In this era of cryptocurrencies, you might have heard of the name Bitmax exchange, now AscendEx (Previously Bitmax exchange) is a crypto exchange platform that was established in 2018 and is headquartered in Singapore. Furthermore, the platform offers you to trade on leverage, and margin trading.

Summary (TL;DR)

- Specific rules should be kept in mind when opting for margin trading, like opening an account, margin loans, interests of a margin loan, repayment, computation, fund transfer, and risk reminder.

- AscendEx provides you with a utility token named ASD.

- Some of the benefits of margin trading on AscendEx is Cross Asset Collateral, low interest on margin borrowings and, intuitive WorkFlows.

- Furthermore, using AscendEx point cards you can reduce your margin interest by 50%.

- The platform offers Stop-loss to mitigate risks and avoid liquidations.

- To learn more about the platform you can read our AscendEx review.

What is AscendEx Margin Trading?

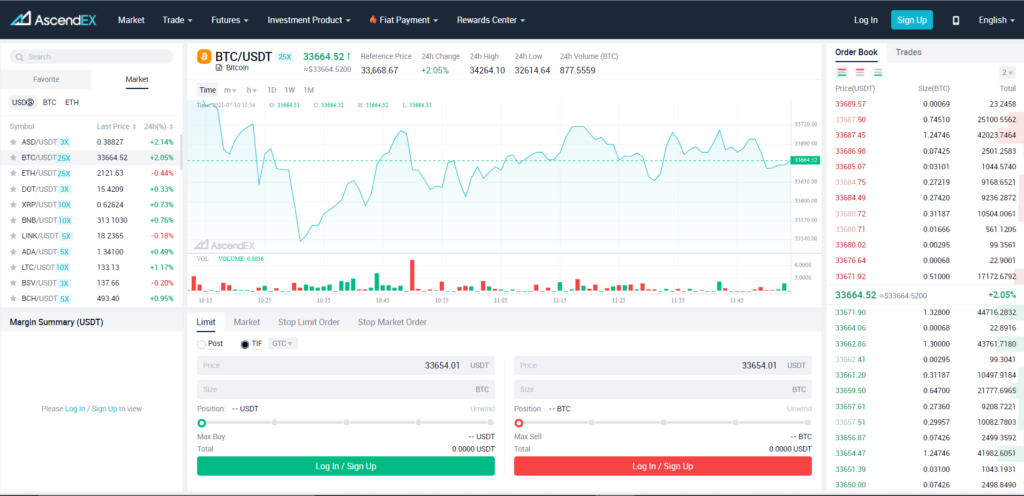

AscendEx margin trading allows traders to use leverage and open positions of higher value than their capital. Operating under the margin trading mode, AscendEx allows its users to trade assets and gain higher returns with higher risks.

AscendEx Margin Trading: Terminologies

Margin Account

The user must have an AscendEx margin trading account. As it allows the users to transfer assets to margin accounts as collateral for margin loans.

Margin Loan

After transferring assets to a margin account, the system automatically applies the maximum leverage based on the balance of margin assets.

Interests of Margin Loan

The platform calculates interests on the margin loans every 8 hours. Furthermore, the holding period of fewer than 8 hours is also counted as 8 hour period.

Loan Repayment

Users can repay the loan by transacting the assets from their margin account or transferring more assets. In addition, AscendEx updates the maximum trading power with the repayment.

Fund Transfer

If the net asset is more significant than 1.5 times IM (Initial Margin), a trader can transfer some hodlings from the margin account to his cash account. This can happen only when the net asset remains higher or equal to 1.5 times IM.

Risk Reminder

Margin trading can amplify the trading loss if the price goes against a trader’s prediction. Therefore, the user should always limit the use of high leverage and mitigate his risks of liquidation and financial losses.

Margin Assets

This is your current balance in your margin account section of AscendEx.

Maximum Trading Power

Maximum trading power is the product of your margin assets and the maximum leverage for your account.

Effective Minimum Margin

It is the minimum amount of margin assets required to avoid any forced liquidation of your positions.

Cushion Rate

AscendEx calculates Cushion Rate by dividing Margin assets and Effective Minimum margin. The platform sends a margin call via email when the cushion rate reaches 1.2, and when it reaches 1.0 your collateral is subject to liquidation.

