Nearly 200 companies now hold billions in Bitcoin, but a new report cautions that only a few can avoid the dangers of a potential death spiral.

Bitcoin’s (BTC) corporate adoption is accelerating fast, with nearly 200 entities now holding over 3 million BTC on their balance sheets. But as new players seem to rush in, only those who can skillfully grow their Bitcoin holdings per share are more likely to survive the risks ahead.

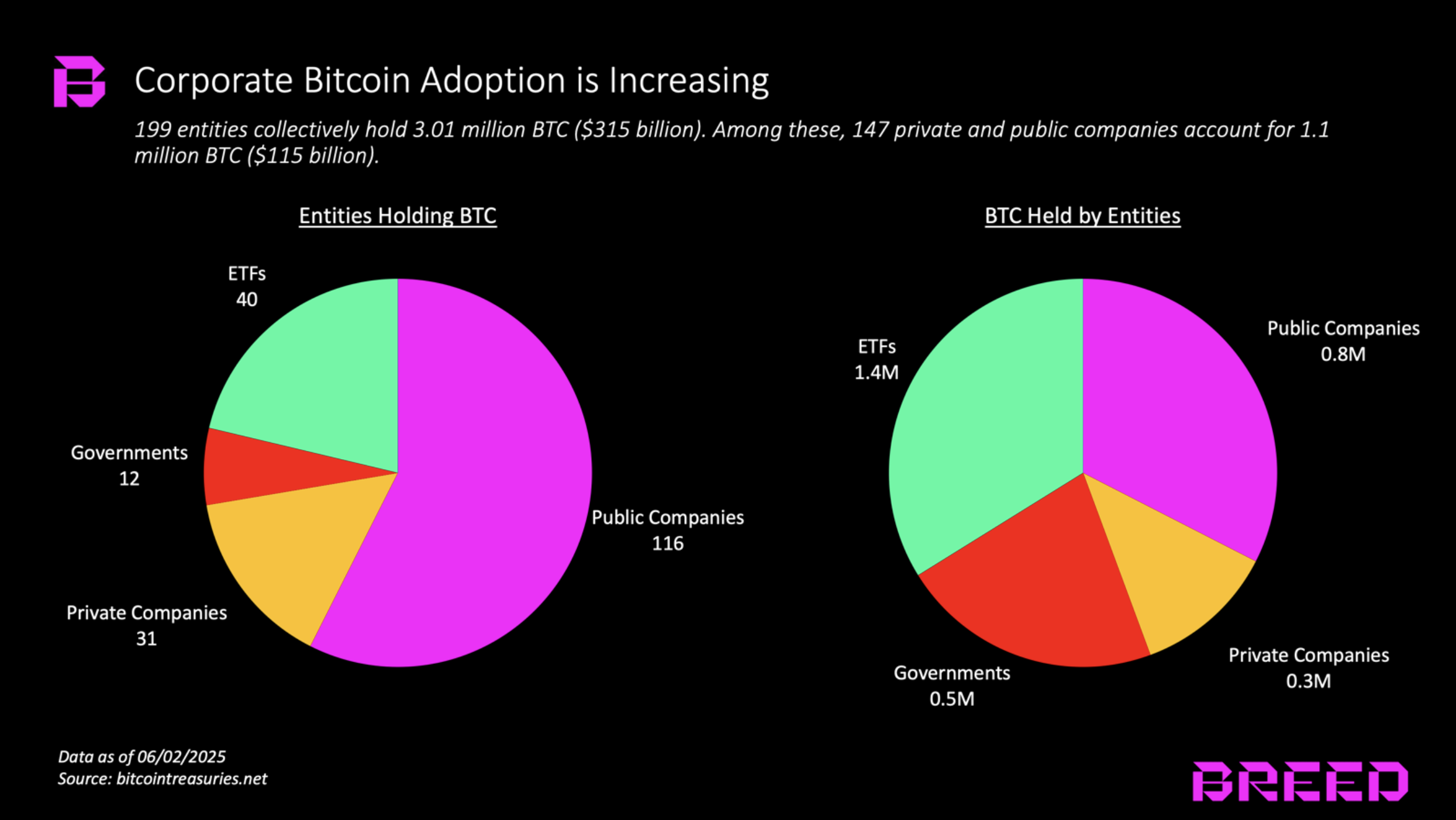

As of May 2025, about 199 entities reportedly hold 3.01 million BTC, roughly $315 billion at current prices. Among these, 147 companies — both private and public — hold around 1.1 million BTC, valued at $115 billion. And this isn’t static. Since early 2024, Bitcoin held by such entities has more than doubled.

