Norway’s central bank holds over $500 million in indirect Bitcoin exposure through investments in MicroStrategy and other cryptocurrency-focused companies.

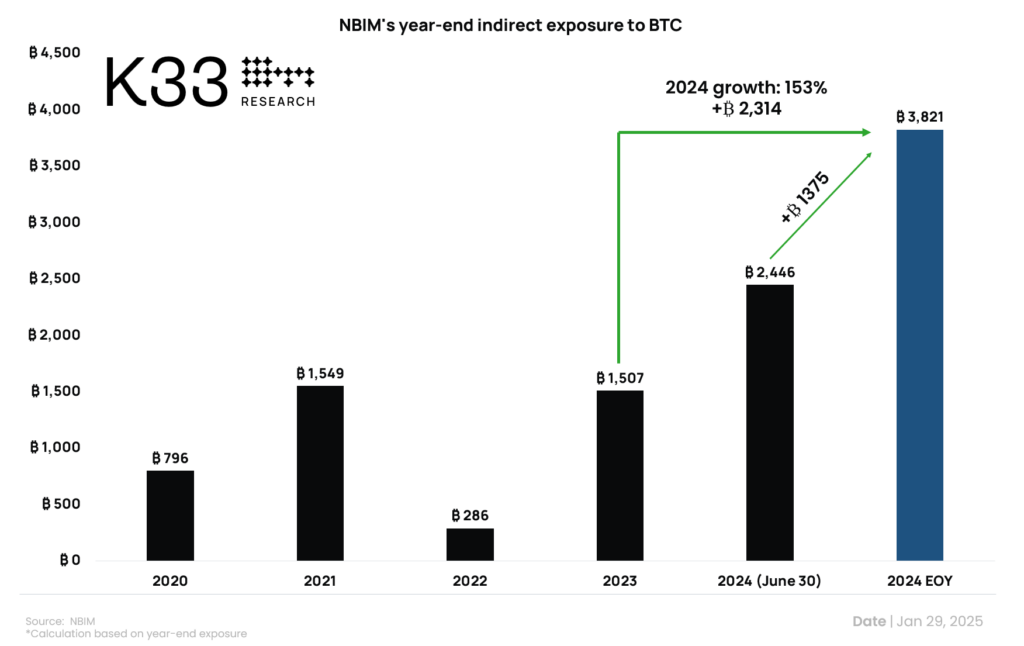

According to K33 Research, Norway’s indirect exposure to Bitcoin (BTC) has nearly tripled over the past 12 months due to increased allocations to crypto-related firms.

Vetle Lunde, K33 head of research at K33, wrote that the Norway Sovereign Wealth Fund holds 0.72% of MicroStrategy’s total shares, valued at approximately $514 million as of December 2024. This investment translates to indirect exposure of around 3,214 Bitcoin.

While Norway’s central bank has invested in MicroStrategy since 2009, the trend accelerated last year as the company cemented its position as the largest corporate holder of Bitcoin, according to Lunde. MicroStrategy remains Norway’s sovereign fund’s largest cryptocurrency-linked investment. The fund is overseen by the central bank and managed by Norges Bank Investment Management.

In addition to MicroStrategy, Norges Bank Investment Management also holds shares in other companies with Bitcoin exposure. These include Tesla, Bitcoin mining firms Marathon Digital and Riot Platforms, cryptocurrency exchange Coinbase, and Tokyo-based Metaplanet.

Together, these investments represent over $61 million in indirect Bitcoin exposure. Lunde noted that Norges Bank Investment Management’s investment strategy likely follows rule-based sector weighting rather than a direct Bitcoin acquisition plan.

However, Lunde also pointed out the unusual nature of some of Norges Bank Investment Management’s investment choices, suggesting that Bitcoin is increasingly finding its way into institutional portfolios worldwide.

Norway’s interest in companies with significant Bitcoin holdings gained attention last year. In August, documents revealed that central banks in Norway and Switzerland made substantial investments in MicroStrategy shares, coinciding with increased Bitcoin purchases by the Tysons Corner-based firm.