Computation of Margin Requirement and Liquidation

The Initial Margin is calculated separately for the user’s borrowed assets, user’s assets, and overall user account. Then, the highest value among the all is used for Effective Initial Margin for the account. After that, IM is converted to USDT value based on the market price available.

AscendEx uses a reference price for calculating margin requirement and forced liquidation.

Also, read What is Margin Trading? [2021]

AscendEx Margin Trading: Strengths

- Cross Asset Collateral: It allows you to post collateral to fund the trading efforts with exposure to assets like BTC and ETH.

- Low Interest on Margin Borrowings: AscendEx offers you low margin interest rates. It also provides 0% interest when the loan is repaid within 8 hours.

- Intuitive Work Flows: AscendEx Margin Trading is accessible through a user interface that is easy to navigate with intuitive workflows.

How to Start Margin Trading?

- Visit AscendEx and create an account, or log into an already exesting accoint.

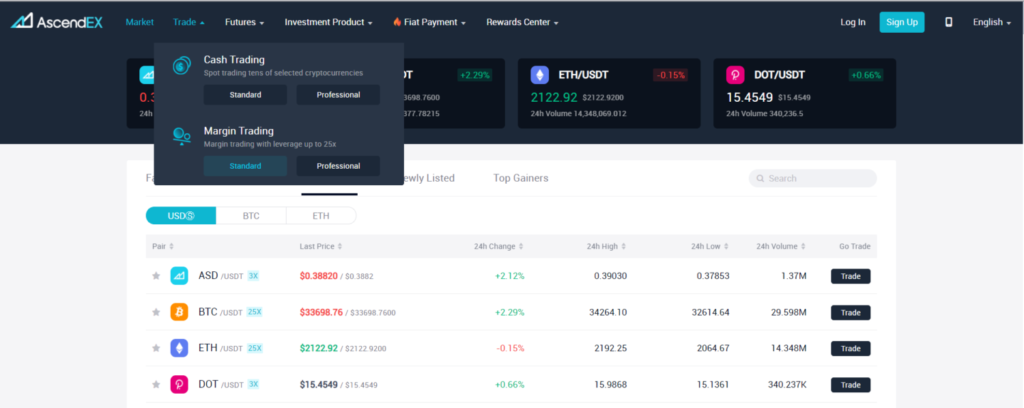

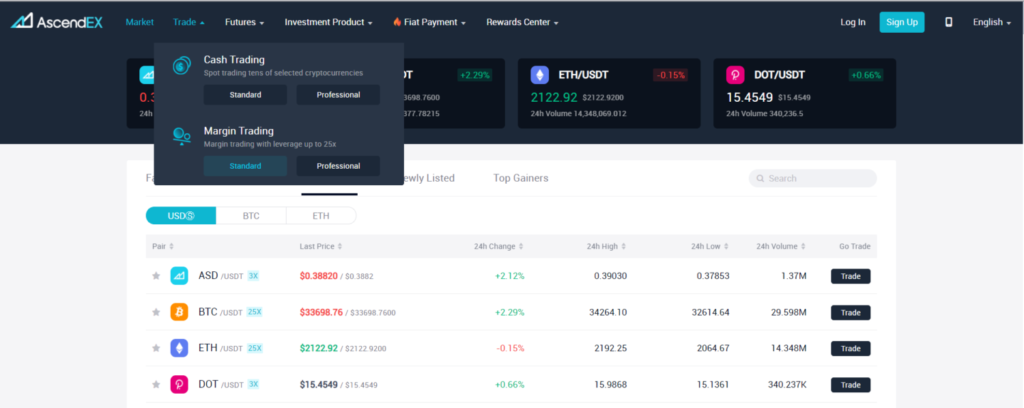

- Then head over to margin trading from the header. There are two modes of margin trading that is Standard mode for beginners and Professional mode for pro traders. Select your desired view and then continue with it.

