New data shows over 30% of South Korea’s wealthy investors prefer crypto for long-term value growth, outpacing interest in gold or property.

South Korean investors — especially the younger crowd — are leaning harder into crypto, and a new report from Hana Bank’s think tank suggests this could be more than just a passing trend.

According to a recent report by Hana Bank, one of South Korea’s largest banks, digital assets could mark a paradigm shift in investment patterns, especially as traditional financial systems fall short of younger investors’ expectations. The think tank noted that should these assets gain the function of settlement and legal status as a financial investment product, the likelihood of forming a new financial order increases. While it’s not a prediction, it can definitely act as a flag.

It’s also a moment of reckoning. While the report didn’t declare crypto the future of finance, it still noted that the proportion of the wealthy investing more than 10 million won (around $7,000) in crypto “surpassed 70%, with the average investment amount more than twice” as much as other investors.

Young Koreans ignore stocks

Some of this is already visible on the ground. Young Koreans are stepping away from the domestic stock market. And fast. “I never invest in the Kospi [The Korea Composite Stock Price Index],” one office worker in his 20s told Korea JoongAng Daily in a mid-April interview. Others in their 30s echoed the sentiment, saying they’re moving toward U.S. equities, and even more aggressively, into crypto.

The report, citing data from the Korea Securities Depository, revealed that by 2023, only 11% of investors in the Korean market were in their 20s. That’s down from 14.9% in 2021. For investors in their 30s, it dropped from 20.9% to 19.4% over the same period.

And crypto? It’s booming among the same group. Nearly 48% of crypto investors in South Korea were in their 20s and 30s last year, according to the Financial Services Commission.

On just five major exchanges — Upbit, Bithumb, Coinone, Korbit and Gopax — their trading volume totaled “2.52 quadrillion won [or around $1.76 trillion],” the report reads. “It’s now common knowledge in the industry that cryptocurrencies like Bitcoin are siphoning off retail investment funds from the stock market,” said one brokerage industry insider.

Crypto.news repeatedly reached out to both Upbit and Bithumb for comment, but neither responded by the time of publication.

CryptoQuant chief executive Ki Young Ju told crypto.news the strong demand likely comes from Korean retail investors, who “have a much higher appetite for risk assets compared to those in the U.S.”