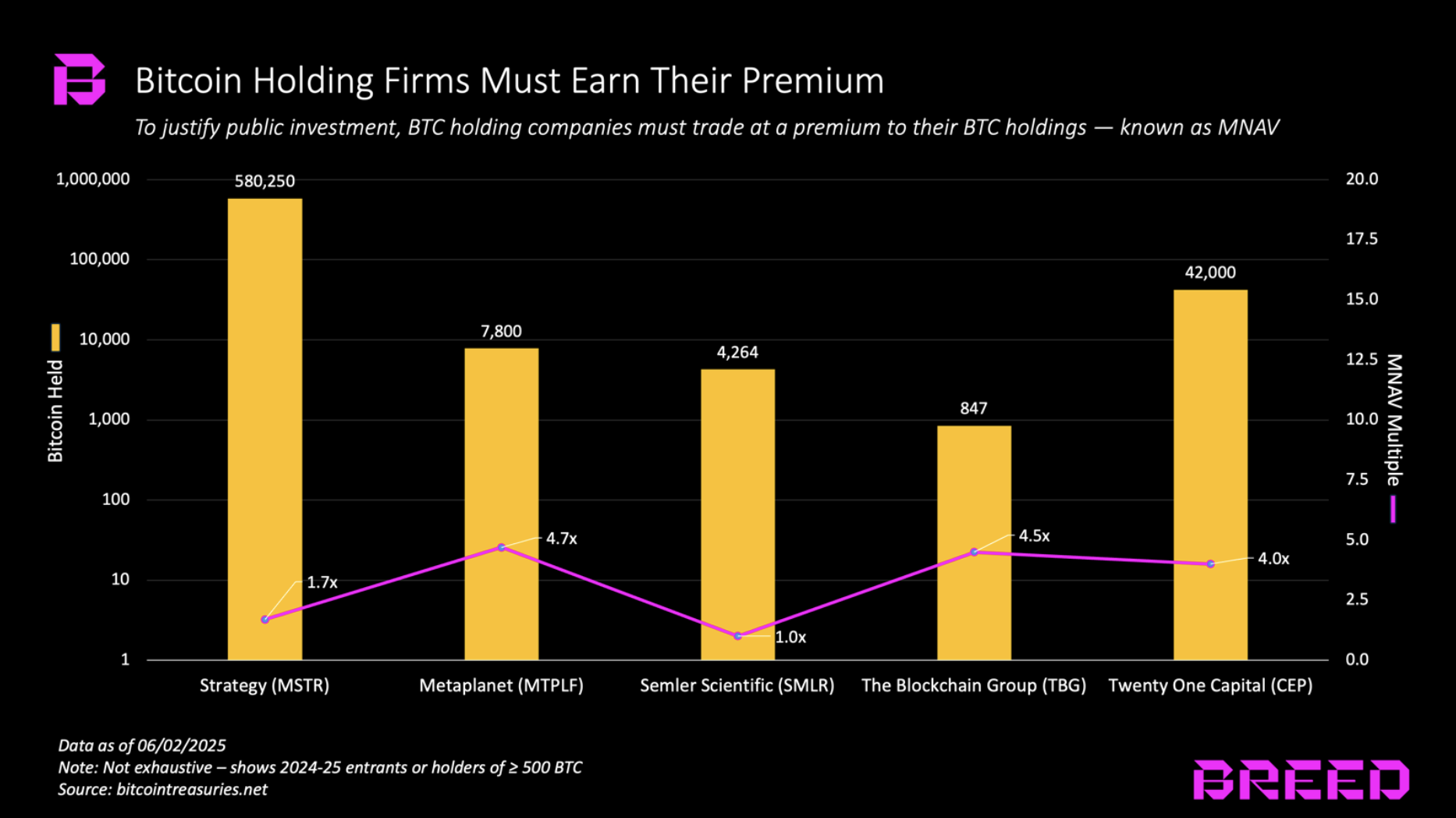

The story here isn’t just about accumulation, but about how companies whose main purpose is to hold Bitcoin are being valued differently, say analysts at Breed.VC. Think of these as Bitcoin holding companies — Strategy is the poster child. A new report highlights that for these firms, survival and success depend on commanding what’s called the Multiple on Net Asset Value, or shortly MNAV. Essentially, this is a premium investors pay above the Bitcoin value on the books.

Wait and see

But this premium, the report explains, “hinges on trust in and execution by the core team.” It’s not just about owning Bitcoin; investors want to see these firms execute a playbook that grows Bitcoin holdings per share faster than anyone could by simply holding Bitcoin on their own.

Strategy currently dominates with about 580,000 BTC, over half of all corporate-held Bitcoin, valued around $60 billion. Yet its market capitalization sits at $104 billion, giving it an MNAV of about 1.7 times. Historically, Strategy’s 2x MNAV has been the gold standard. The report outlines three main levers Strategy has used since 2020:

- Issuing convertible debt with low coupons, which converts to equity only if the share price jumps substantially, protecting shareholders from dilution unless performance warrants it.

- Running at-the-market stock issuance programs, allowing them to sell new shares when the price exceeds MNAV and then dollar-cost average into more Bitcoin.

- Reinvesting all free cash flow from legacy businesses into buying spot Bitcoin.

Others are watching and learning. New entrants are adopting and tweaking this approach, some even enabling Bitcoin holders to swap coins for shares without triggering capital gains, or acquiring undervalued businesses and turning that value into Bitcoin. Others pursue distressed Bitcoin litigation claims or raise capital via PIPE deals, apparently navigating regulatory grey areas to their advantage.

The roster of Bitcoin treasury players is growing fast. Over 40 companies have announced Bitcoin treasury strategies in the first half of 2025 alone, raising tens of billions to back these moves. These firms come from all over: Metaplanet from Japan is capitalizing on low interest rates there, Semler Scientific and GameStop in the U.S. have pivoted their treasuries, and pure-play firms like Twenty One Capital — backed by Tether and Cantor — are also in the mix.

