Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data shows HODLing conviction has been growing on the Litecoin network, with the 5+ years old hands only adding further with each cycle.

Litecoin Has A Notable Part Of Its Supply Dormant For Years Now

In a new post on X, the market intelligence platform IntoTheBlock has discussed about the trend in the supply of two Litecoin long-term holder cohorts. The “long-term holders” (LTHs) broadly refer to a class of LTC investors who have been holding onto their coins for more than a year, without having sold or moved them on the network even once.

Statistically, the longer an investor holds onto their coins, the less likely they become to sell them at any point, so the LTHs with their long holding times are considered resolute entities.

Related Reading

In the context of the current topic, not the entire LTH cohort is of interest, but rather two subdivisions of it: the holders carrying coins dormant since between three and five years ago, and those since more than five years ago.

As these investors are on the deeper side of the the LTHs, they would represent the most stalwart side of the market. The 5+ years old LTHs, especially, would be the diamond hands among diamond hands.

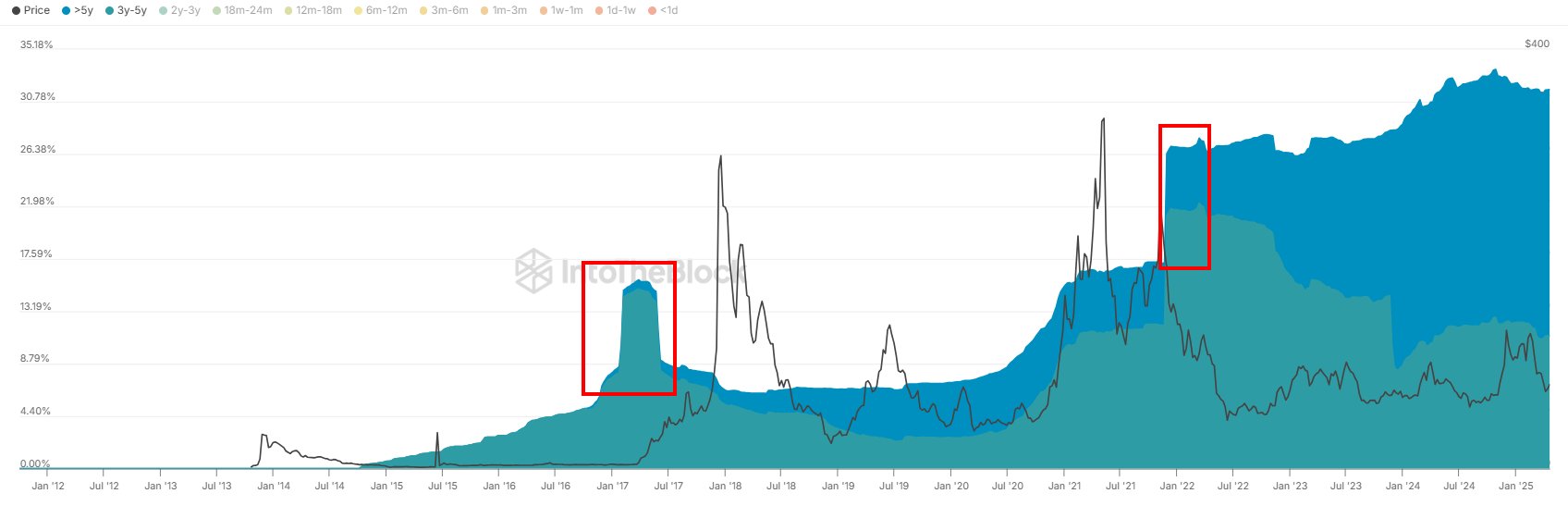

Now, here is the chart shared by the analytics firm that shows the trend in the amount of Litecoin supply held by these LTH groups over the history of the cryptocurrency:

In the graph, IntoTheBlock has pointed out an interesting pattern with red boxes. These boxes correspond to periods of sharp increase in the supply of the 3 years to 5 years Litecoin cohort.

Something to keep in mind is that a rise in the supply for these groups doesn’t correspond to accumulation that’s occurring at the time of the increase. Rather, what it indicates is that some buying occurred 3+ years ago and those coins have now matured enough to become part of one of these cohorts.

The timing of the red boxes would put the buying periods of the coins roughly to the previous bull run. Thus, it would appear that some resolute hands buy during bull runs and hold tight until at least the next one.

While accumulation has a delay equal to the cutoff of the group attached to it, selling isn’t the same. When coins are moved on the blockchain, their age instantly resets back to zero, and so, they are ejected out of the LTH cohort.

Related Reading

From the chart, it’s visible that despite their conviction, the 3 years to 5 years group does sell sometimes. “They tend to sell both into the next rally and during the following downturn,” notes the analytics firm.

Interestingly, the 5+ years group has proven to be different, as its supply has mostly been following an upward trajectory over the years. Today, these diamond hands control more than 20% of the Litecoin UTXOs.

LTC Price

Litecoin has made recovery of over 9% in the past week as its price has jumped to $83.

Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com