Ethereum (ETH) remains under the $2,700 level despite Bitcoin’s resilience, as the broader crypto market and top altcoins rebound. Traders appear to be shrugging off concerns over China’s DeepSeek artificial intelligence advances and U.S. President Donald Trump’s tariffs.

The largest altcoin’s price performance remains underwhelming, however this could change as sentiment among traders turned positive, according to data provider Cryptoeq.

Ethereum price struggles even as on-chain metrics turn bullish

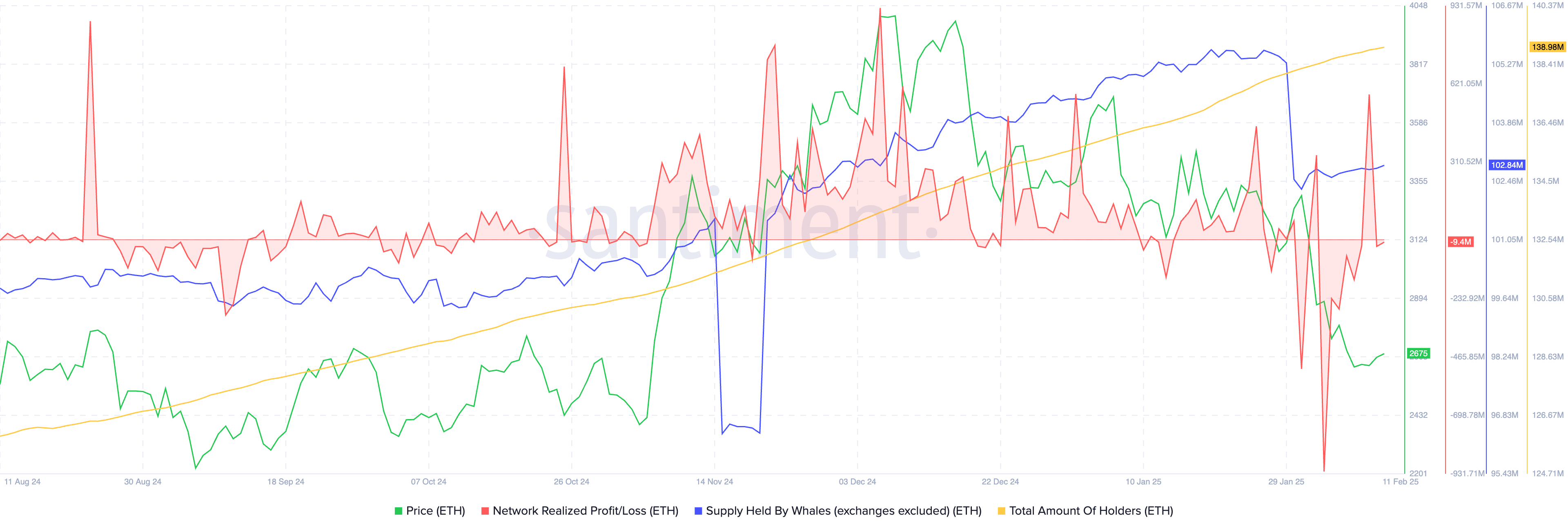

Ethereum’s holder count has continued to rise steadily, according to on-chain data from intelligence tracker Santiment. On Tuesday, the number of Ethereum holders climbed to 138.98 million, marking an increase of nearly 500,000 new Ether holders holders in the past week. This supports a bullish thesis for the altcoin.

The Network realized profit/loss metric, which measures the net profit or loss of Ether tokens moved daily, showed large negative spikes between Jan. 30 and Feb. 8.

A large number of traders selling ETH at a loss is typically considered a sign of capitulation. Ethereum traders may be exchanging their ETH for stablecoins or other cryptocurrencies, which could signal a potential price recovery in the near future.

Ethereum supply held by whales or large wallet investors, excluding exchange wallets has climbed by nearly half a million ETH tokens in February 2025.

