Pi Network crashed after the mainnet launch, leading to a $6 billion wipeout in the first two days.

Pi Network (PI) was trading at $0.76 on Saturday, down from the mainnet launch price of $2. Here are the four main reasons why the Pi coin price crashed.

Pi Network prices crashes amid scam accusations

A key reason why the Pi coin price crashed is that Ben Zhou, Bybit’s chief executive officer, attacked it of being a scam. He cited a Chinese report that accused Pi of being a scam targeted towards the elderly.

Pi Network has rejected these accusations and maintained that it is a genuine crypto project that has been in development in the last six years.

Bybit’s CEO statement was notable for two reasons. First, the company has become the second-biggest crypto exchange in terms of volume after Binance. Second, it came on the same day that a $1.4 billion hack happened on its exchange.

Pioneers likely dumped their tokens amid panic

Another reason why the Pi coin price crashed is that many pioneers decided to dump their tokens after the mainnet launch.

Historically, most pre-mainnet launch token holders sell them as soon as possible to prevent further losses. In Pi Network’s case, many of these holders have seen other tap-to-earn tokens crash without bouncing back.

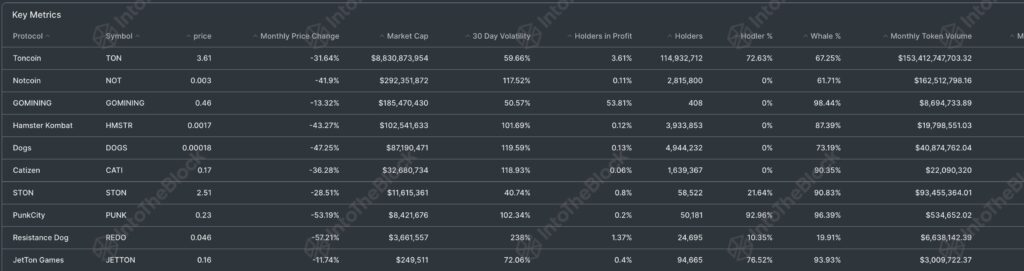

The chart below shows that all tap-to-earn tokens on the TON blockchain have crashed after their mainnet launch. This includes popular names like Notcoin (NOT) and Hamster Kombat.

Many newly launched tokens crash

Further, Pi Network price crashed because many recently-launched tokens have crashed. For example, a high-utility token like Wormhole (W) initially peaked at $1.6 after its airdrop in April last year and has crashed to $0.18.

Similarly, ZkSync (ZK) price soared to $0.2942 after its airdrop and then dropped to $0.1. EigenLayer (EIGEN), another blue-chip coin, dropped from $5.6 in 2024 to $2.

Most recently, Official Trump and Melania meme coins have plunged by over 80% from their peak.

Pi coin price crashed as cryptocurrencies dived

Further, the Pi Network price crash accelerated because of the ongoing weakness in the crypto industry. Bitcoin price remains in a correction after falling by 10% from its all-time high. Other altcoins like Ethereum, Cardano, Algorand, and Near have also pulled back by double digits from their November highs.

The crypto fear and greed index has moved from the extreme greed zone of 88 to the neutral point of 40. Historically, newly launched tokens do well when there is a bull market.

This is a similar concept as in the initial public offerings, where many newly listed firms rise when stocks are doing well.

Will Pi Network price rebound?

It is hard to predict whether the Pi Network coin will bounce back this year since it is in a price-discovery phase. Its rebound will likely depend on more demand coming in from investors, and its ecosystem growth.

Pi Network had about 100 apps on its network at the mainnet launch. A strong user growth for some of these apps may be a good catalyst for the price.

For example, wildly popular dApps like AAVE and Uniswap have helped to support the Ethereum network in the past few years.