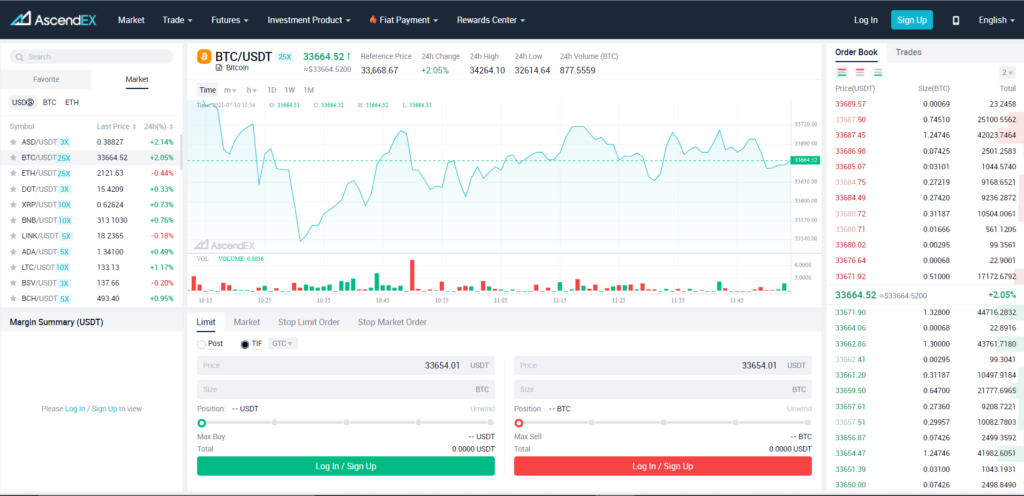

- Look for the trading pair you want to trade and select it, let’s say BTC/ USDT.

- AscendEX margin trading embraces cross-asset margin mode. In cross margin mode you share the capital across all of your positions and hence saving yourself from liquidations.

- All the account balances can be used as collateral after transferring BTC, USDT, or ETH to the margin trading account.

- Consider you want to put a limit purchase order of BTC. Now, if you expect the BTC rate to move up, you can borrow USDT from the platform to go long.

- Moreover, if you expect the BTC rate to go down, you can borrow BTC from the platform to go short BTC.

The platform calculates interests every 8 hours on the user’s account for margin loans. Furthermore, the platform does not charge you any margin loans if you are able to repay them before 8 hours.

Also, read A Guide to Bybit Margin Trading 2021

How to use Stop Loss in margin trading?

Stop-loss is the most important thing when you trade on leverage, it prevents you from unnecessary liquidations and cuts your losses. Stop loss on AscendEx is divided into Stop limit or Stop Market.

Stop Limit

Traders use Stop-Limit when they buy or sell an asset on margin and seek to make decent returns. Then, to mitigate the risk of forced liquidation, they use stop-limit order to set BTC. For this, click on Stop Limit order and then input a stop price with an order price. Enter your sell price, the stop-loss price, number of BTC, and hit submit button. An order is placed and filled by the system automatically once the stop price is reached.

Stop Market

When the market buy order of BTC is filled, then, to mitigate the risk of forced liquidation or losses, you can use stop-market order to set BTC. For this, click on Stop Market order and then input a stop price with an order price. Make sure the stop price is lower than the previous buy price and current price. After that, click on unwind and sell BTC. An order is placed and filled by the system automatically once the stop price is reached.

AscendEx Margin Trading: ASD Token

AscendEx provides you with a utility token named ASD that is native to its platform. Many platform services and different benefits are made eligible for the users who hold ASD tokens.

