- XRP futures filing made under CFTC’s self-certification process.

- Ripple paid $50 million in SEC settlement last month.

- Grayscale, Franklin Templeton, and others filed for XRP ETFs

Coinbase has taken another major step in expanding its derivatives offerings by seeking regulatory approval to launch an XRP futures contract. The US-based crypto exchange submitted documentation on Thursday to the Commodity Futures Trading Commission (CFTC) to self-certify the new product, with the launch date set for April 21.

The move positions Coinbase to offer its third crypto futures product in 2024, following earlier listings for Solana (SOL) and Hedera (HBAR). Unlike spot trading, futures contracts allow investors to speculate on an asset’s price movement without holding the underlying token.

The addition of XRP could significantly enhance institutional access to the coin, especially in the wake of Ripple’s partial settlement with the US Securities and Exchange Commission (SEC) last month.

XRP futures launch set for April

Coinbase Derivatives’ latest filing with the CFTC outlines plans for XRP futures to begin trading from April 21, pending regulatory clearance.

The submission comes under the CFTC’s self-certification process, a mechanism that permits exchanges to fast-track product listings provided they meet all applicable rules. If the agency does not object, the product can go live without delay.

Coinbase’s decision to add XRP to its regulated futures lineup underscores its broader strategy to support both crypto-native and traditional investors.

In recent months, the exchange launched futures products for Solana and Hedera, both of which received CFTC approval through the same route. Along with XRP, Coinbase is currently awaiting regulatory sign-off for futures contracts tied to Cardano (ADA) and natural gas (NGS), expected to go live by the end of April.

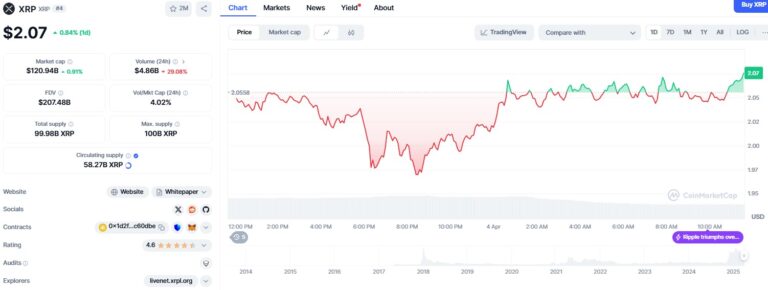

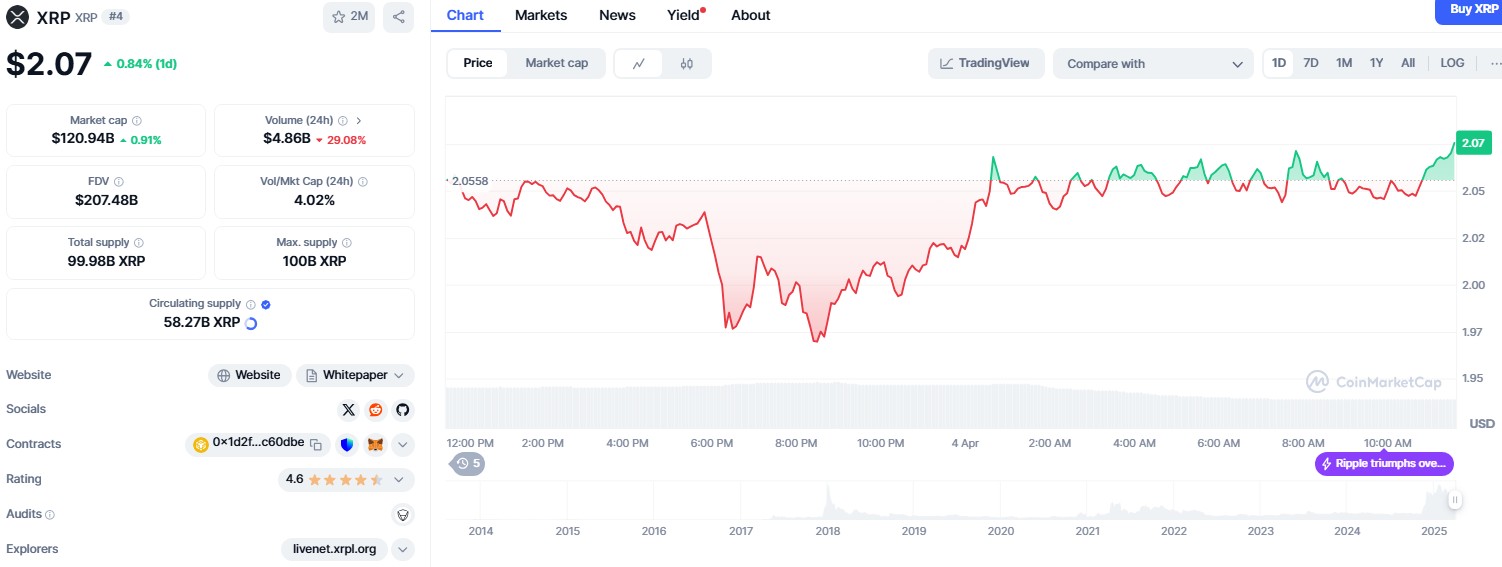

XRP price steady above $2

At present time, XRP was trading slightly above $2 with minimal intraday volatility. The coin’s relatively stable performance contrasts with the broader crypto market, where prices have remained highly reactive to macroeconomic signals and regulatory updates.

Source: CoinMarketCap

XRP’s core utility lies in its function as a settlement token for fast and inexpensive cross-border payments. The launch of a regulated futures contract could allow investors to hedge or gain exposure to the token’s price movement without owning it directly.

This may be particularly appealing to institutions and high-frequency traders seeking to avoid the custodial risks associated with spot crypto holdings.

The move could also impact liquidity for the XRP spot market, as increased derivatives activity often correlates with stronger trading volumes and price discovery mechanisms.

Legal clarity may unlock ETFs

Coinbase’s XRP futures push comes shortly after Ripple, the company behind the token, resolved its long-running legal dispute with the SEC. In March 2024, the agency dropped its appeal in the case that began in December 2020.

Ripple agreed to pay $50 million as part of the settlement, significantly reduced from the originally proposed $125 million. Ripple also withdrew its own cross-appeal, effectively bringing the multi-year litigation to a close.

The resolution has fuelled speculation that the SEC may now approve a spot XRP exchange-traded fund (ETF). Several major fund managers—including Grayscale, Franklin Templeton, Bitwise, 21Shares, CoinShares, WisdomTree, and Canary Capital—have filed for XRP ETFs.

ProShares and Volatility Shares are also seeking regulatory approval for related investment products. Analysts believe that regulatory clarity on XRP’s legal status could pave the way for larger financial institutions such as BlackRock and Fidelity to explore new product offerings.

While the SEC has not issued any approvals yet, industry participants suggest that the settlement has eliminated a key barrier for XRP’s adoption within more traditional financial frameworks.

Coinbase expands crypto derivatives

Coinbase’s self-certification model is emerging as a test case for how crypto-native firms can operate within traditional financial regulation.

The exchange’s growing futures portfolio demonstrates how crypto companies are adapting to CFTC oversight, even as broader regulatory tensions between US agencies continue.

The CFTC has signalled interest in expanding its role over crypto derivatives markets, often clashing with the SEC on jurisdictional grounds.

Coinbase’s ability to navigate this environment may determine how quickly new digital asset futures products reach the market. As institutional interest grows, regulatory responsiveness will likely shape which platforms can compete at scale.