Ethereum price has crashed this year and is hovering near its lowest level since September last year.

Ethereum (ETH) was trading above $2,200 at last check Sunday, down by over 45% from its highest point in November last year. Several crucial charts explain why the ETH price has crashed, and provide hints of what to expect this year.

Ethereum price formed a triple-top pattern

The weekly chart shows that the ETH price found strong resistance at around $4,000 in 2024. This pattern is characterized by three peaks and a neckline, and is one of the most bearish patterns in the market.

ETH has now dropped to the neckline at $2,150. Therefore, a clear break below that level risks more downside, potentially to $1,176, down by 45% from the current level.

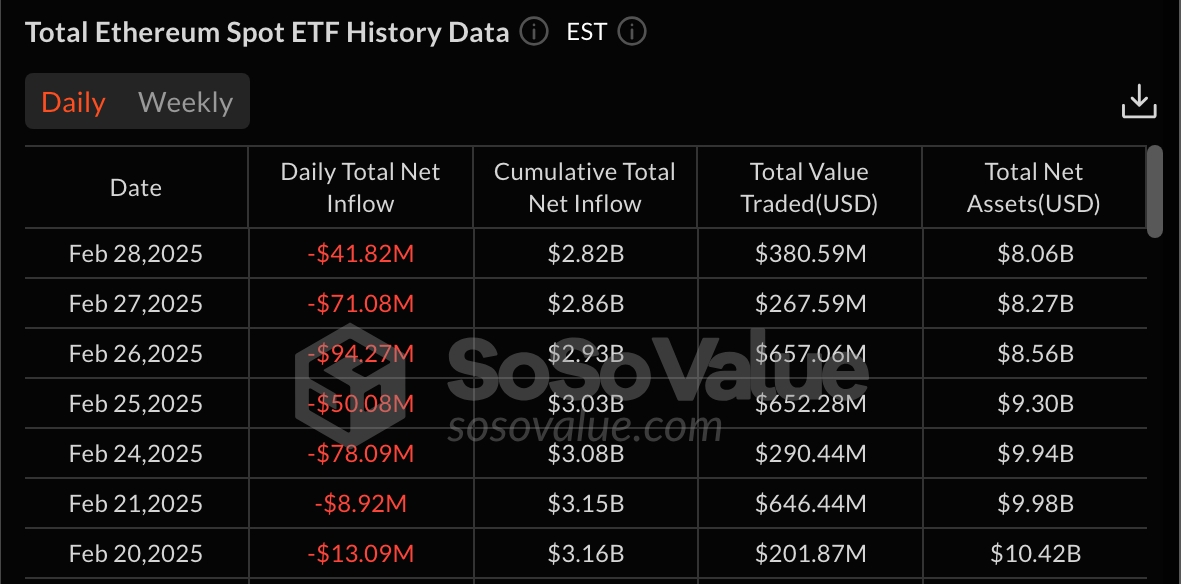

Spot ETH ETFs are having outflows

Meanwhile, spot ETH ETFs have had substantial outflows in the past few weeks.

And while these funds have attracted cumulative inflows of $2.82 billion, it’s a much smaller figure compared to Bitcoin’s $38 billion.

