CRV is showing strong potential for a trend continuation after finding support at a major confluence zone. With volume starting to step in and price structure forming a potential higher low on the daily, all eyes are on whether bulls can defend this area and push the chart into the next leg higher.

Curve DAO Token (CRV) is beginning to show signs of a potential structural shift on the daily timeframe. After a sustained downtrend, recent price action has started consolidating above a zone packed with technical confluences. These zones typically attract strong buyer interest and, when defended successfully, often mark major pivot points. This analysis explores the key levels and signals traders should monitor to confirm the formation of a higher low and the likelihood of a continuation.

Key technical points

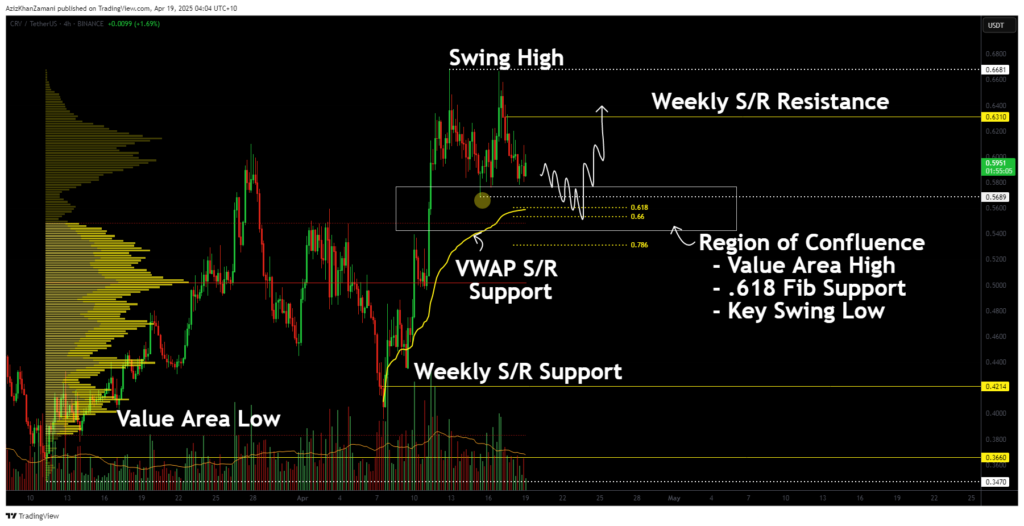

- Confluence Zone Support: Price is holding above the value area low, the 0.618 Fibonacci retracement, and a local swing low, suggesting buyers are actively defending this level.

- Higher Low Setup: A grinding move into the key swing low, followed by a reclaim and sustained hold above it, would confirm strength and trend continuation.

- Volume and VWAP Alignment: Sustained buy volume, with VWAP aligned to this zone, would add conviction to a potential bullish breakout.

CRV’s current chart structure is building out a classic higher low formation, often seen at the early stages of a bullish trend reversal. What makes this setup particularly compelling is the heavy confluence of key technical levels stacked within one zone. The value area low, derived from volume profile analysis, aligns closely with the 0.618 Fibonacci retracement from the recent leg up. This overlap is further reinforced by a local swing low, giving bulls a solid foundation for defense.

Zooming out slightly, this confluence zone sits just above a weekly support/resistance flip, suggesting the market has memory at this level. The ongoing consolidation just above this zone shows that buyers are stepping in, but haven’t made the decisive push just yet. This kind of slow, grinding action often precedes explosive moves, especially if the swing low is taken briefly (a liquidity grab) and then quickly reclaimed.

A key confirmation trigger would be seeing the value area high within the same zone act as support. This would indicate that market participants are not only defending the base, but also comfortable reloading on dips. For this to play out effectively, volume should begin rising steadily as price reclaims and holds above this range. The VWAP, also aligned near the Fib level, adds further weight to the bullish case.

What to expect next

If buyers continue to defend the current region and push above the value area high with rising volume, CRV could target significantly higher levels in the short term. The structure suggests accumulation, and any reclaim of the local highs may spark a trending move. For now, the focus remains on the higher low being locked in, and if it holds, a breakout could be just around the corner.