Open interest for Bitcoin just surged by 10,000 BTC, signifying an 8% surge that could shake up the price of BTC even more than it already has.

Summary

- Open interest on Binance surged by 10,000 BTC for BTCUSDT, indicating big waves.

- A spike in open interest could lead to a boost or a plummet in prices.

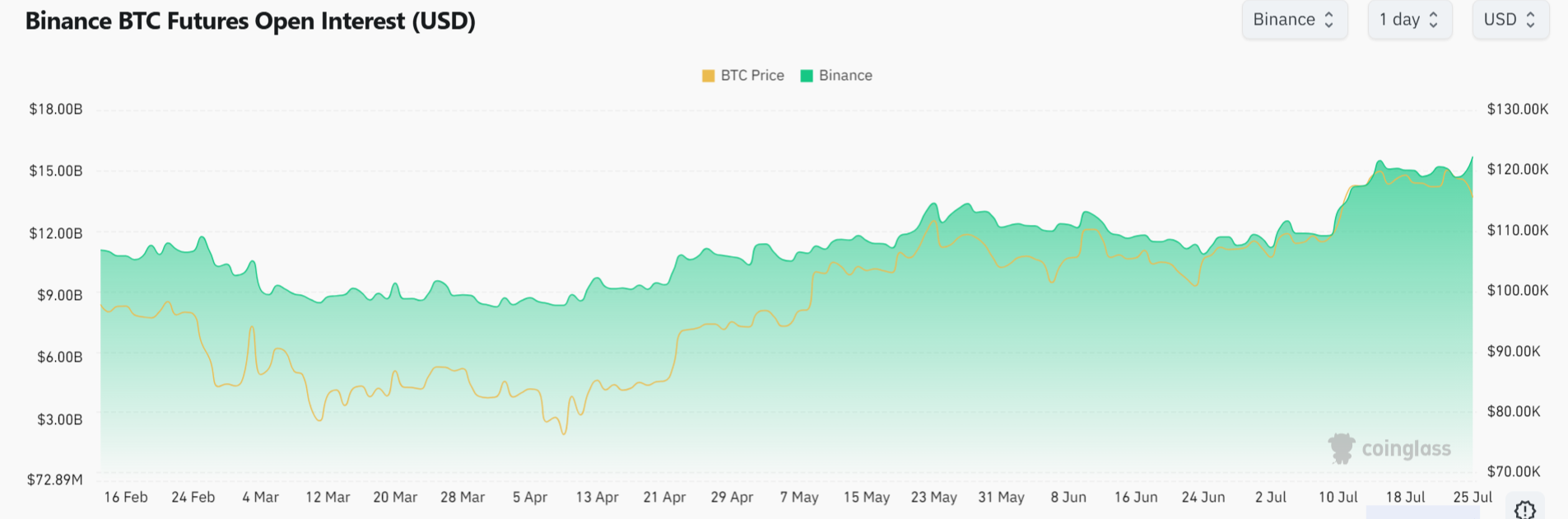

According to data from CoinGlass, Binance total BTC (BTC) futures for open interest is currently standing at 136,190 BTC or worth approximately $15.74 billion. In the past 24 hours, the rate for the total Bitcoin open interest has seen a 5.74% surge, with most of it coming from CME and Binance.

Based on on-chain monitoring, as much as 10,000 BTC ($116 million) has just been added to Binance’s BTCUSDT (USDT) pair. Considering that Binance futures contributes roughly 17.77% of the total open interest amount, this indicates a large chance that major price movements may be on the horizon.

At press time, Bitcoin has been under the weather, decreasing having just come down from its previous high at $119,415. So far, it has gone down 2.09% in the past 24 hours and is currently trading hands at $116,157.

Bitcoin’s Open Interest surge could shake up prices

An addition of 10,000 BTC would represent an 8% to 9% one‑time surge in Binance BTCUSDT open interest. This is a sizable build in short‑or‑long positioning over a short period of time. A move like that could lead to a sudden influx of speculative leveraged capital, which raises the risk of liquidation cascades and volatile swings if prices move sharply.

Open interest is the total number of contracts that have not yet been settled or closed out. In terms of crypto, the open interest tracks all outstanding futures contracts on BTC and represents leverage or bets that have not been settled on-chain.

When open interest is high, especially after a sudden jump, there’s a higher chance market moves will trigger forced liquidations. If BTC spikes or plummets too sharply, these futures may be forced out of their positions. This could lead to amplified price movements in the near future.

In the past, a high open interest has led to BTC reaching all-time highs. Most recently, this occurred near the end of May when Bitcoin’s value hit an all-time high of $111,970 at the same time as Bitcoin’s open interest spiking to $80.91 billion.