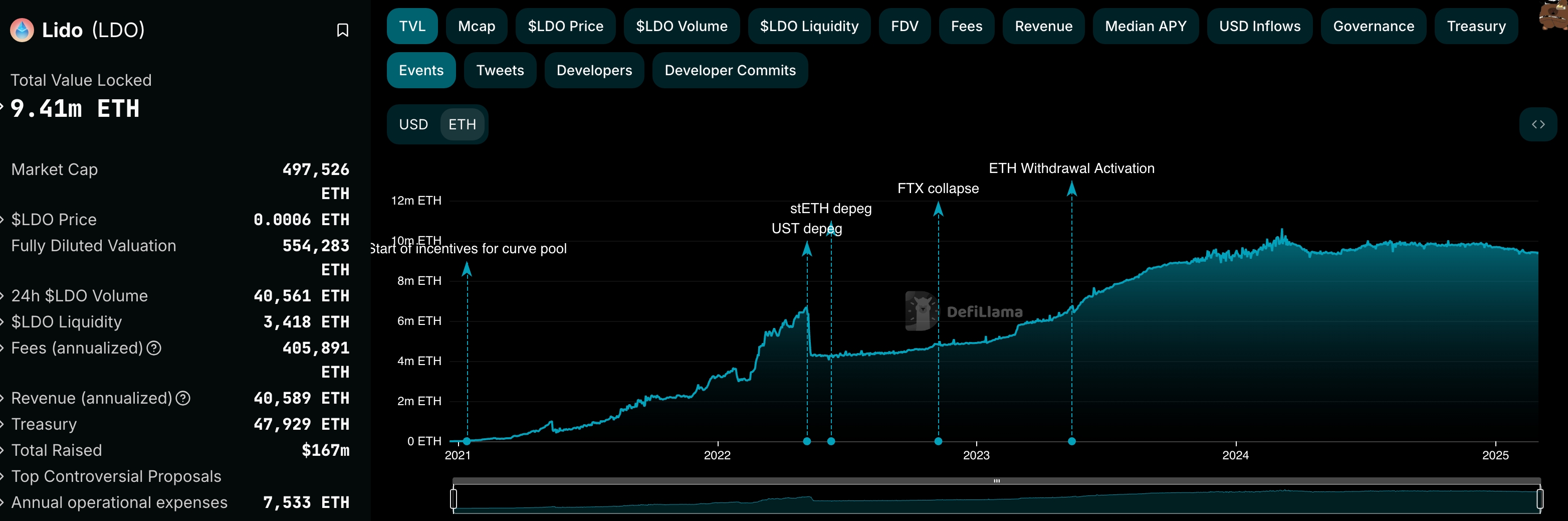

Ethereum staking outflows rise

ETH price has also crashed as staking outflows rise. Data by StakingRewards shows that the staking market cap has dropped by 20% in the last seven days to $74.5 billion. It has had outflows in the last four straight days.

A good example of this is Lido, the biggest liquid staking network in the crypto industry. Lido’s total value locked has dropped from over 10.1 million ETH to 9.41 million.

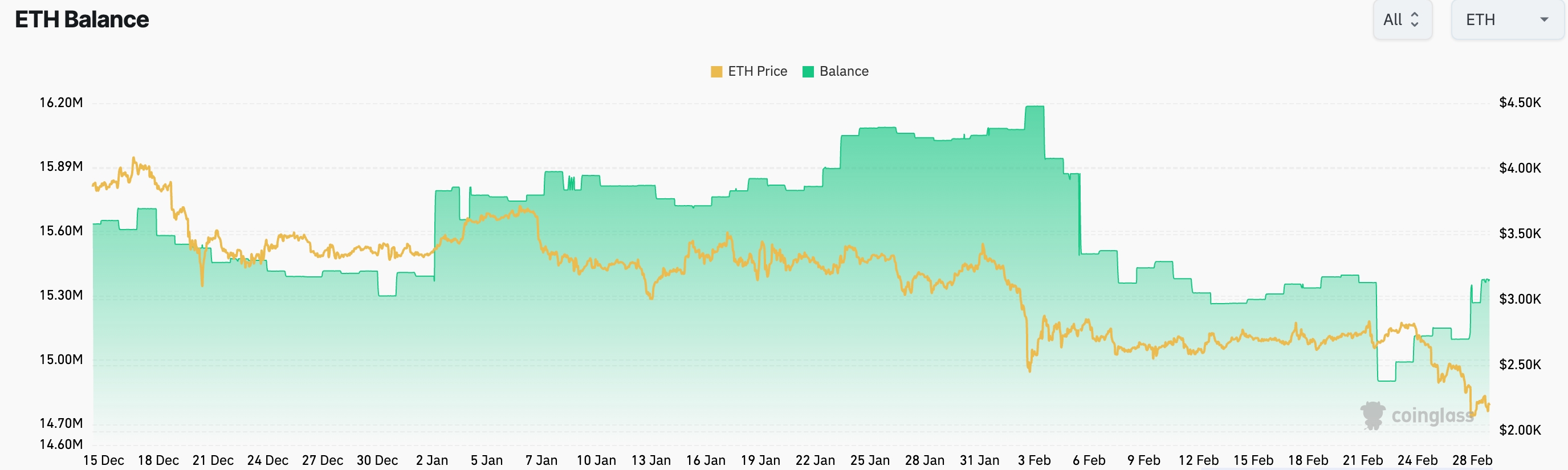

Ethereum balances on exchanges are rising

Further, there are signs that more investors are selling their ETH coins. One way of finding this is to consider the balances on exchanges. Data by CoinGlass shows that the balances have risen in the past few days. These balances rose to 15.40 million, the highest level since Feb. 1.

