The crypto market has come under pressure this month, continuing a downtrend that began in the fourth quarter of last year.

Bitcoin (BTC) dropped from an all-time high of $109,300 in January to $82,000, while Ethereum (ETH) has slumped from $4,100 in November to $1,800.

Other altcoins have retreated, with blue-chip names like Solana (SOL), Cardano (ADA), and Polkadot (DOT) falling by double digits from their highest levels in 2024.

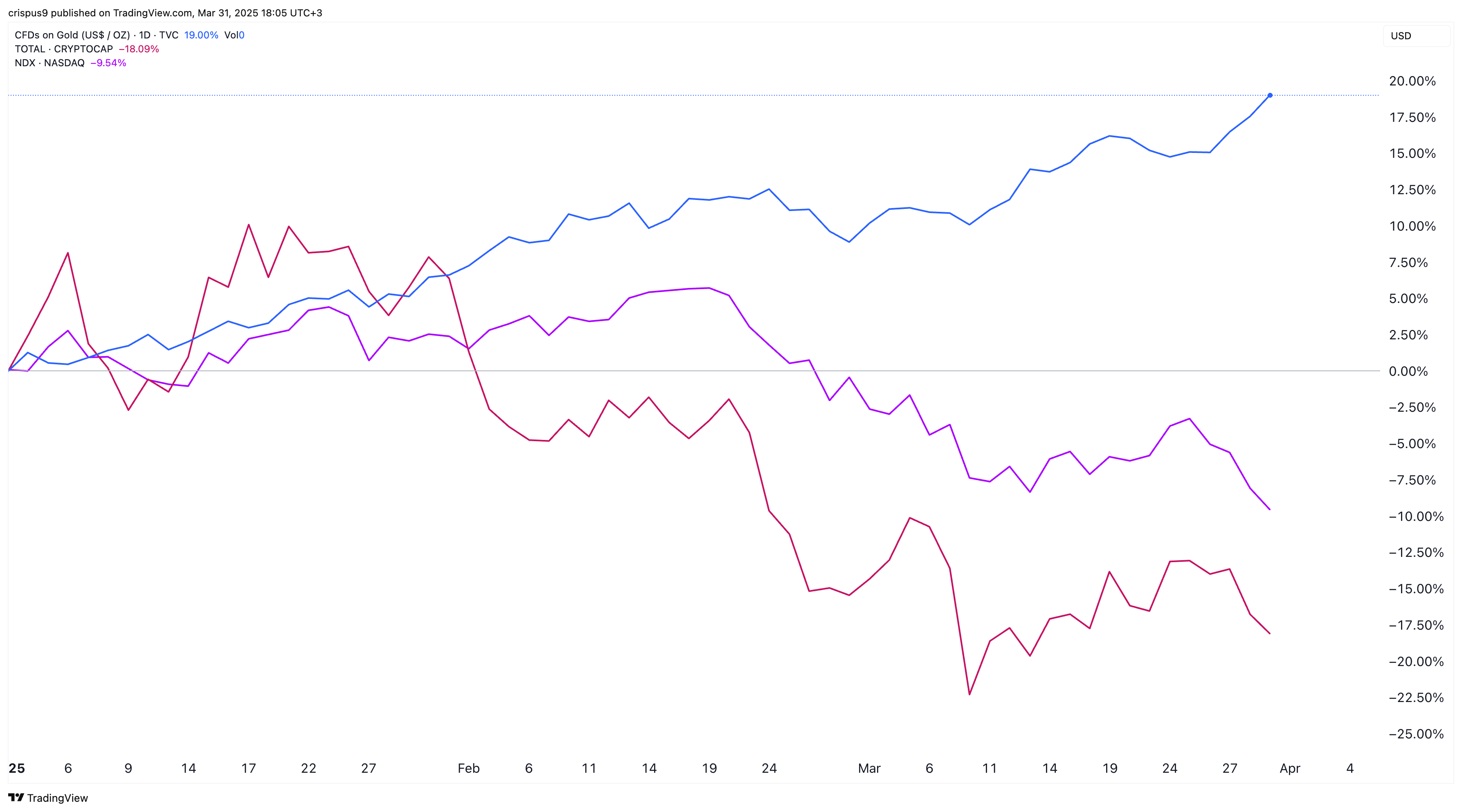

Cryptocurrencies have largely moved in sync with the U.S. stock market, which has entered a correction. The tech-heavy Nasdaq 100 index fell by 350 points on Monday and has dropped to its lowest level since September.

Similarly, the Russell 2000, S&P 500, and the Dow Jones have all declined by double digits from their highs earlier this year.

On the other hand, gold prices have continued to shine this year. The metal has rallied for five consecutive weeks and is now at an all-time high of $3,120. It is up over 20% this year, while the largest gold ETFs like GLD and IAUM are seeing substantial inflows.

Gold is seen as a better safe haven asset than crypto

The ongoing surge in gold prices, coupled with the decline in stock and cryptocurrency prices, suggests that investors view gold as a superior safe-haven asset amid rising risks.

Investors see the upcoming Donald Trump’s Liberation Day tariffs as a black swan event that could lead to a recession.

Trump has already announced sweeping tariffs in recent weeks. Last week, he unveiled a 25% tariff on imported cars to the United States. He has also imposed a 25% tariff on imports from Canada and Mexico.

His Liberation Day plan includes reciprocal tariffs on most countries that do business with the U.S. He hopes the measures will spur domestic investment and reduce the trade deficit.

The challenge, however, is that tariffs are effectively taxes, which could reduce consumer spending and push the U.S. economy into a recession.

On the positive side, a recession would likely prompt the Federal Reserve to slash interest rates and initiate quantitative easing, which could drive renewed demand for risk assets like stocks and cryptocurrencies.

Further, Trump is also counting on the Mar-a-Lago Accord, which aims to devalue the U.S. dollar to make American goods more competitive abroad. A weaker dollar would be bullish for gold, crypto, and stocks.