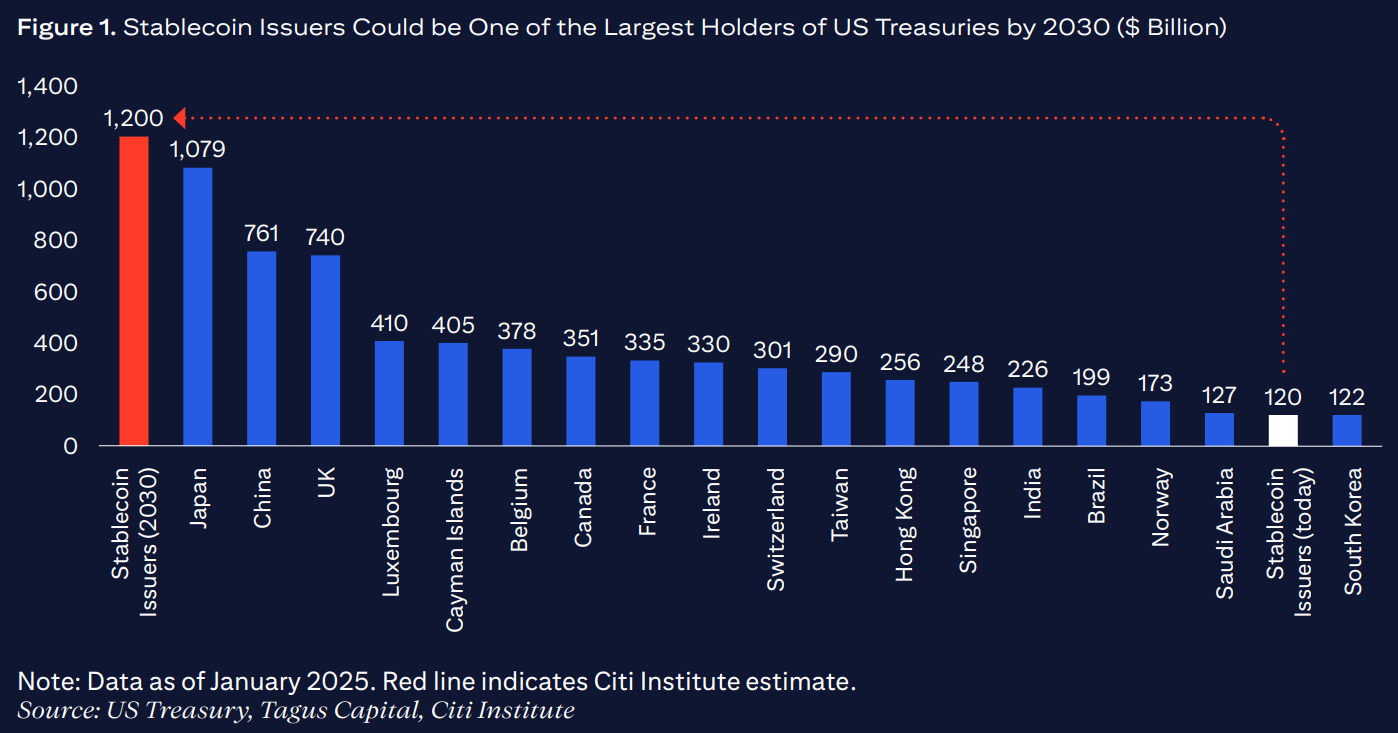

Stablecoin regulation could add over $1 trillion in Treasury demand and make issuers among the largest holders of U.S. government debt, Citigroup says.

Stablecoin issuers could become some of the largest holders of U.S. Treasuries by 2030 if the U.S. adopts a regulatory framework, Citigroup said in a new report, adding that more than $1 trillion in additional demand for Treasuries could come from stablecoin growth.

According to the New York-based bank, a supportive U.S. regulatory framework could lead stablecoins to drive demand for “dollar risk-free assets inside and outside the U.S.”

“Creating a U.S. regulatory framework for stablecoin would support demand for dollar risk-free assets inside and outside the U.S. The stablecoin issuers will have to buy U.S. Treasuries, or comparable low risk assets, against each stablecoin as a measure of having safe underlying collateral.”

Citigroup

Citigroup’s base case assumes that stablecoin issuers “could hold more U.S. Treasuries by 2030 than any single jurisdiction today,” adding that if base case holds true, stablecoin issuers “could become one of the largest holders of U.S. Treasuries relative to any other jurisdiction today.”

However, the bank’s analysts also highlighted risks and challenges. Since stablecoins “carry run-risk,” the failure of a major issuer “could cause contagion effect,” the report reads. Citigroup also noted that stablecoins de-pegged “about 1,900 times in 2023, with around 600 of these being large-cap stablecoins.”

Geopolitical risks may also slow global stablecoin adoption as stablecoins “may be viewed by many non-U.S. policy makers as an instrument of dollar hegemony,” Citigroup warned, adding that “policymakers in China and Europe will be keen to promote central bank digital currencies or stablecoins issued in their own currency.”