The latest softening of the White House’s statements on tariffs against the European Union has sparked a market recovery.

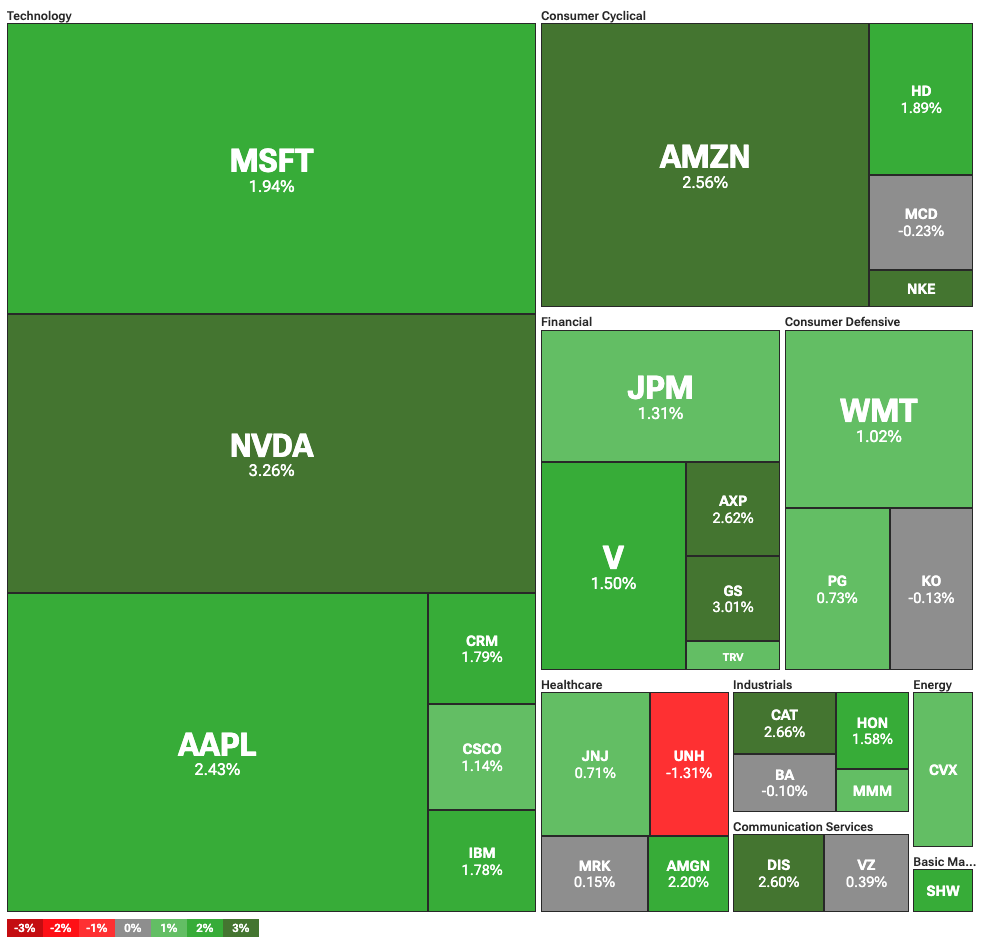

Stocks are once again moving in lockstep with former President Donald Trump’s rhetoric on trade. On Tuesday, May 27, the Dow Jones Industrial Average climbed to 42,243—up 640 points or 1.54%. The S&P 500 rose to 5,911, gaining 109 points or 1.88%, while the tech-heavy Nasdaq Composite advanced to 19,177, up 440.52 points or 2.35%.

Technology stocks led the gains in the Dow, with Nvidia rising 3.26% ahead of its earnings report on Wednesday. This came despite recent warnings that the company could face a $5.5 billion revenue hit due to potential restrictions on AI chip exports to China. Still, traders remain bullish, expecting Nvidia to post record revenues that beat expectations.

Apple was also up 2.43%, despite Trump’s earlier threats to impose a 25% tariff on its smartphones. Trump later explained that this would also apply to Samsung, Apple’s main competitor in the mobile market.

Trump, EU, hopeful about trade talks

The broader rally in equities was driven by optimism on the trade front. President Trump softened his stance on tariffs and praised the EU for agreeing to fast-track trade negotiations with the United States. The bloc is aiming to avoid 50% mutual tariffs, which Trump has delayed until July 9.

“This is a positive event, and I hope that they will, FINALLY, like my same demand to China, open up the European Nations for Trade with the United States of America,” Trump posted on Tuesday. “They will BOTH be very happy, and successful, if they do!!!”

The negotiations, led on the EU’s side by trade chief Maroš Šefčovič, will focus on key areas such as semiconductors, automobiles, pharmaceuticals, and aluminum. In parallel, the EU and the U.S. will also tackle tariffs and non-tariff barriers. The two biggest economies in the world now have six weeks to resolve their disputes, unless Trump extends the deadline further.