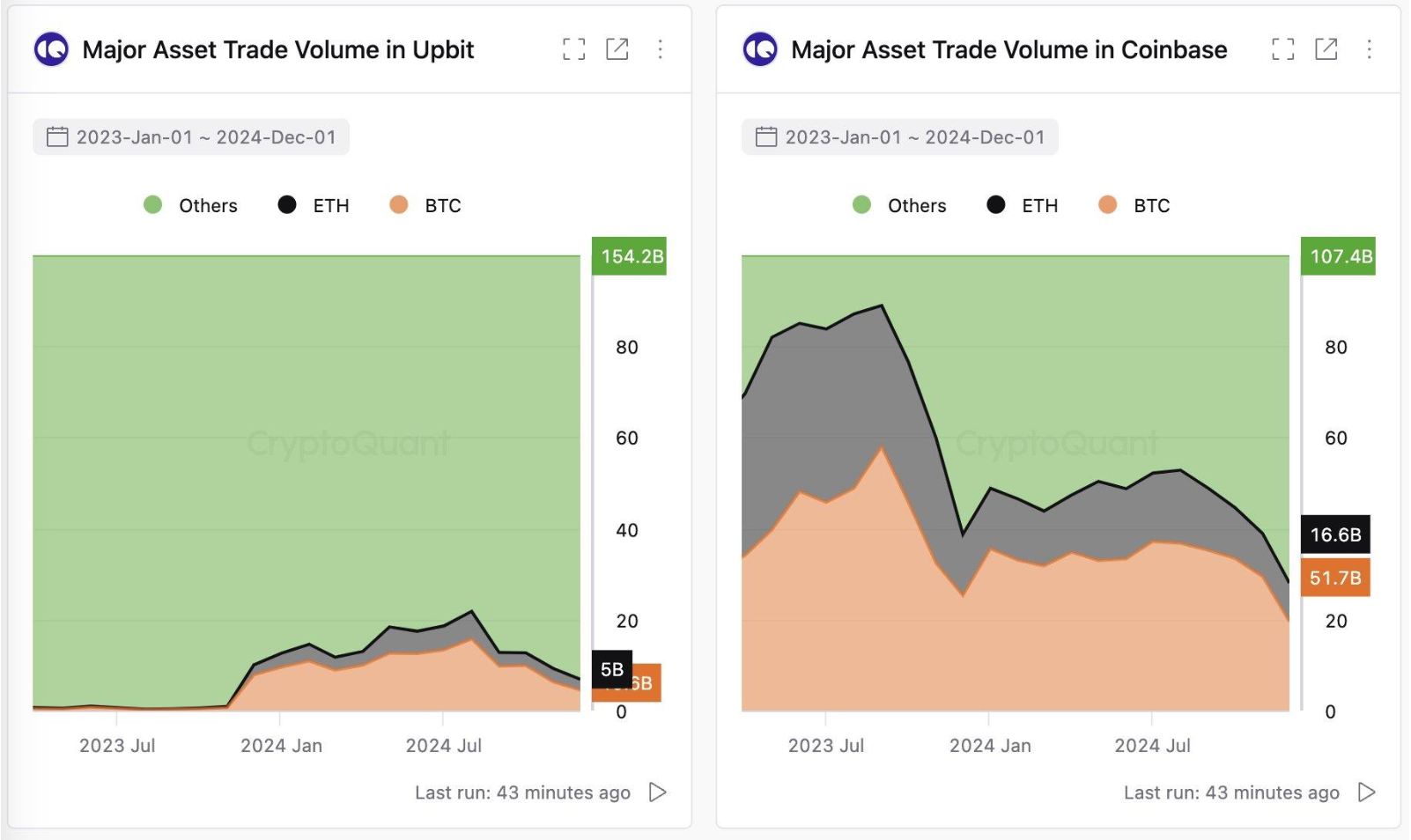

“Crypto trading volume in Korea has long surpassed that of the local stock market (Kosdaq), and when it comes to altcoins, Korea leads the world. By the end of 2024, Coinbase’s monthly altcoin volume was $107 billion —while Upbit’s hit nearly $154 billion.”

Ki Young Ju

Hana’s report doesn’t endorse any single crypto asset. But its researcher Yoon Seon-young noted that the wealthy group expecting growth potential in crypto “signals the maturity of this field.”

“However, the institutional safety nets are still insufficient, and understanding of new technologies is lacking, leading to a clear division in opinions about virtual assets. Nonetheless, the wealthy tend to study thoroughly before investing and prefer to invest in areas they understand. I hope their interest and efforts to learn about new investment areas will continue.”

Yoon Seon-young

While that doesn’t mean crypto is safe, it does though mean it’s being taken more seriously — even by legacy players.

Changing regulatory landscape

South Korea’s regulators are catching on as well. The Financial Services Commission recently said it plans to release comprehensive investment guidelines for crypto by the third quarter of 2025.

It’s part of a broader effort to bring crypto closer to the formal financial system. Universities and nonprofits could be allowed to sell their crypto holdings soon. Institutional rules are in the works. Even spot ETFs — once banned — are being quietly reconsidered.

At a policy meeting this month, FSC Vice Chairman Kim So-young said Korea is moving faster to “foster its crypto market,” noting that the U.S. under Trump is accelerating global crypto adoption. The upcoming rules will focus on “best practices,” with standards around disclosure, reporting, and trading.

Two-sided sword

It’s a tightrope. On one side, potential. On the other, volatility. South Korea — home to one of the world’s most active crypto markets — is trying to walk that line.

Politicians are starting to take notice, too. Presidential candidate Hong Joon-pyo has recently said he wants to roll back crypto regulations, comparing it to deregulatory moves under the Trump administration. That kind of talk could resonate with younger voters, many of whom already see crypto as a long-term play — or at least a better alternative than the Kospi.

This shift isn’t limited to Korea. But it’s particularly sharp here. Roughly 30% of the population trades crypto, according to Korea Economic Daily. That’s a staggering figure — and one regulators, banks, and political leaders can’t ignore.