Wormhole appears poised for a bearish reversal, with technical indicators continuing to signal weakness ahead of a Coinbase listing.

In a Tuesday announcement, Coinbase confirmed it would list Wormhole (W) on July 2 as an SPL token on the Solana network.

Listings on major exchanges such as Coinbase often generate short-term bullish sentiment; however, in this case, the token has failed to attract meaningful investor interest ahead of the event.

This listing comes shortly after Wormhole entered into a strategic partnership with Ripple Labs to integrate multi-chain interoperability with the XRP Ledger and its EVM-compatible sidechain. By enabling cross-chain messaging, asset transfers, and multi-chain token issuance, the partnership aims to strengthen the XRP Ledger’s capabilities.

Yet these developments have failed to improve investor sentiment, as evident by Wormhole’s price action, which remains subdued. The token is currently down 77.6% year-to-date. After falling to an all-time low of $0.051 on June 22, it has only managed a modest recovery to $0.071 at the time of writing.

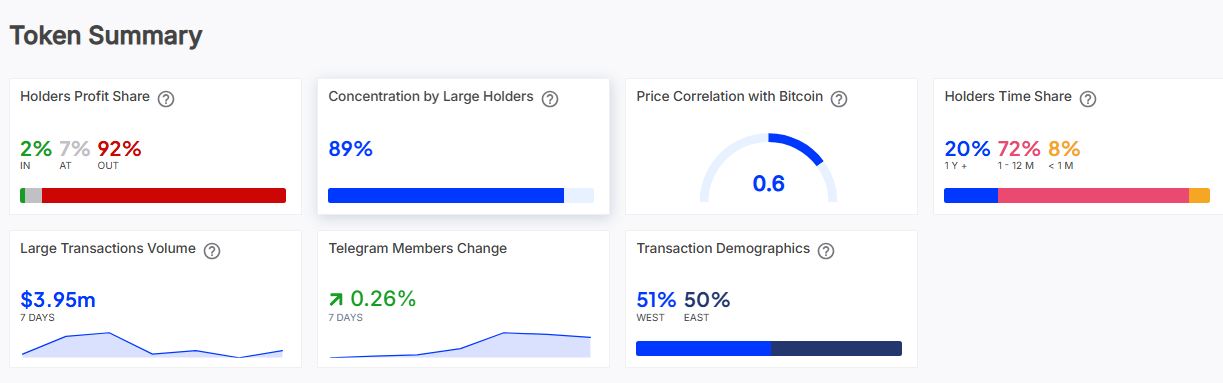

Adding to the caution, most investors are currently underwater, and a small group of whales control the majority of the token supply.

According to data from IntoTheBlock, 92% of Wormhole addresses are currently in losses, with 88% of the circulating supply concentrated in the hands of whales. This distribution raises the risk of large-scale sell-offs as these holders may seek to mitigate further losses, which could exacerbate price volatility.

Additional data from Nansen highlights further weakness in investor confidence. Influencers and publicly known accounts have reportedly been offloading their Wormhole holdings over the past week.

Such actions by high-visibility figures often trigger negative sentiment among retail investors, adding to the selling pressure and undermining broader market support.

W price analysis

Wormhole’s market structure is also showing signs of stress, with a bearish pattern forming.

On the 4-hour W/USDT chart, the token has broken below the lower boundary of an ascending broadening wedge, a volatile and typically bearish structure that had been forming since the token’s recent local bottom.

An ascending broadening wedge is characterized by expanding price swings and rising trendlines, which often means markets are becoming unstable and losing directional conviction. A breakdown below the lower trendline generally signals that bearish pressure is mounting and that a further drop may follow.

Momentum indicators support this bearish outlook. The MACD lines have crossed to the downside, while the Relative Strength Index has retreated to neutral levels at 50. This suggests that bullish momentum has dissipated, and sellers are taking over. A negative Chaikin Money Flow reading further confirms this trend.

Given these conditions, W may be poised to retest the $0.066 level, which corresponds with the 23.6% Fibonacci retracement zone. A decisive break below this support could expose the token to further losses, potentially leading to a retest of its all-time low at $0.051.

This level may serve as a temporary support zone, provided selling pressure eases. However, failure to hold above it could result in a deeper price correction.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.