AAVE bounced back from its recent drop after Aave announced plans to revamp its tokenomics, sparking fresh interest among whale investors.

According to data from crypto.news, Aave (AAVE) surged nearly 27%, reaching an intraday high of $220 on March 5, bringing its market cap back to approximately $3.3 billion as of the last check in the Asian afternoon session.

Aave’s daily trading volume doubled to over $850 million, while open interest in its futures market surged 48% to over $257 million, indicating a big jump in investor activity and demand among its derivatives traders.

Despite AAVE’s recent rally, the altcoin is still 75% below its highest point this year, while its circulating supply stands at just over 15 million AAVE tokens.

Most of today’s gains came after Marc Zeller, founder of the Aave Chan Initiative, formally requested community support on a proposal to restructure Aave’s revenue allocation, end the LEND smart contract, and improve liquidity management for users.

“The proposal reshapes revenue distribution, updates tokenomics, and outlines an economic framework for Aave’s future,” wrote Aave in an X post.

Another key driver of AAVE’s gains is its recent integration with Sonic, a high-speed EVM blockchain formerly known as Fantom. The move pushed Sonic’s total value locked to $33 million within a day.

With this integration, Sonic joined Aave’s lending and borrowing network alongside Ethereum, Optimism, Arbitrum, and Polygon, among others, expanding Aave’s ecosystem, which has driven fresh interest among investors.

Meanwhile, whales and Smart Money investors have turned their attention to AAVE.

According to Lookonchain, a whale recently bought 20,000 AAVE tokens worth around $4.25 million. Another whale spent 1,928.86 WETH to purchase $3.95 million worth of AAVE, currently sitting on a floating profit of $406K.

Additionally, on-chain data firm Alphanomics observed strong AAVE accumulation over the past two days, with $1.5 million accumulated by top holders and a $600K net inflow from Smart Money wallets.

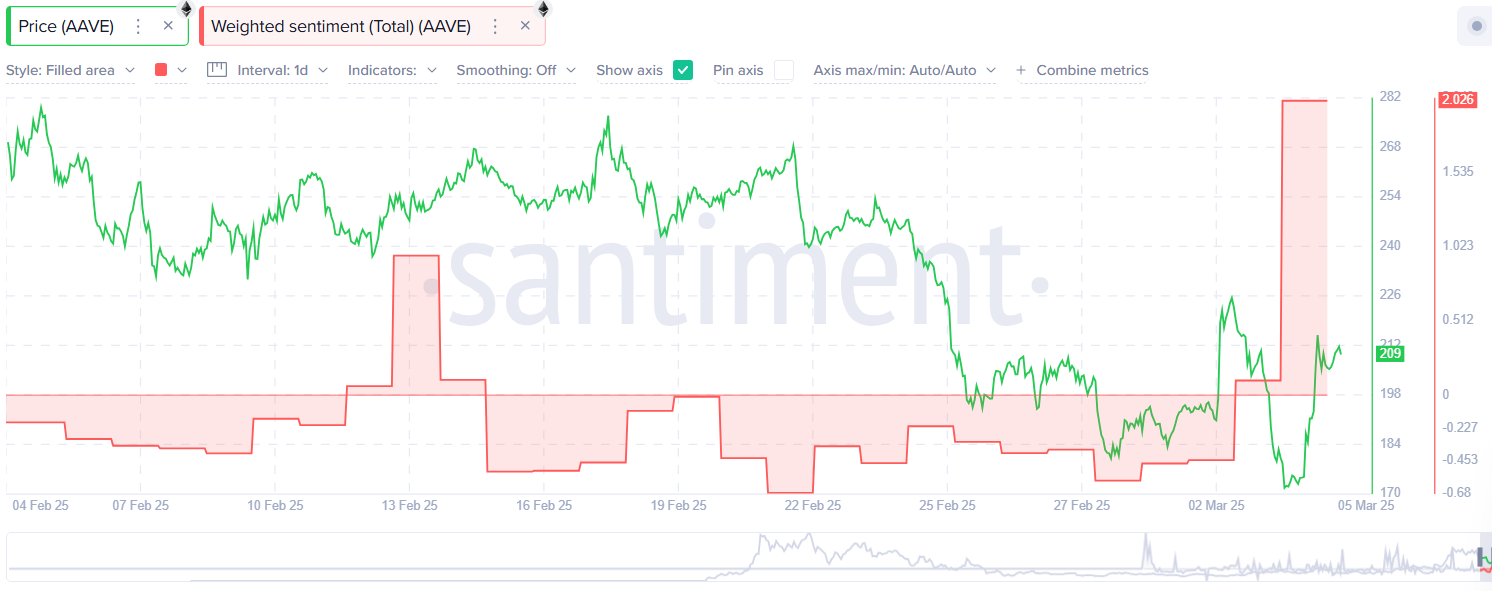

Per Santiment data, the social sentiment around AAVE has turned strongly positive, with the altcoin trending on Google.

AAVE price analysis

Technical indicators seem to indicate that AAVE could see more gains in the short term.

On the 4-hour AAVE/USDT price chart, both the MACD and signal lines have pointed upward, suggesting that AAVE is seeing strong buying pressure, which could likely sustain its bullish trend.

Further, the Relative Strength Index at 62 suggests that the bullish trend is getting stronger and could likely lead to more gains over the coming days.

However, analysts note that for AAVE to confirm a strong uptrend, it must first break out of the falling wedge pattern it has been forming since Jan. 21, with $230 as the immediate resistance level.

Such a breakout could potentially push AAVE’s price up close to $350, a level where it faced resistance at the end of January and which also serves as a key psychological barrier.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.