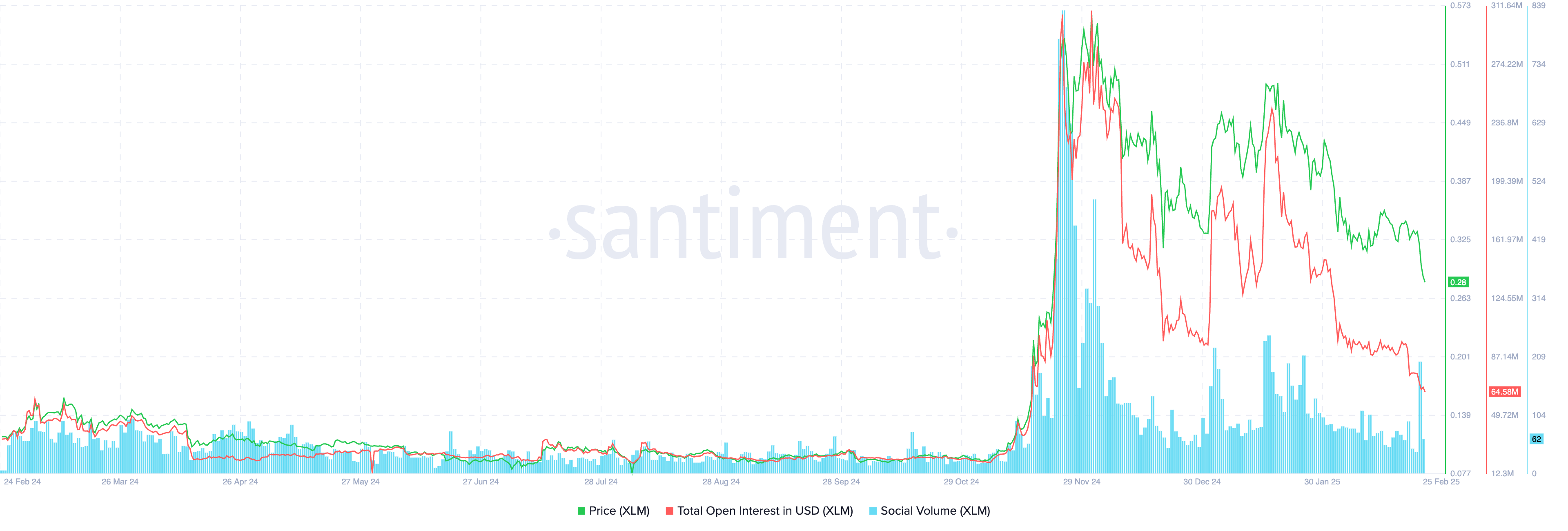

Stellar’s fundamentals suggest further downside risk this week. Data from Santiment shows that total open interest for stellar has fallen to 64.5 million, the lowest level since November.

Additionally, the social volume metric has dropped to 0.28, down from last year’s high of 0.55, indicating reduced attention on social media. Historically, cryptocurrency prices tend to perform better when social media engagement is high.

XLM price analysis

The daily chart shows that stellar has formed a series of lower lows and lower highs. These price movements have created a descending channel pattern, confirming a downward trend.

Stellar is also approaching a death cross, which occurs when the 50-day and 200-day moving averages intersect. Additionally, it has fallen below the 61.8% Fibonacci retracement level, a key technical zone where most pullbacks occur.

Given these factors, there is a risk that stellar will continue declining, with the next reference level to watch at $0.2056, the 78.6% retracement point, which is approximately 28% below the current level.