With the holidays draining liquidity and uncertainty still in the air, the crypto market is clearly moving more cautiously. Bitcoin has managed to remain stable, but rising ETF outflows and slowing momentum are difficult to ignore.

At this point, it’s unclear whether the BTC price will slide down or is just consolidating before the next rally.

Summary

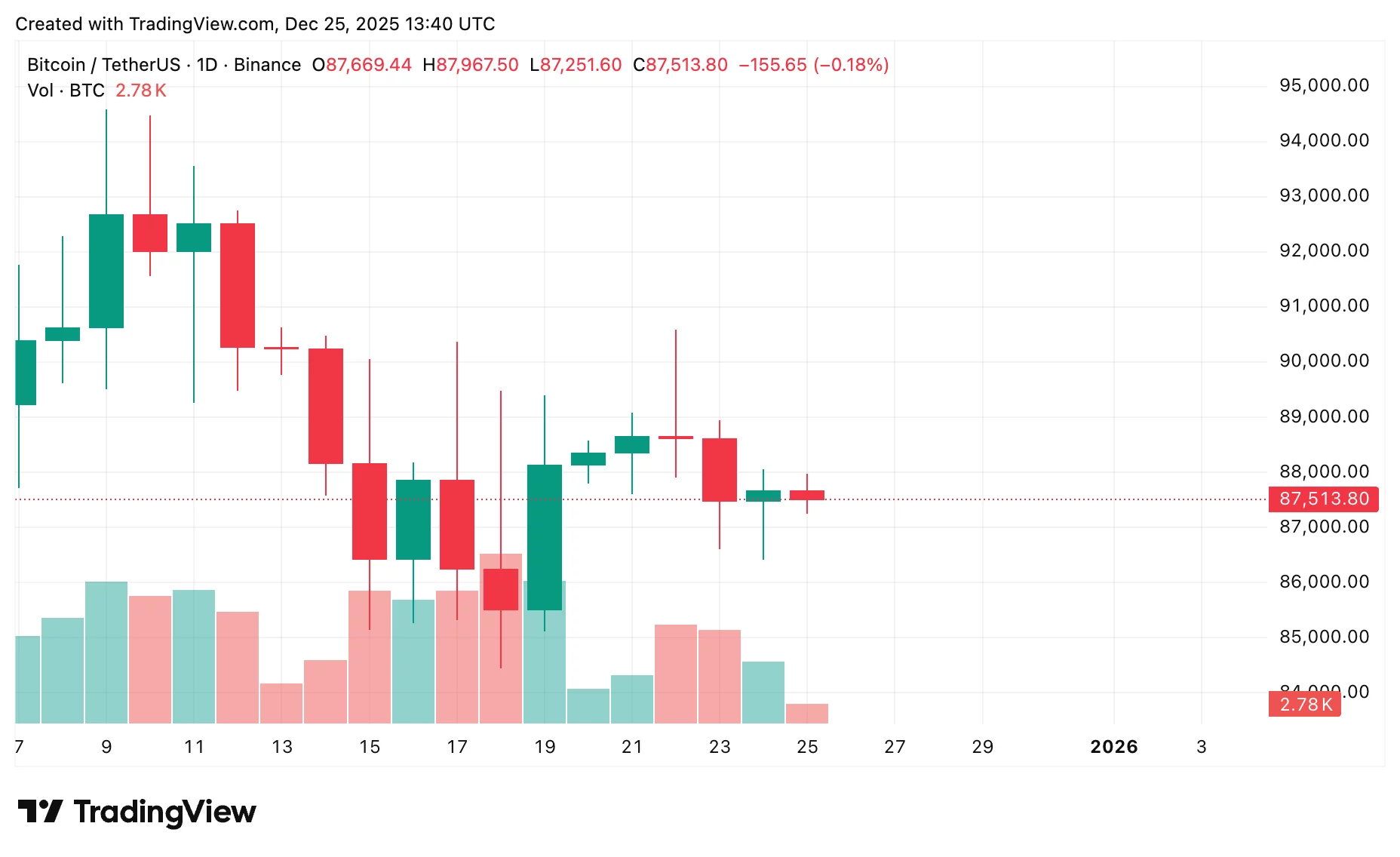

- BTC is trading near $87,500, consolidating in the $86,400–$88,000 range amid cautious holiday trading.

- Support at $86,400–$86,700 remains strong, but $175M in ETF outflows is weighing on market sentiment.

- A breakout above $89,000–$90,000 could push BTC toward $93,000–$94,000, signaling renewed bullish momentum.

- Downside risks remain if support fails, with potential pullbacks to $85,500, $84,000–$82,000, or even $80,000 in a more bearish scenario.

Current market scenario

On Christmas, Bitcoin (BTC) is holding steady at around $87,500, gaining about 0.3% over the last 24 hours. The BTC price remains range-bound between $86,400 and $88,000, pointing to consolidation rather than panic selling.

Support between $86,400 and $86,700 continues to show strength, drawing buyers each time price touches this zone and keeping market confidence intact.

That said, ETF outflows are dampening market sentiment. Spot Bitcoin ETFs recorded $175.29 million in net outflows on December 24, and if this trend continues, it could exert near-term pressure on the BTC price.

Upside outlook

Bitcoin’s technical structure remains constructive, with the price holding above short-term support and keeping bullish expectations alive. That said, buyers need to clear the $89,000–$90,000 resistance area to truly regain momentum, as this zone has acted as a strong ceiling.

If price breaks above and closes the day higher, market sentiment would likely improve. The BTC forecast in that case would target the $93,000–$94,000 range, an area known for prior selling pressure. Such a move would imply that ETF outflows are no longer dominating price action.

Downside risks

Bitcoin may look stable in the short term, but the downside isn’t off the table. Falling under $86,400 while ETF outflows persist could accelerate the pullback, with $85,500 as the first support to monitor.

If selling continues, the BTC price prediction becomes more cautious, targeting the $84,000–$82,000 range, where buyers have stepped in before. In a more bearish market, Bitcoin could even test $80,000, shaking out late entrants.

Bitcoin price prediction based on current levels

Overall, this Bitcoin price prediction shows the market is caught between key support and resistance. BTC price action has been consolidating rather than selling off, with strong buying near $86,400. Still, ongoing ETF outflows remain a downside risk.

As long as support holds, the BTC outlook stays neutral-to-cautiously bullish, eyeing potential gains toward $93,000–$94,000.

If these levels don’t hold, Bitcoin could slide further toward $82,000–$80,000. For now, it’s wise to stay on the sidelines and let the market show its next direction.