Tether CEO Paolo Ardoino celebrates the stablecoin’s user base recent quarterly growth with a viral Simpsons meme as more global users flock to USDT amidst economic volatility.

In a recent post, Ardoino announced that the stablecoin firm has seen an increase in its user base throughout the first quarter of 2025. To commemorate the growth, he posted a meme from the long-running U.S. animated series, The Simpsons.

In the picture posted by Ardoino, USDT (USDT) is the coffee being poured from a jug into a cup held by Lisa Simpson, who represents Tether stablecoin users receiving more USDT in their on-chain wallets.

“Number of USDT users grew 13% in Q1/2025,” wrote Ardoino in his recent post.

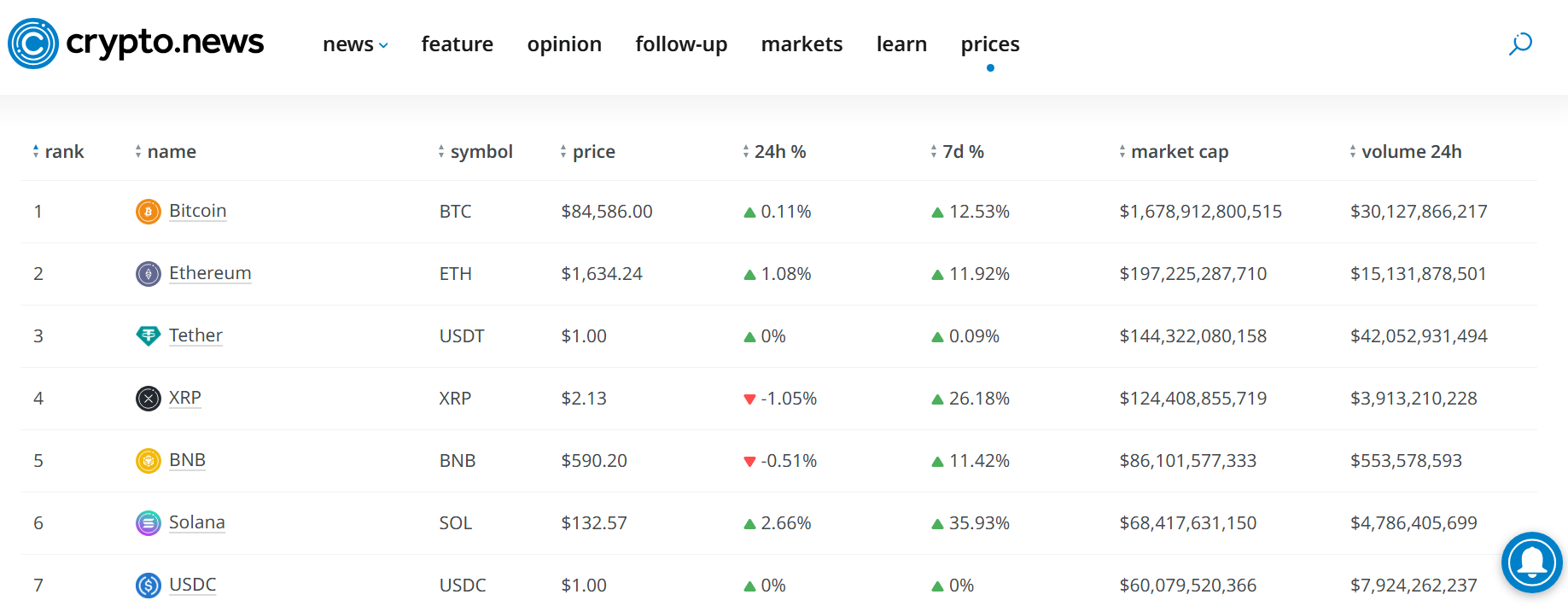

Ardoino recently revealed that the stablecoin firm has surpassed more than 400 million users worldwide. However, the firm has yet to reveal the exact number of users it approximately has as of Q1 2025. At press time, Tether remains the largest stablecoin firm by market cap with $144 billion. It ranks in third place just below Bitcoin (BTC) and Ethereum (ETH) on the overall crypto leaderboard.

Meanwhile, its competitor Circle (USDC) is in 7th place, with $60 billion in market cap, less than half of USDT’s market cap.

What has caused the surge in Tether users?

The recent surge in USDT users could be attributed to the economic uncertainty triggered by President Donald Trump’s Liberation Day blanket tariffs on products entering the U.S. Since then, Trump has declared a 90-day pause on tariffs affecting more than 180 countries and region, with the exception of China.

Stablecoins provide users with a safe haven asset to store their funds, one that is evidently less volatile compared to other crypto assets. Therefore, many users have chosen to swap their crypto and fiat into stablecoins to protect it from market volatility.

Most recently, Bloomberg published a report that highlighted how wealthy Indonesians have begun purchasing more USDT in recent months as a way to cope with concern regarding the economic uncertainty.

According to the report, one private banker said Indonesians with a net worth ranging from $100 million and $400 million have invested 10% of their assets into crypto. On April 9, the Indonesian rupiah fell to near its record low, around Rp16,957 per dollar following tariff tensions.

Since the beginning of March, trading for the USDT-rupiah pair, now contributes to more than a quarter of the Indonesian crypto exchange Tokocrypto’s daily volumes, according to the firm’s chief marketing officer, Wan Iqbal.