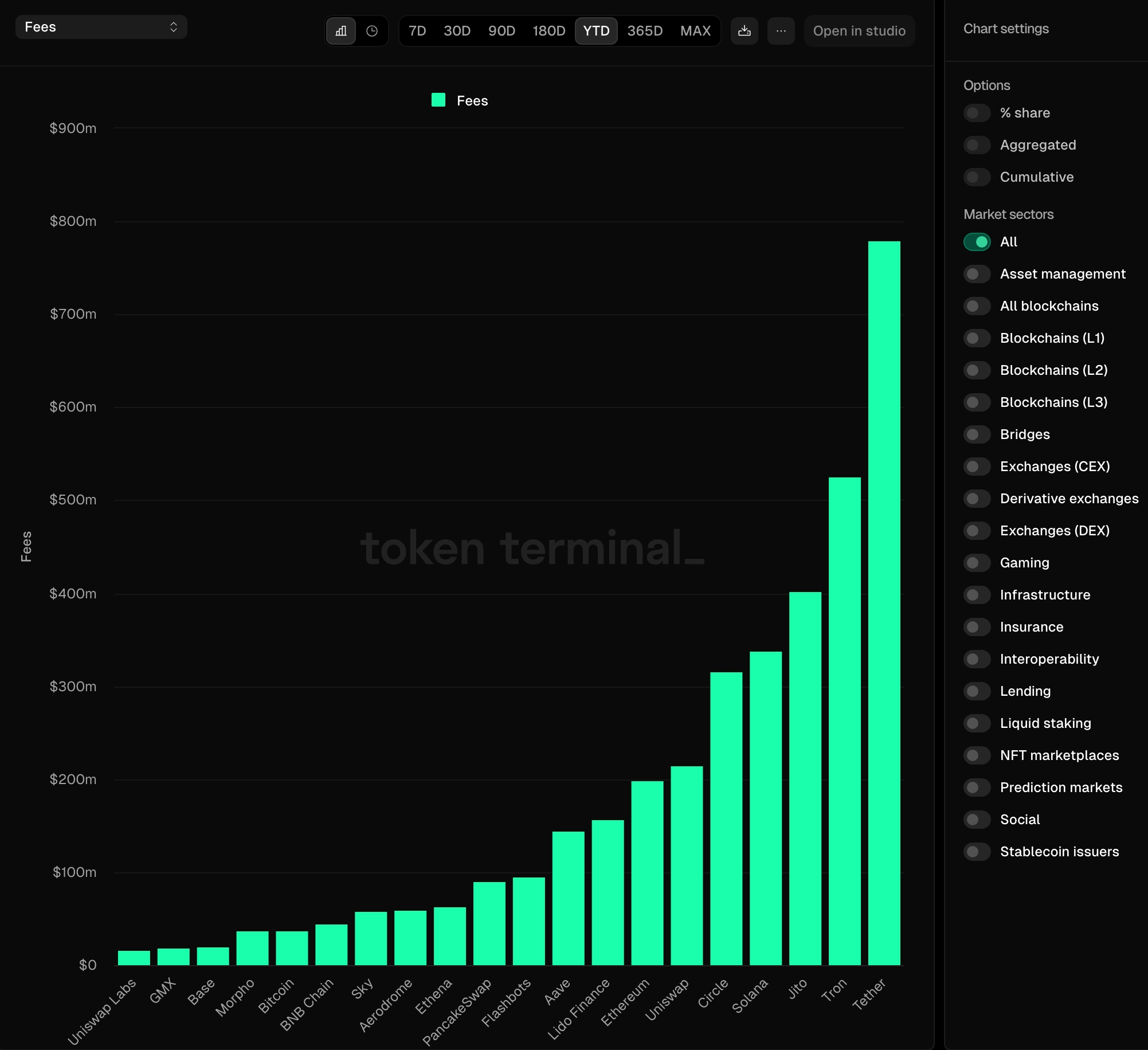

Ethereum fees have dropped

Further, Ethereum’s price has dropped because it is no longer the most profitable player in the crypto industry. Ethereum has made $198 million this year, meaning that it has been overtaken by other players in the crypto industry like Uniswap (UNI), Circle, Solana (SOL), Jito (JTO), and Tron (TRX).

Other charts explain the ongoing ETH price crash. For example, this chart shows that Ethereum is losing market share in the DEX industry, where layer-2 networks like Arbitrum and Base are struggling. Another chart by Santiment shows that Ethereum whales have been selling the coin.