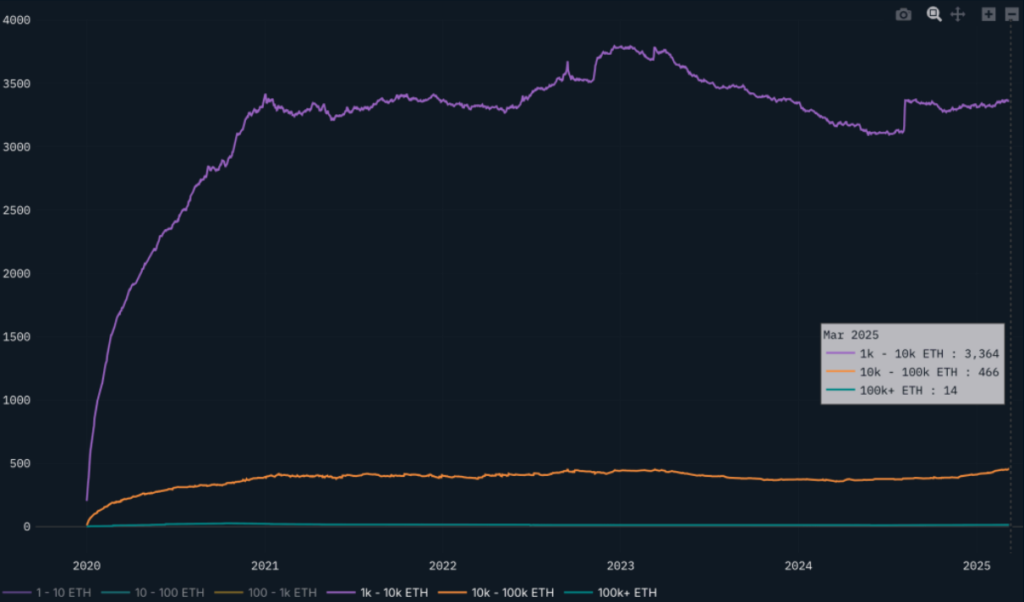

Large ETH holders have been accumulating throughout late 2024 and into 2025, even as retail balances decline, data from Nansen shows.

Even though Ethereum’s (ETH) price is down over 44% this year and trading around $1,900, some large investors are still adding to their holdings, according to on-chain data from Nansen shared with crypto.news.

While smaller ETH holders have been reducing their balances, whales holding between 10,000 and 100,000 ETH have increased their holdings by over 12% in early 2025.

“The 10k-100k segment saw over a 12% growth in 2025 alone on their total ETH balances whereas the 1k-10k segment saw a 3% increase in their holdings YTD.”

Nansen

At the same time, Ethereum’s network activity seems to have slowed, with median gas prices reportedly dropping nearly 50 times since early 2024, while some of the activity appears to have shifted to Solana (SOL) and layer-2 networks, the report suggests.

Ethereum also faces growing competition, with Nansen saying that the network is “competing on all fronts and risks being a ‘jack of all trades but master of none’ when compared with BTC, SOL and TIA.”

Despite accumulation from some whales, the broader trend remains uncertain as ETH leaves “much to be desired across many of the onchain metrics,” Nansen notes, adding that the asset has “severe underperformance on both the way up and the way down.”

For ETH to reverse its long-term downtrend against BTC, “significant changes would need to occur,” analysts at Nansen claim, though it remains unclear whether any near-term catalyst could shift market sentiment.