Japanese investment firm Metaplanet has increased its Bitcoin holdings by 1,004 BTC, bringing the total reserve to 7,800 BTC.

Tokyo-listed investment firm Metaplanet has expanded its Bitcoin (BTC) holdings with a new purchase of 1,004 BTC, bringing its total reserves to 7,800 BTC.

In a regulatory filing on May 19, Metaplanet disclosed that the latest buy, valued at around $104 million, was made at an average price of $97,182 per BTC, placing the company’s total Bitcoin investment at approximately $712.5 million to date.

The purchase comes as Bitcoin’s market price surpassed $100,000, buoyed by optimism over U.S.-China tariff discussions. Based on current prices, Metaplanet now holds an unrealized profit of $77.4 million, according to the company’s website.

The announcement sent Metaplanet’s stock price up by 12% on the Tokyo Stock Exchange, pushing shares to levels last seen in February, while the company’s market capitalization rose to ¥365.12 billion (approximately $2.34 billion), based on data from Yahoo Finance.

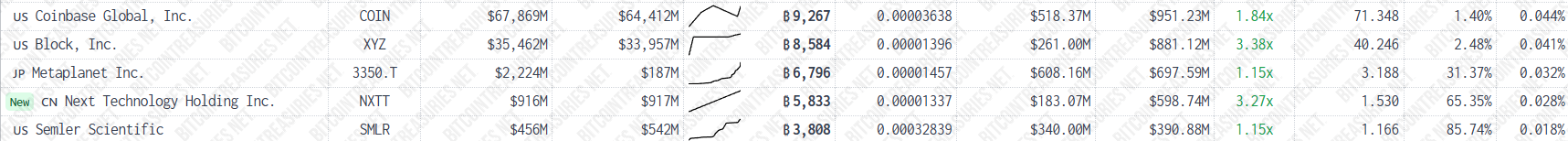

The latest accumulation puts Metaplanet within range of major corporate Bitcoin holders such as Jack Dorsey’s Block Inc, which holds 8,584 BTC, and U.S.-based cryptocurrency exchange Coinbase, which holds 9,267 BTC, according to tracking website Bitcoin Treasuries.

Metaplanet chief executive Simon Gerovich earlier said the company aims to accumulate 10,000 BTC by the end of 2025. With the latest purchase bringing total holdings to 7,800 BTC, Metaplanet has now reached 78% of that target.