Bitcoin is gearing up for a significant volatility event, triggered by $7.25 billion in options that are set to expire.

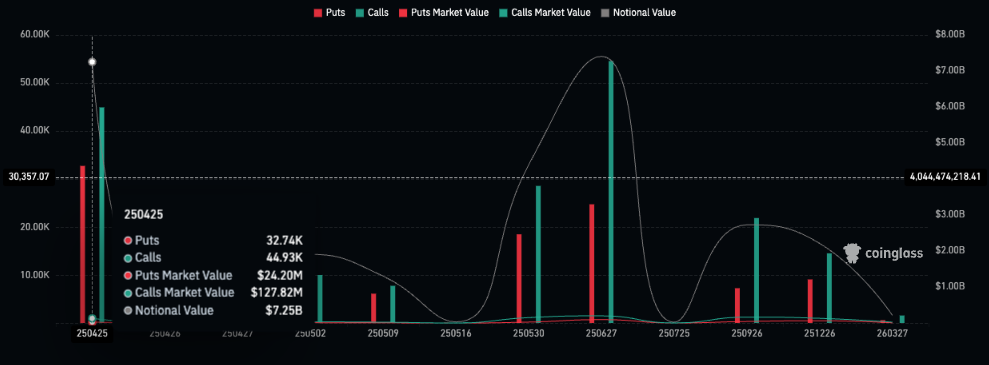

Bitcoin’s (BTC) derivative market may soon become a catalyst for major moves for BTC. On April 25, $7.25 billion in Bitcoin options are set to expire, typically triggering significant volatility. Still, the direction of this volatility remains uncertain.

According to Marcin Kazmierczak, co-founder and COO of oracle provider RedStone, Bitcoin has shown notable resilience. Compared to traditional markets, crypto assets have fared relatively well amid recent macroeconomic uncertainty.

“Tomorrow’s expiry looks particularly spicy, coming at a time when the market seems undecided about its next major move,” Kazmierczak said in a note sent to crypto.news.

On April 25, a total of 32.74k put contracts and 44.93k call contracts are set to expire. The market value of these contracts stands at $24.20 million for puts and $127.82 million for calls. The significant gap between puts and calls, with calls outnumbering puts by roughly 5x, suggests that traders are leaning toward a bullish outcome.

Smart money is betting on volatility: Kazmierczak

Kazmierczak acknowledges that options expiry events often contribute to significant market swings. If all contracts were exercised, their total notional value would be $7.25 billion, a figure that could have a noticeable impact on BTC’s price. For this reason, he believes that smart money is preparing for volatility.

Smart money is likely positioning for some dramatic swings, making this a perfect moment for both opportunity seekers and cautious investors to pay close attention,” Marcin Kazmierczak, RedStone.

At the same time, he highlights the continued maturation of the crypto ecosystem. This provides long-term investors with a chance to capitalize on volatility and secure more favorable entry points.

“While we may face volatility around options expiries, the underlying fundamentals remain exceptionally strong, with stablecoin volumes, Bitcoin adoption, and real-world asset tokenization all showing remarkable growth trajectories.”

Kazmierczak also noted that the crypto markets have remained relatively steady in comparison to equities. In contrast, traditional markets have faced notable turbulence, largely due to fears surrounding the impact of Donald Trump’s tariffs on major trading partners.

“It’s worth noting that crypto markets have demonstrated surprising resilience compared to traditional markets, which have been rocked by tariff concerns – a sign that digital assets may be establishing their own market dynamics less correlated to traditional financial turbulence.”