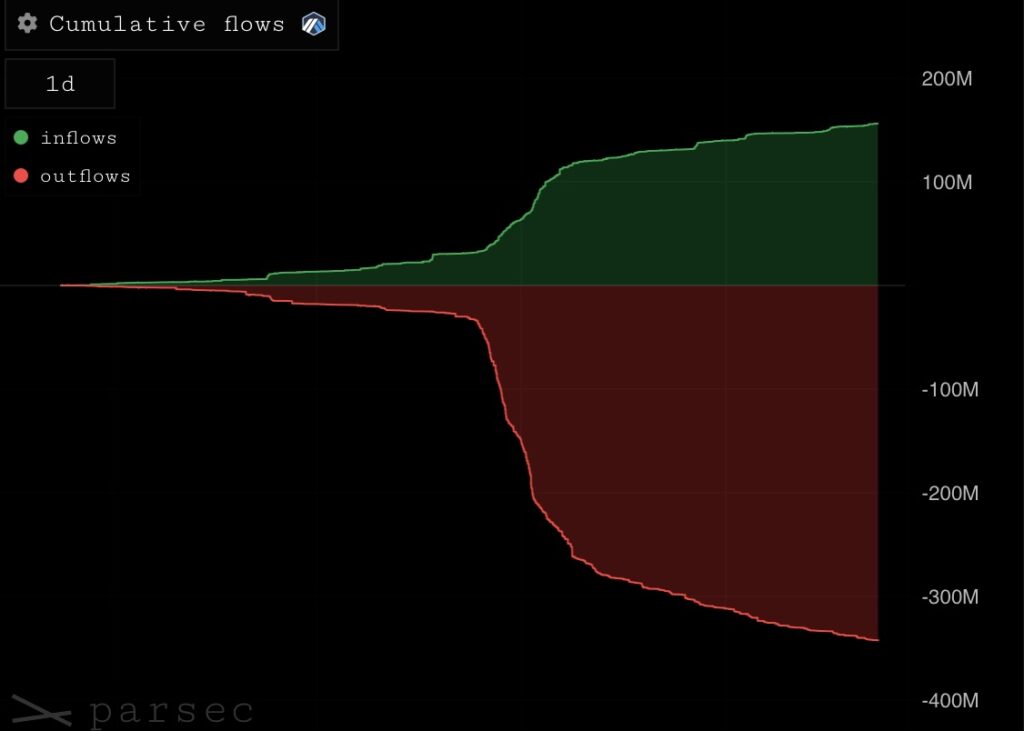

Hyperliquid has seen over $340 million in USDC outflows following a controversy surrounding JELLY, a token that surged 429% before being delisted.

According to data from blockchain analytics firm Parsec, the latest outflows happened within hours of the JELLY liquidation event, echoing a similar $300 million outflows seen during a previous Bitcoin (BTC) whale liquidation event. As a result, Hyperliquid’s (HYPE) USDC reserves have fallen from a high of $2.58 billion to $2.02 billion over the past 30 days.

The JELLY controversy began when Hyperliquid’s treasury assumed a $5 million short position in JELLY. As the token’s price unexpectedly spiked, the unrealized loss grew to $10.63 million. If JELLY had reached $0.17, Hyperliquid’s treasury faced a potential $240 million loss.

The price spike appears to have been manipulated. An address identified as 0xde95 opened a massive 430 million JELLY short position on HyperliquidX, only to remove its margin shortly after.

This action led to a series of liquidations, with the losses being absorbed by Hyperliquid’s treasury. Another wallet, 0x20e8, opened a long position in JELLY at the same time, which caused the price to rise even more.

To stop additional harm, Hyperliquid’s validator committee decided to delist JELLY and force-settled it at $0.0095. The platform assured users that short positions were settled at their initial entry price and that the Hyper Foundation would fully compensate impacted users.

However, the manner in which the incident was handled has drawn criticism. Bitget CEO Gracy Chen called Hyperliquid’s actions “immature, unethical and unprofessional,” drawing comparisons to FTX. According to Chen, the platform functions less like a decentralized platform and more like an unregulated offshore exchange.

Meanwhile, Hyperliquid’s native token, HYPE, is down 10% in the past 24 hours, according to crypto.news price tracker. Trading volume surged 443%, reaching $466 million, showing increased market activity. HYPE remains 58%% below its all-time high of $34.96 but is still 284% up from its lowest price.

The total value locked in its Hyperliquidity Provider Vault, a protocol vault that does market making and liquidations, has also declined, dropping from a peak of $540 million on Feb. 10 to $195 million as of Mar. 27, as per DefiLlama data.