Robinhood’s partnership with Arbitrum failed to boost investor interest, instead triggering a sharp downturn in ARB’s price despite the initial hype.

According to data from crypto.news, Arbitrum (ARB) fell over 13% over the past 24 hours, trading at $0.32 while its market cap was seated at $1.61 billion.

ARB’s price tumbled shortly after U.S.-based trading platform Robinhood confirmed its highly anticipated partnership with Arbitrum during an event it was hosting in Cannes. The collaboration will see the Layer-2 network project build the Robinhood Chain, a blockchain infrastructure that will reportedly enable EU-based users to trade U.S. equities onchain.

Much of the news had already been priced in by investors after Robinhood teased the announcement on June 29, revealing that one of its top executives and A.J. Warner, CSO of Offchain Labs, the developers behind Arbitrum, would appear together on a panel during yesterday’s event.

ARB initially surged 46% to $0.38 within eight hours of the teaser, but has since dropped nearly 16%, suggesting a textbook “sell-the-news” event, where traders front-run expected bullish news and then exit positions post-announcement to lock in profits.

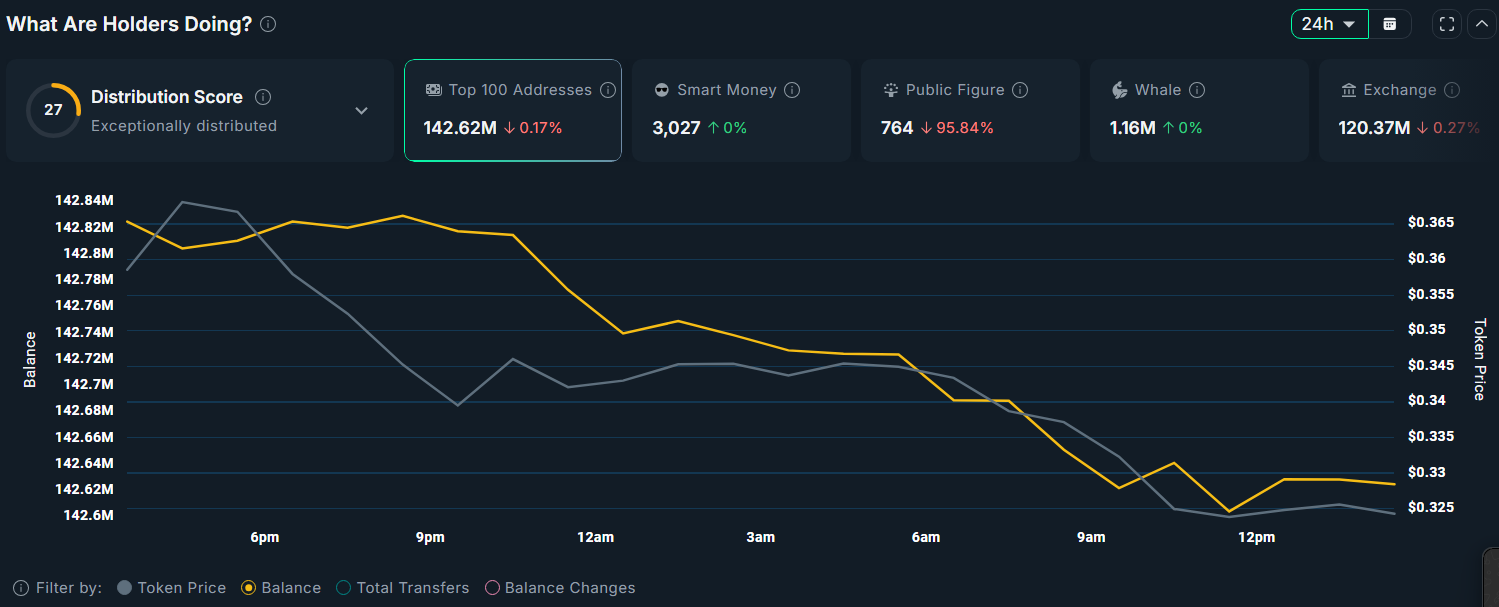

According to Nansen, the sharp downturn may have been accelerated by heavy selling from verified public figures and influencers. Their cumulative ARB holdings dropped by 95.8% in the past day, now standing at just 784 tokens. Such moves are often perceived by retail traders as bearish signals, reinforcing broader sell pressure.

These conditions have yet to ease, as Nansen data also shows that ARB exchange balances have increased by 17% over the past week, indicating continued inflows to trading platforms likely intended for selling.

ARB price analysis

On the 4-hour/USDT chart, Arbitrum (ARB) is showing multiple bearish technical signals that point to a likely continuation of its downward trajectory.

The 50-day Simple Moving Average appears to be on the verge of crossing below the 200-day SMA, a formation commonly referred to as a “death cross.” Such a pattern is widely regarded by traders as a strong bearish indicator, often preceding extended periods of price weakness.

Momentum indicators further support the bearish outlook. The MACD line has crossed below the signal line, typically interpreted as a sell signal that reflects waning bullish momentum. In addition, the Chaikin Money Flow index has dropped sharply from 0.45 to 0.08, which signals a significant reduction in buying pressure and a possible shift toward net capital outflows.

Given these confluences, ARB is likely to continue its decline toward the immediate support level at $0.31.

A breakdown below this level could expose the token to further downside, with the next major psychological and structural support resting at $0.28.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.