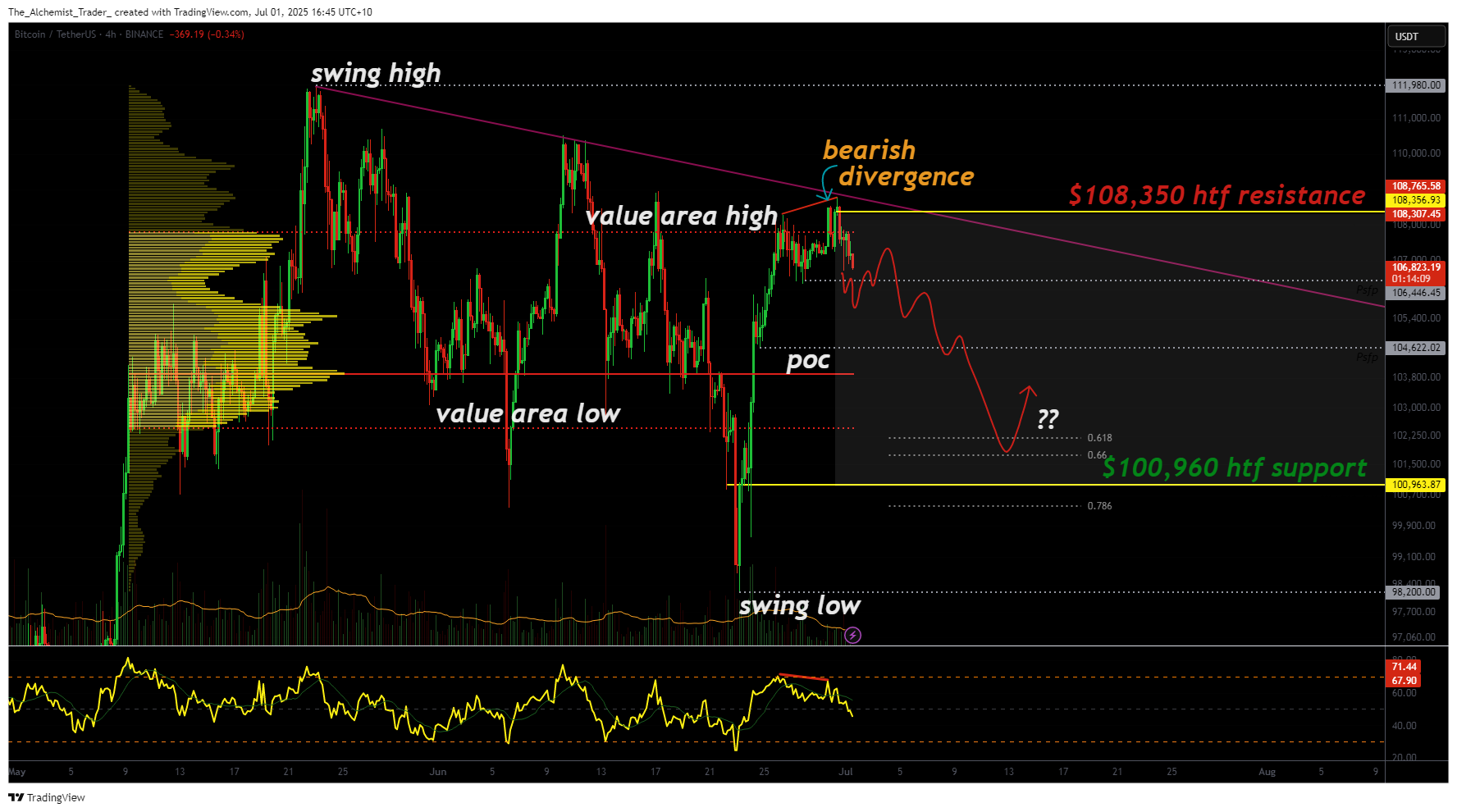

Bitcoin is showing signs of exhaustion at the $108,350 resistance zone. With a developing bearish divergence, declining volume, and repeated failures to break higher, price action is at risk of rotating lower toward key support.

Bitcoin (BTC) has spent the past week consolidating under a major resistance zone near $108,350 — a level that aligns with the value area high of the current trading range. Despite attempts to push higher, price remains capped. Now, a bearish divergence is developing, suggesting the recent rally is losing momentum. If sellers step in at this level, it could trigger a rotation back toward the value area low around $100,960.

Key technical points

- $108,350 Resistance Zone: High time frame resistance with value area high confluence

- Bearish Divergence: RSI is making lower highs while price pushes higher

- Declining Volume Profile: Lack of strong demand to break resistance structure

Bitcoin’s rejection from $108,350 has formed a potential lower high, continuing a bearish structure that has been unfolding over the past several weeks. The level itself represents a significant barrier, with multiple rejections confirming it as a supply-heavy zone. Without a decisive breakout, the price is more likely to rotate within the established range.

The bearish divergence — where price pushes slightly higher while the RSI weakens — is a typical early warning of exhaustion. This divergence is especially significant when it occurs at key resistance, as it suggests bulls are running out of steam. It also signals that the recent rally may have been driven more by short-term momentum than sustained buying interest.

Volume has been steadily declining throughout this consolidation. In the context of technical resistance and divergence, this weakening volume reinforces the bearish bias. For a breakout to occur, strong volume would need to confirm a shift in demand. Without that, price is more likely to roll over and test the next key support — the point of control and eventually the value area low at $100,960.

What to expect in the coming price action

As long as Bitcoin remains below $108,350, the bias leans bearish. A confirmed rejection backed by increasing sell volume could trigger a clean rotation down toward $100,960. If that level fails, further downside toward the previous swing low may unfold.

Alternatively, a reclaim of $108,350 on strong volume would be the first bullish signal and could invalidate the current bearish setup.