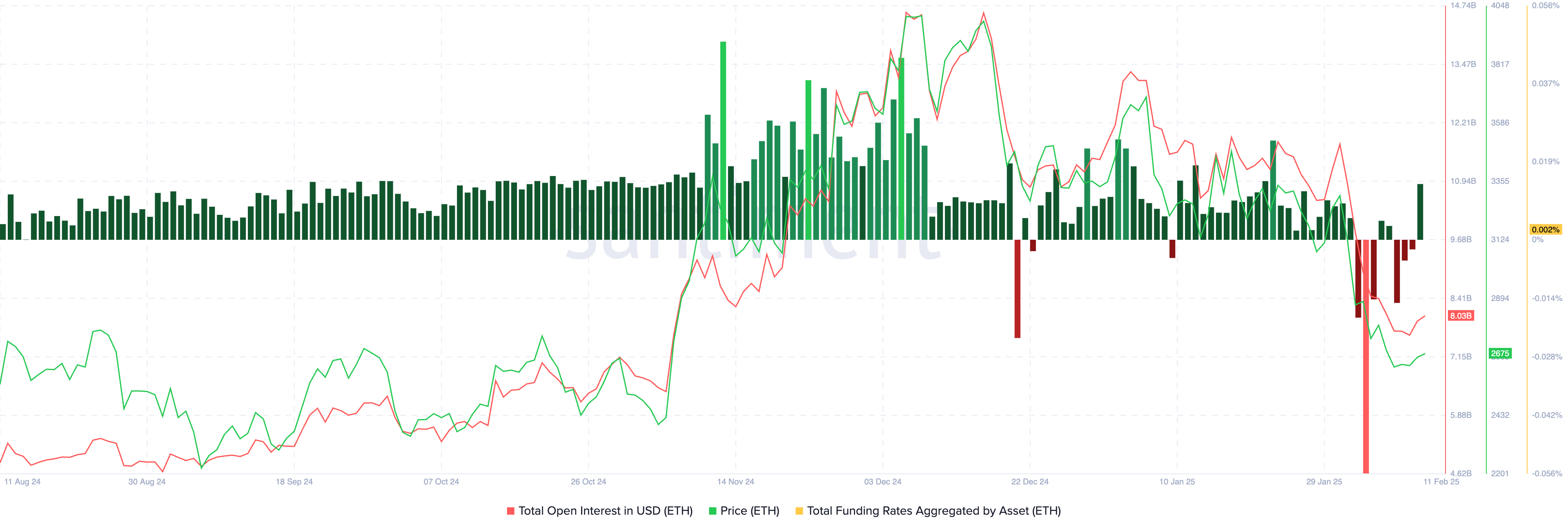

Metrics from derivatives traders show the sentiment shifting towards “bullish.” The funding rate aggregated across derivatives exchanges turned positive, after several negative spikes in the chart. The total open interest or value of all open derivatives contracts in Ether climbed to $8.03 billion, according to Santiment data.

Derivatives traders anticipate a recovery in Ethereum price.

Whales accumulate Ether while institutions are indecisive: Bull case

U.S. Spot Exchange Traded Fund flows from Farside Investors shows no significant inflows or netflows to Ether ETFs in the past four business days. On Feb. 10, Ethereum ETFs recorded $22.5 million in outflows, as seen in the table below.

While whales off exchanges accumulate more Ether, institutional interest in Spot Ether ETFs does not show signs of growth. This supports a bearish thesis for the altcoin and Ethereum likely faces an uphill battle when it comes to institutional adoption, when compared to the largest cryptocurrency, Bitcoin (BTC).

Lookonchain data shows that institutional interest is slowly shifting with $514,000 in net inflows at the time of writing on February 11, Tuesday.

Experts says Ethereum value proposition is strong

Marcin Kazmierczak, Co-founder & COO of blockchain startup RedStone told Crypto.news in an exclusive interview:

“While ETH’s price may fluctuate with broader market sentiment, its fundamental value proposition remains remarkably strong. The network has evolved into a sophisticated financial ecosystem, processing over $30 billion in daily transactions across its Layer 2 networks like Arbitrum, Base, and zkSync.

Short-term price movements often overshadow the network’s growing adoption – from institutional participation in liquid staking to the scaling solutions handling millions of daily transactions. This robust infrastructure and proven utility suggest Ethereum’s long-term trajectory is more about ecosystem growth than temporary market reactions. While a dip of ETH below $2k is possible, it depends on the broader crypto market’s volatility and where negotiations land today.”

Staked Ether plateaus as institutional attention is focused on Bitcoin: Bear case

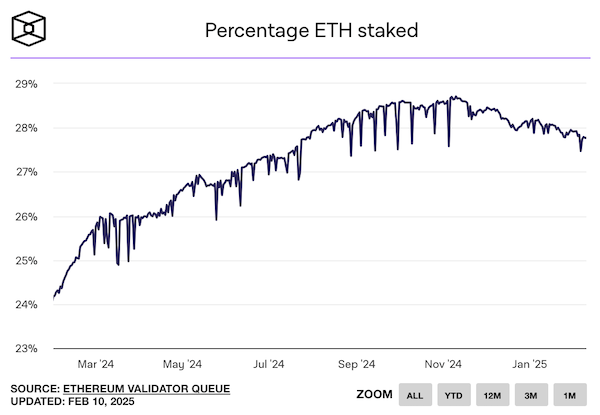

Data from The Block shows that the percentage of ETH staked Ethereum’s staking contract has declined to 27%, returning to levels last seen in July 2024. This is the first notable drop since ETH staking peaked at 29%, reached in late 2024.

Currently, 33.5 million ETH remains staked, ensuring that the Ethereum network remains secure despite this decline.

Ethereum is critical to the DeFi and NFT network it supports, even while institutions shift their focus to Layer 2 protocols or Bitcoin. The rising opportunities for earning a yield and airdrops from Layer 2 chains across the ecosystem has likely resulted in traders taking a measured approach to Ether staking.

The shifting landscape of Ether staking therefore presents both opportunities and challenges for the network. The Ether ecosystem continues to evolve and the dynamics between staking rates, protocol dominance, and network security likely influence both protocol development and ETH holders’ behavior.

Ethereum long-term outlook is bullish

Ruslan Lienkha, Chief of Markets at YouHodler told Crypto.news in an exclusive interview:

“While the short-term outlook for Ethereum appears bearish, a broader perspective reveals that its price is approaching a strong long-term support level. This suggests that, despite current market weakness, institutional investors see an attractive entry point for long-term accumulation.

Historically, such accumulation by institutional players often precedes a market recovery, as these investors tend to take positions based on long-term fundamentals rather than short-term price fluctuations. Additionally, with other major cryptocurrencies having reached new all-time highs multiple times in recent months, ETH may be positioned for a significant upward move once market sentiment shifts.”