Bitcoin may outperform every major asset over the next decade, according to a new Bitwise report projecting a 28% annual growth rate. The firm cites rising institutional demand, scarce supply, and growing concerns over fiat currency debasement as key drivers for the rally.

Summary

- Bitwise projects Bitcoin could grow 28.3% annually over the next decade, potentially reaching $1.3 million per BTC by 2035.

- Growth drivers include $1-5 trillion in potential institutional demand, 94.8% of the 21 million BTC already in circulation, and rising U.S. debt, up $13 trillion in five years.

- Combined with a low 0.21 correlation to equities, these factors make Bitcoin a strong long-term store-of-value.

Bitcoin (BTC) could be on a track of another big leap, according to a new report by Bitwise Asset Management, which says that over the next decade, BTC may outperform every major asset in the world, with an estimated compound annual growth rate of 28.3%.

In a 24-page report, Bitwise says its thesis is driven by “three primary factors,” outlining what Bitwise sees as the key ingredients for a long-term bitcoin rally: institutional demand, limited supply, and rising concern about fiat money debasement.

The first factor, institutional demand, stems from the unique nature of Bitcoin’s adoption. Unlike other emerging assets such as private equity or credit, which first attracted institutional investors, Bitcoin’s rise was led by retail investors, the report reads. Nearly 95% of all Bitcoin that will ever exist is already owned “primarily by retail investors,” leaving institutions with almost no exposure, the firm says.

Now that institutions are starting to allocate to the largest cryptocurrency by market cap, the market could see a tidal wave of demand.

“The World Bank believes that institutional investors control roughly $100 trillion in total assets. In the coming decade, we believe these investors will allocate between 1% to 5% of their portfolios to bitcoin, meaning they will need to buy $1 trillion to $5 trillion of bitcoin.”

Bitwise

By comparison, Bitcoin ETPs currently hold $170 billion, a fraction of the $1 trillion to $5 trillion that Bitwise expects institutions could buy in the coming decade.

Scarce supply

Adding fuel to the fire is Bitcoin’s strict scarcity. It’s well known in the crypto circles that the total supply is capped at 21 million BTC, and 94.8% of that supply is already in circulation. New BTC is produced at a slowing rate, with annual issuance expected to drop from 0.8% today to just 0.2% by 2032. Unlike gold or oil, Bitcoin’s supply can’t be increased to meet rising demand, making it highly inelastic.

As Bitwise notes, the collision of large institutional demand with limited, inelastic supply provides a “simple economics-driven rationale for our thesis.”

Finally, Bitwise points to rising concerns about fiat currency debasement. U.S. federal debt has ballooned by $13 trillion in the past five years to $36.2 trillion, while annual interest payments have grown to $952 billion, making them the fourth-largest item in the federal budget. As interest rates rise above expected GDP growth, the pressure on traditional currencies is intensifying.

“The combination of these three factors—institutional demand, limited supply, and rising concerns about fiat debasement—allows bitcoin investors to benefit as bitcoin earns an increasing share of the store-of-value market, and as the size of that market grows.”

Bitwise

Valuation model

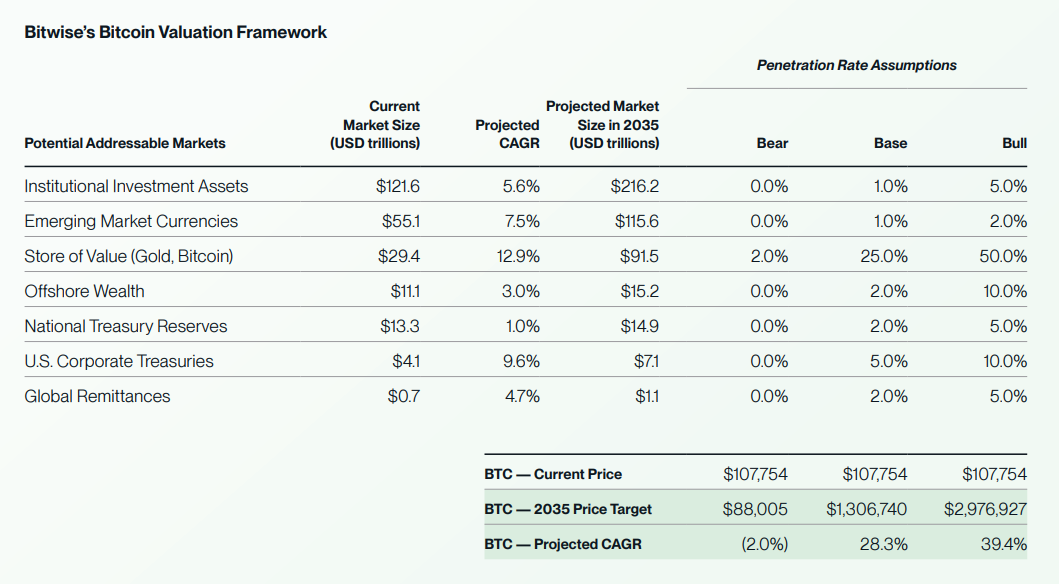

To estimate Bitcoin’s future price, Bitwise uses a Total Addressable Market approach, which looks at the potential size of markets Bitcoin can serve and its likely penetration. This includes non-sovereign stores of value like gold, corporate and national treasuries, offshore wealth, and global remittances.

Based on conservative assumptions, Bitwise forecasts a 2035 bitcoin price of $1,306,740, reflecting a 28.3% CAGR from current levels. Bear and bull cases range from $88,005 to nearly $3 million per BTC. The firm notes that these projections are not a guarantee, but a framework for understanding the market opportunity.

Bitwise also makes the case for Bitcoin’s value in simple terms: it provides a service, the ability to store wealth digitally without relying on a bank or government. As the firm explains, the more people who want this service, the “more valuable bitcoin becomes.” At the same time, the fewer people who want this service, the less valuable Bitcoin becomes. If no one wants this service, the value of bitcoin is zero, the report states.

Four-year cycle is dead now

Bitcoin’s low correlation with other assets adds another layer of appeal for investors. Over the past decade, its average correlation to U.S. equities has been just 0.21, and it has rarely exceeded 0.50 in short-term measures, contrary to common media portrayals. Even when equities drop sharply, bitcoin has historically rebounded faster, highlighting its potential as a diversifying asset.

The blend of scarcity, institutional interest, hedging potential, and low correlation makes Bitcoin an attractive long-term portfolio asset. However, Bitwise analysts caution that the traditional four-year cycle may no longer apply, as the influence of past market drivers has waned.