The crypto market rebounded today, Dec. 2, with Bitcoin and top altcoins rising by over 1% in the last 24 hours, and the market capitalization of all tokens rising to nearly $3 trillion.

Summary

- The crypto market is going up today as liquidations drop.

- It also jumped as the odds that the Federal Reserve will cut interest rates in December hit 90%.

- The ongoing rebound could be a dead-cat bounce, also known as a bull trap.

Crypto market up, liquidations drop, open interest spikes

Bitcoin (BTC) and other altcoins rebounded as third-party data showed that futures market activity improved modestly.

According to CoinGlass, liquidations plunged by 60% on Tuesday to $328 million, while the futures open interest improved slightly to $125 million.

A drop in liquidations is a positive sign because it indicates fewer bullish trades are being forcibly closed by centralized and decentralized exchanges.

Still, there are signs that crypto investors are concerned about liquidations, especially after the October 10 event that wiped out over 1.6 million traders. The total liquidations on that day rose to over $20 billion, the worst single-day performance.

Cryptocurrencies rebounding as Fed cut odds soar to 90%

The crypto market rebounded as investors bet the Federal Reserve will cut interest rates by 0.25% at its meeting next week.

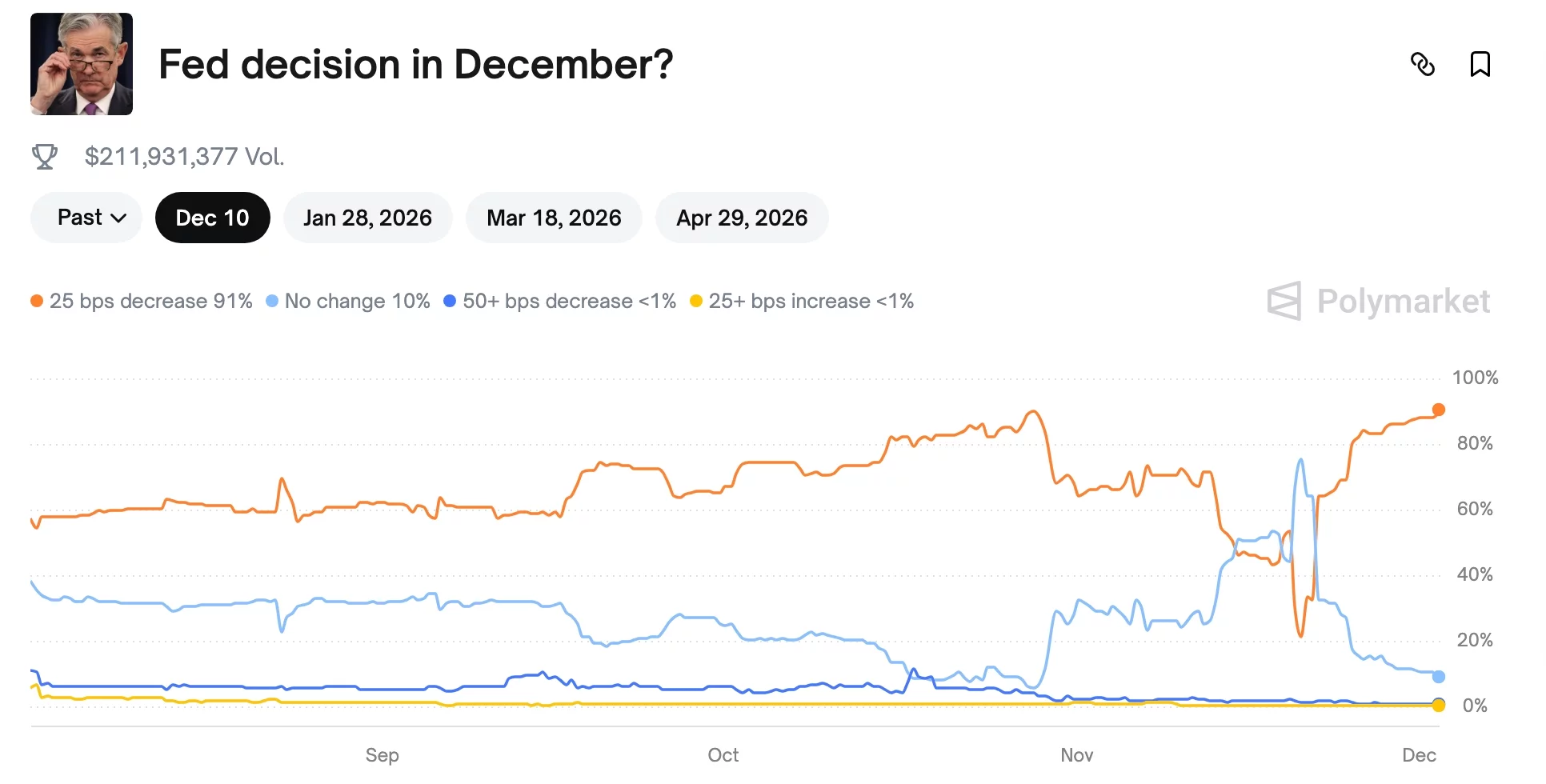

A Polymarket poll with over $212 million in assets shows that the odds of a cut in December rose to 90% from the November low of less than 50%.

At the same time, the Fed has already ended its quantitative tightening, which saw its balance sheet shrink by over $2 trillion in the past two years.

At the same time, there are signs that the bank may soon begin quantitative easing, in which it pumps funds into the economy to stimulate growth.

Indeed, the bank pumped $13.5 billion into the banking system through overnight repos. That was a notable amount as it was the second-biggest capital injection since the pandemic.

Potential dead-cat bounce or bull trap

The crypto market is also rising as investors buy the dip, which is a common situation when assets plunge, as they did on Monday.

Therefore, there is a risk that the ongoing crypto rebound is a dead-cat bounce, which is also known as a bull trap.

A DCB is a situation where a falling asset drops, bounces back briefly, and then resumes the downward trend. It is known as a bull trap because it traps traders into believing a bull market is forming, only for prices to resume the downtrend.

The crypto market has had several bull traps in the past few months. For example, it rebounded from $98,990 on Nov. 3 to $107,276 on Nov. 11, and then resumed the downtrend.