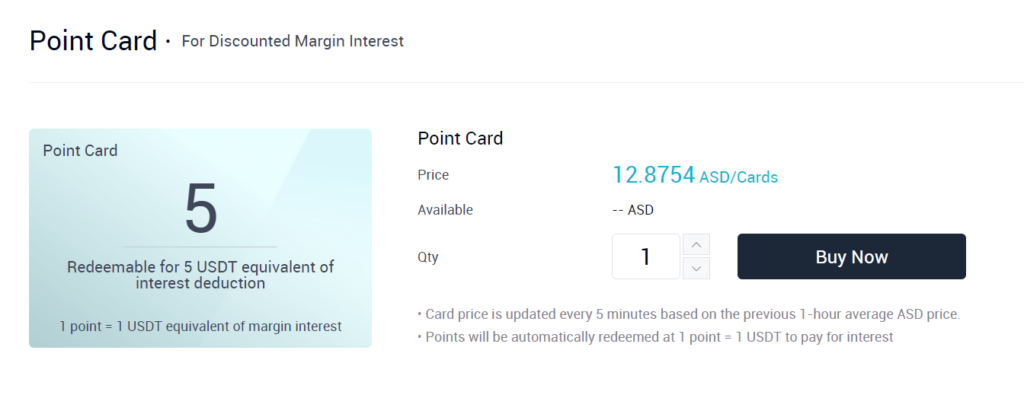

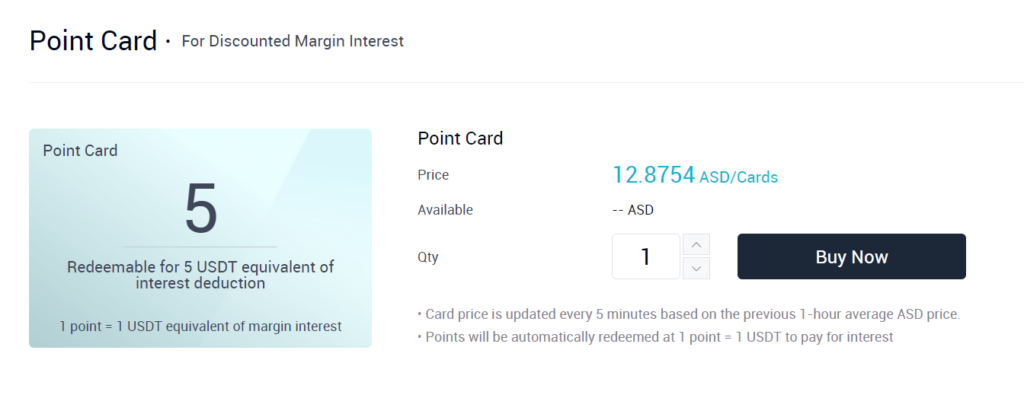

AscendEx Margin Trading: Point Card

If you wish to cut down AscendEx low margin rates to half, you should try the AscendEx point card. It cost 5 USDT, which is payable in ASD tokens. Each point card has points in which each point is equivalent to 1 USDT. Thus, it is like a prepaid balance from which the margin interest is deducted at first. Further, the interest incurred after the purchase gets a 50% discount whenever paid with the AscendEx Point Card. Point Cards are non-refundable once sold.

How to Buy AscendEx Point Cards?

- Select ‘Margin’ from the top left menu.

- Click on ‘Buy Point Card’ at the bottom.

Rights and Ecosystem for ASD Holders

- ASD is used as the unit of exchange for all offerings and operations offered on the AscendEX.

- Multiple mode options across different tradings on varied needs of customers and user groups are offered on AscendEx.

- There is a separate VIP transaction for both ASD holders and traders within AscendEx. Furthermroe, this fee structure enhances the ASD as the users who hold tokens are offered attractive marketplace advantages on the transaction fees.

- ASD token holders also get additional benefits related to interest, transaction fee, token release, etc.

AscendEx Margin Trading: Pros and Cons

| Pros | Cons |

|---|---|

| It supports leverage up to 25 times. | AscendEx is not suitable for novice traders. |

| The transaction fee for trading is 0.04%. | With leverage, there also comes high risks. |

| The daily interest rate is low as 0.01%. | |

| You can use Point cards to avail a 50% discount on the interest rates. |

AscendEx Margin Trading: Conclusion

Margin trading enables you to borrow funds to trade more digital assets than you could generally be able to afford. It increases your buying and selling power and also gives you high returns. Depending on the amount you have on your margin account, AscendEx gives up to 25x leverage on margin trading. In addition, AscendEx makes margin trading user-friendly and straightforward, just as cash trading; the only difference is Margin trading has a Margin summary box.

Frequently Asked Questions

How to margin trade on AscendEx?

For margin trading with AscendEx, visit the “Trade” option displayed on the top bar of the platform and then the “Margin Trading.” Once you have selected the standard or professional mode, you may begin setting orders. You can use leverage to have more trading power, even taking care of your available margin to resist liquidations.

Hor do liquidations at AscendEx work?

Suppose you have an open order, and your margin stage is depleted. In that case, the exchange will automatically close no matter the amount of cash you have borrowed. This is because the margin mechanism works to prevent the platform from having losses at the hands of buyers.

How to stop loss in Margin Trading?

A stop-loss order helps you mitigate the loss when a specific price is reached, and you have an intuition that the market might not be in your favor. AscendEx offers mainly two types, one being the stop limit and the other is the stop market.