PancakeSwap, the biggest decentralized exchange on BSC Chain, has doubled in the last 30 days even as most cryptocurrencies crashed.

PancakeSwap (CAKE) jumped to a high of $2.80 on Friday, its highest point since February 25, and 145% above its lowest level this month.

This surge happened as the network continued gaining market share in the DEX industry. According to DeFi Llama, PancakeSwap’s weekly volume jumped by almost 60% in the last seven days to $14.1 billion. This increase brought its 30-day volume to $53 billion. Its weekly volume was higher than that of Uniswap, Raydium, Meteora, and Fluid combined.

The soaring PancakeSwap volume led to a big increase in network fees. According to TokenTerminal, it has made almost $120 million in revenue this year, making it the second most profitable DEX in the industry after Uniswap.

Still, it is unclear whether the volume surge will continue because it was driven by recently launched meme coins in the ecosystem. The most notable one was Mubarak, whose token surged and then pulled back. Its market cap has dropped to $110 million from $200 million this week.

Other top BSC chain meme coins were Mansa, AOPA, Siren, and AIFlow Token. In most cases, these meme coins jump and then crash as insiders sell. As such, as it happened with Solana (SOL) DEXes, there is a likelihood that the PancakeSwap volume may be short-lived.

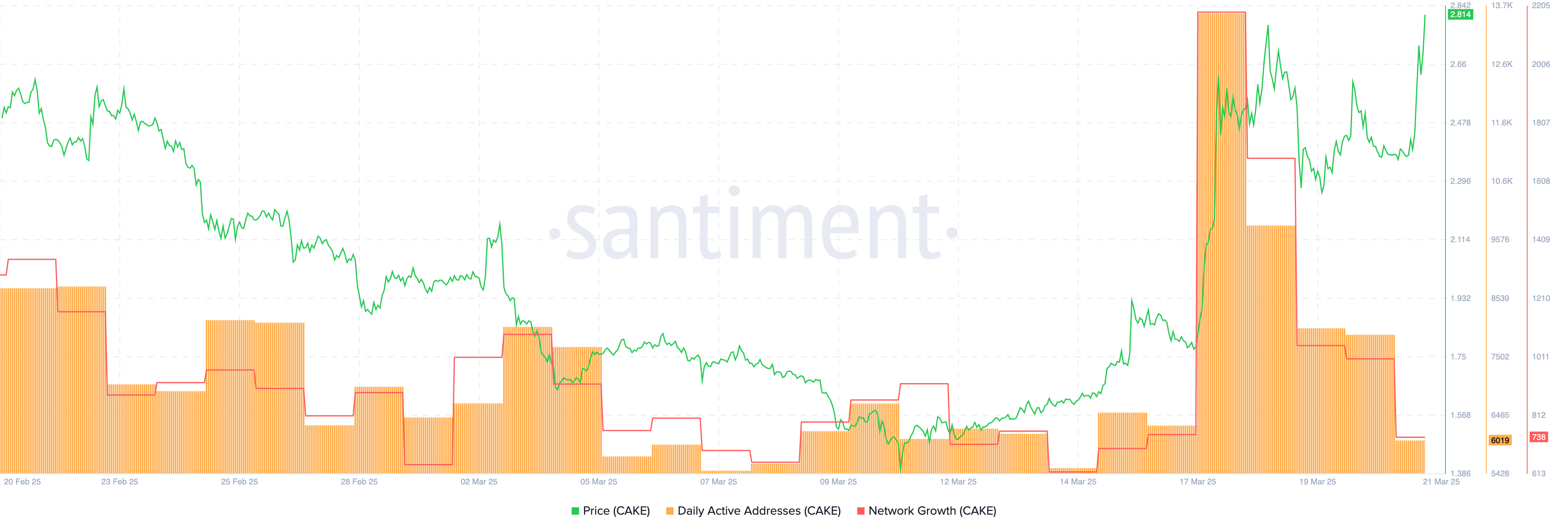

The other risk for the CAKE price is that the network growth and the number of active addresses have dropped. The network growth metric moved from 2,186 on March 17 to 738, while daily active addresses dropped from a weekly high of 13.6k to 6,020.

CAKE price analysis

The CAKE price has jumped from the year-to-date low of $1.1825 to a high of $2.9 as the network volume soared. It has moved above the 50-day and 200-day moving averages, a sign that bulls are in control.

PancakeSwap price has moved to the strong pivot reverse point of the Murrey Math Lines at $2.73. Oscillators like the Relative Strength Index and the Awesome Oscillator have all pointed upwards.

Therefore, CAKE will likely rise and hit the resistance at $3.4, its highest level in February and the overshoot point of the Murrey Math Lines. With its active addresses and network growth metric falling, there is a risk that it will retreat after hitting that resistance level.