Grayscale is accelerating its ETF expansion as the company seeks new avenues for growth amid increasing competition in the crypto ETF market.

Grayscale, a leading asset management firm specializing in crypto investment products, is planning an expansion of its ETF lineup. According to Fortune’s interview with CEO Peter Mintzberg, the company has already increased its monthly launches or regulatory filings from one product in 2024 to five per month in 2025.

The ramp-up comes as the firm struggles to maintain its edge after losing the fee advantage that once set its core product GBTC apart. The U.S. Securities and Exchange Commission’s approval of spot Bitcoin (BTC) ETFs in January last year—spurred by Grayscale’s own legal victory—opened the door for low-cost offerings from giants like BlackRock and Fidelity. While GBTC still manages $16 billion in assets, its 1.5% fee has driven substantial outflows as investors flocked to cheaper alternatives.

In response, Grayscale introduced a “mini” GBTC ETF with a competitive 0.15% fee, which has so far amassed $3.5 billion in assets. Still, shrinking margins have pushed the firm to rethink its business model. Now, Peter Mintzberg, who took over as CEO in August 2024, is trying to position Grayscale to compete not just on fees but also through differentiated investment products to win back market share.

The firm has already started its ETF expansion plan by rolling out two new Bitcoin covered call ETFs on April 2 —BTCC (Grayscale Bitcoin Covered Call ETF) and BPI (Grayscale Bitcoin Premium Income ETF). Both funds use covered call strategies to generate monthly income from Bitcoin’s price volatility. BTCC prioritizes income generation through options on Grayscale’s own spot Bitcoin ETFs, while BPI aims to provide both income and potential upside by writing out-of-the-money call options.

In addition to covered call ETFs, Mintzberg sees strong revenue potential in Ethereum (ETH) staking. In February last year, Grayscale applied with the SEC to allow staking in its Ethereum Trust ETF and Ethereum Mini Trust ETF, with the decision delayed until June 1.

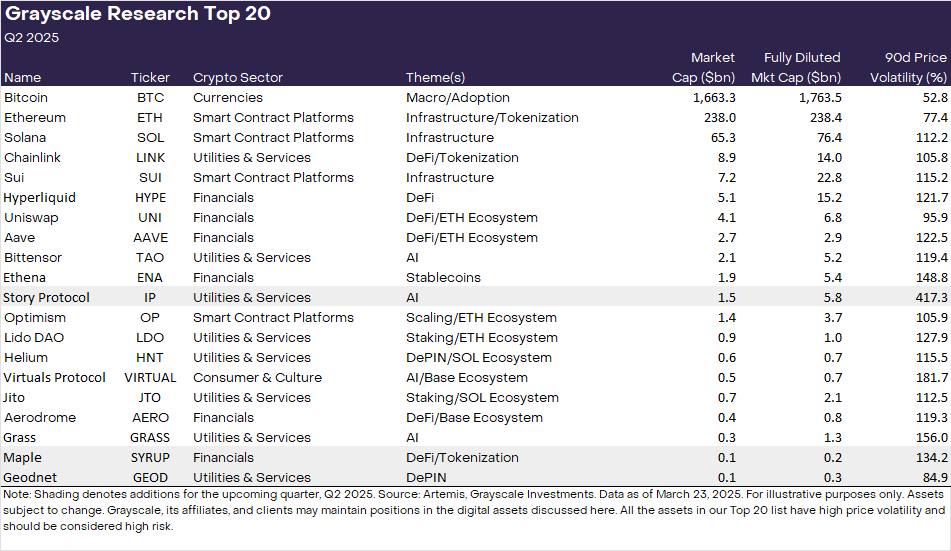

Grayscale is also eyeing ETFs that offer broad exposure to emerging crypto assets. Clues about which tokens might be included came with the recent release of the firm’s Q2 2025 “Top 20” list—a quarterly snapshot of high-potential projects based on internal research.

This quarter, the focus is on tokens with real-world utility across three main narratives, namely RWA tokenization, DePIN, and intellectual property, with standout picks being Maple (SYRUP), Geodnet (GEOD), and Story Protocol (IP).