Contagion risk

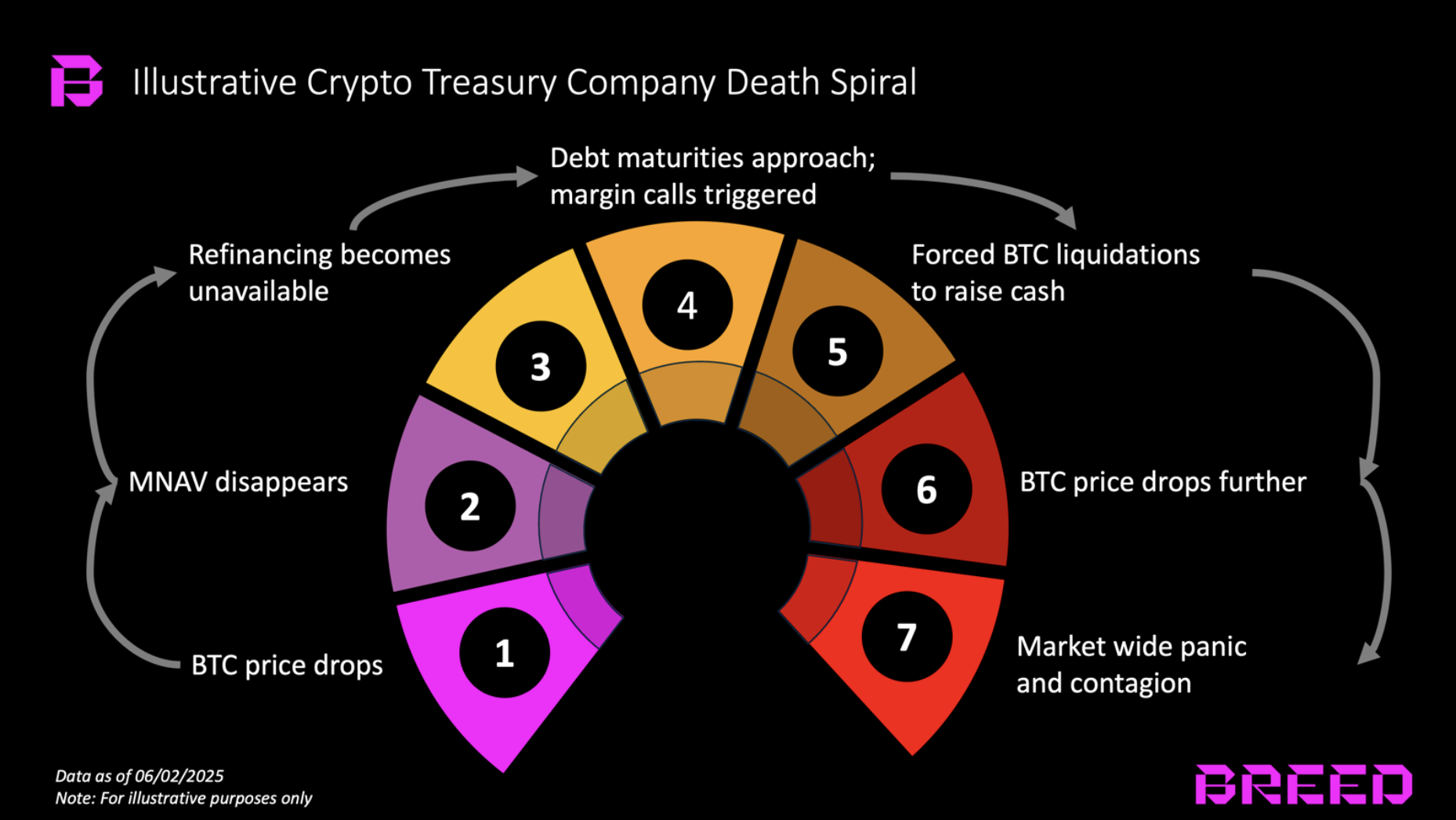

Yet, despite all the optimism, the report cautions that “nothing in finance is bulletproof,” especially in this space. Strategy itself faced a brutal stress test during the 2022–23 bear market. Bitcoin’s price plummeted 80%, the MNAV premium collapsed, and capital dried up. Though the company survived, the threat is clear.

An extended bear market combined with looming debt maturities could force firms to sell Bitcoin to meet obligations, potentially triggering a vicious cycle of price drops and forced sales. This risk is said to be particularly acute for newer companies lacking Strategy’s scale and reputation. They often raise capital on tougher terms with higher leverage, which in downturns could accelerate margin calls and distressed selling, amplifying market pressure.

The report predicts that “when failures inevitably hit, the strongest players are likely to acquire distressed companies and consolidate the industry.”

“Fortunately, contagion risk is muted because most financing is equity-based; however, companies that rely heavily on debt pose a greater systemic threat.”

Breed.VC

Looking ahead, the Bitcoin treasury company model appears to be just getting started, and not only for Bitcoin. The playbook is already spreading to other crypto assets. For example, Solana has DeFi Development Corp, which holds over 420,000 SOL and is valued around $100 million, and Ethereum has SharpLink Gaming, which raised $425 million in a round led by Consensys.

The report expects this trend to grow globally, with more companies chasing higher leverage to amplify success. However, it also foresees that “most will fail.” In that shakeout, only a handful will maintain a lasting MNAV premium through “strong leadership, disciplined execution, savvy marketing, and distinctive strategies.”

In short, the game is evolving. Bitcoin treasury firms aren’t just holders anymore as they are becoming their own breed of companies, entities that must demonstrate skill and discipline to outperform the market they invest in.