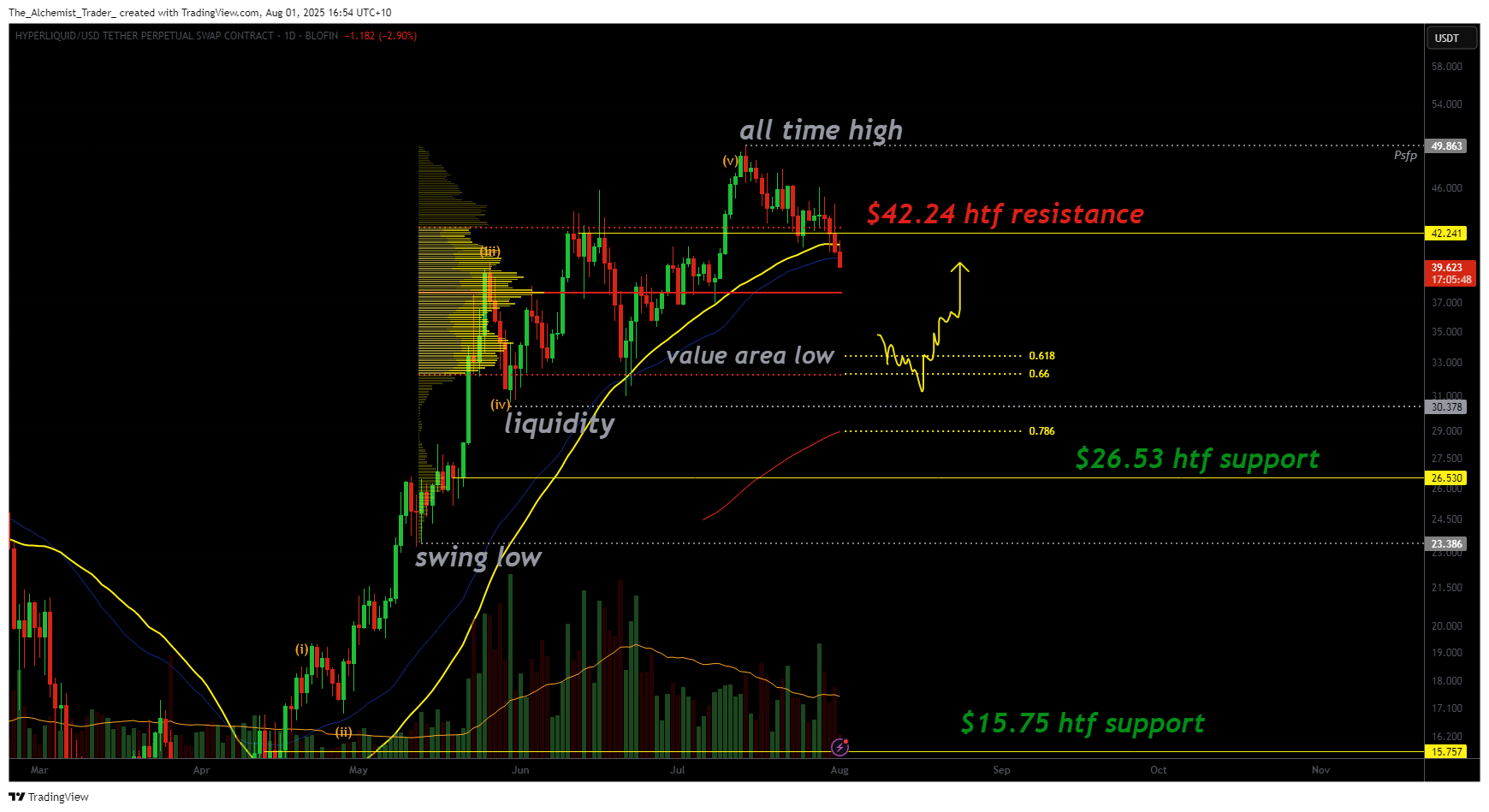

HyperLiquid has lost its high-timeframe resistance level at $42.24, signaling a failed breakout. Price action is now in a corrective phase, with focus shifting to lower support zones as structure weakens.

Summary

- HYPE lost its high-timeframe resistance at $42.24 after a failed breakout to all-time highs

- Key support zones lie at the point of control and the value area low near $30

- Volume remains weak, signaling lack of demand and increasing the risk of deeper correction

After briefly reclaiming $42.24 and establishing a new all-time high, HyperLiquid (HYPE) failed to sustain above the level, forming what now appears to be a deviation or failed auction. This breakdown has initiated a corrective move, with price currently approaching the point of control, an important support zone that has not yet been tested during this correction.

Key technical points

- Failed Auction at $42.24: Price lost a critical high-timeframe resistance, triggering downside.

- Support Zones Below: Point of control and value area low at $30 are the next trade locations.

- Volume Declining: Lack of demand at recent highs increases the risk of extended corrective structure.

The loss of $42.24 marks a significant shift in momentum, especially given that the level briefly acted as support after the new all-time high. This failure now confirms a deviation, a typically bearish signal that can lead to deeper retracements. Price action is rapidly approaching the point of control, which now serves as the first line of defense in this corrective leg.

If HYPE holds the point of control on a daily closing basis, the current pullback may be viewed as a healthy correction within a broader uptrend. However, failure to hold this zone increases the probability of continued decline toward the value area low near $30. This area remains untapped and contains significant liquidity, making it a high-probability bounce location.

Should the $30 level also fail, the next major high-timeframe support lies at $26.53. A breakdown toward this level would define a larger range between $42.24 resistance and $26.53 support, creating a broader rotational structure that could persist absent strong directional volume.

From a structural perspective, the bullish trend remains intact as long as the value area low is respected on a closing basis. Losing this level would break the current market structure and introduce deeper consolidation or a trend reversal scenario.

Volume analysis confirms the weakness. Since printing the all-time high, volume has declined with no clear bullish influx. This reflects a lack of demand at higher levels. Until buyers step in with conviction, price is likely to rotate within a wider range.

What to expect in the coming price action

HyperLiquid is now in correction mode after failing to hold above $42.24. Traders should monitor the point of control for signs of support. A hold could spark reversal, but failure may lead to a move toward $30 or even $26.53. Volume confirmation remains essential for any sustainable recovery.