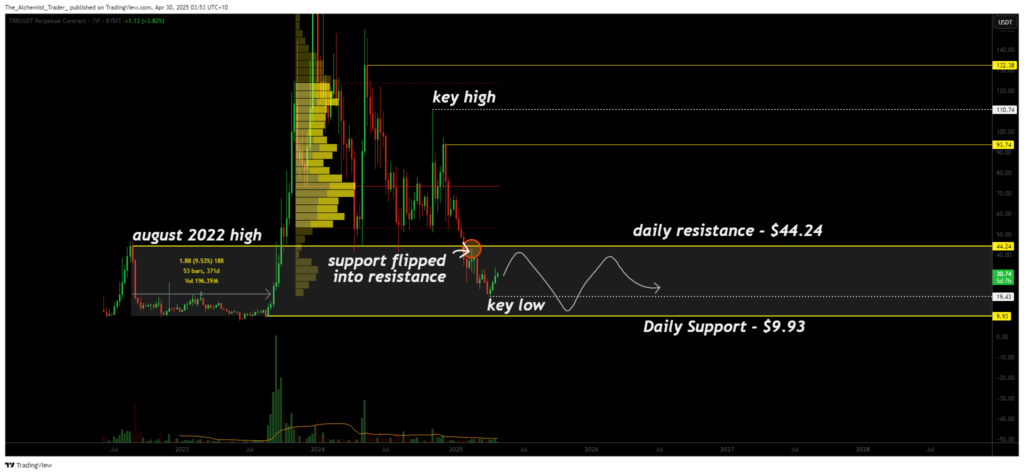

TRB has slipped back into its macro trading range between $9.93 and $44.24. Price acceptance within this zone suggests a prolonged accumulation phase might be the next major development.

Tellor (TRB) is currently trading within a historically significant range that previously held the asset for over 370 days. With price once again accepted within this region, traders are closely watching for signs of either a prolonged consolidation or a decisive breakout.

The recent drop in volume and ongoing bearish structure only add weight to the theory that this market may be entering a slow accumulation phase rather than prepping for immediate expansion.

Key technical points,

- Macro Range Established: $9.93 key support and $44.24 resistance define the historical range.

- Bearish Volume Profile: Volume remains below average, signaling weak momentum.

- Previous Pattern Echo: TRB previously ranged here for 371 days before breakout.

TRB’s return to this range highlights a likely scenario of extended sideways movement. The market has shown multiple weekly closes within this band, confirming price acceptance. From a technical standpoint, this opens the door for price to rotate within this range for a substantial period—potentially up to 337 days if history repeats itself.

This bearish consolidation is supported by volume analysis. Current volume remains significantly underwhelming, with volume nodes forming below average levels. This lack of market participation often indicates indifference rather than accumulation or distribution, favoring continued range-bound movement.

Structurally, TRB has remained weak, posting lower highs and lower lows, and it has yet to show any signs of strength or bullish reversal. The upper boundary of this range, around $44.24, remains a critical resistance. Until this level is broken with clear conviction and supported by volume, the probability remains skewed toward extended consolidation.

For bulls, the only sign of hope would come from reclaiming higher levels with growing volume and a shift in momentum indicators. However, that scenario currently lacks supporting data.

What to expect in the coming price action,

As things stand, traders should expect more rotational movement between $9.93 and $44.24. Until volume picks up and resistance is breached, accumulation within this macro range is the most likely path forward.