The crypto market is back on the decline only a day after it received a much-needed boost from Trump’s crypto reserve announcement. Here’s why crypto is down today.

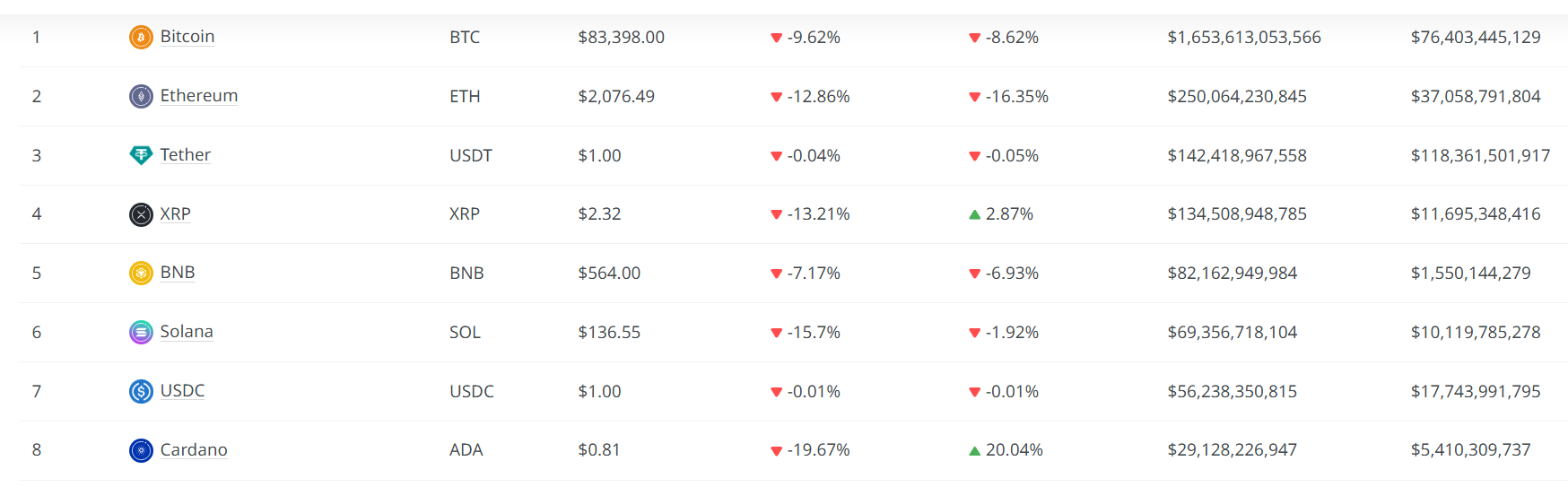

According to data from crypto.news, the top six largest tokens by market cap have gone down in value in the past 24 hours, ranging from 7% to a 20% decline.

The overall crypto market cap has plummeted by 10.4% to $2.8 billion. Just a day before, the crypto market cap surged to as high as $3.2 billion after President Donald Trump reaffirmed his commitment to establishing a national crypto reserve with major tokens in the lineup. This has left many traders wondering why crypto is down today despite the boost it received yesterday.

On March 3, Bitcoin (BTC) was able to climb out of its earlier slump and reach beyond $93,000. However, at press time the largest cryptocurrency by market cap has fallen back by nearly 10%. It is currently trading hands $83,180, losing nearly $10,000 from yesterday’s peak value.

Cardano (ADA) suffered the worst loss, tumbling down more than 20% to only $0.81. When just a day prior, ADA’s mention in Trump’s crypto reserve lineup was enough to elevate the token into a rally as Cardano went over 75% to a high of $1.13.

Next is Solana (SOL), which declined more than 16% in the past 24 hours. It is currently trading at $135.97. Yesterday the token was up by 20% thanks to its mention in Trump’s Truth Social post.

Ethereum (ETH) and XRP (XRP) suffered similar losses, with both tokens falling by around 13% in the past day of trading. Yesterday, ETH soared by 11%, while XRP skyrocketed 28%. XRP even managed to surpass USDT (USDT) and rose to the top three cryptocurrencies by market cap.

Even Binance Coin (BNB), which stayed relatively in the safe zone during the last crypto market crash, decreased by 7.06% in the past 24 hours. BNB is currently trading hands at $564.30.

Not only that, according to data from the Kobeissi Letter, the crypto market is now worth $100 billion less compared to before Trump’s U.S. crypto reserve announcement.

Why crypto is down today after the U.S. crypto reserve announcement

Although Donald Trump’s announcement regarding his plans to establish a crypto reserve provided a major boost for the crypto market, it was a short-lived rally as it was later eclipsed by events like concerns over Trump’s tariffs, technical selling the broader risk-off sentiment has reversed that momentum.

President Trump’s declaration about imposing new tariffs on Canada, Mexico, and China has heightened global trade tensions. Instead of pushing investors to flock towards “safe-haven” assets like crypto to protect their funds, this macroeconomic uncertainty has prompted the opposite effect. Investors are now wary of investing in risky assets like crypto which they may consider even more volatile in nature, as the recent Feb. 24 crash is still fresh in the public’s mind.

Not only that, analysts have pointed out key technical levels, such as a significant CME futures gap, which are currently triggering automated sell orders. These technical pressures have accelerated the downturn for the crypto market.

Moreover, corporate investors are in the process of rebalancing their portfolios amid broader market volatility. This shift toward a risk-off stance has further pushed prices down.