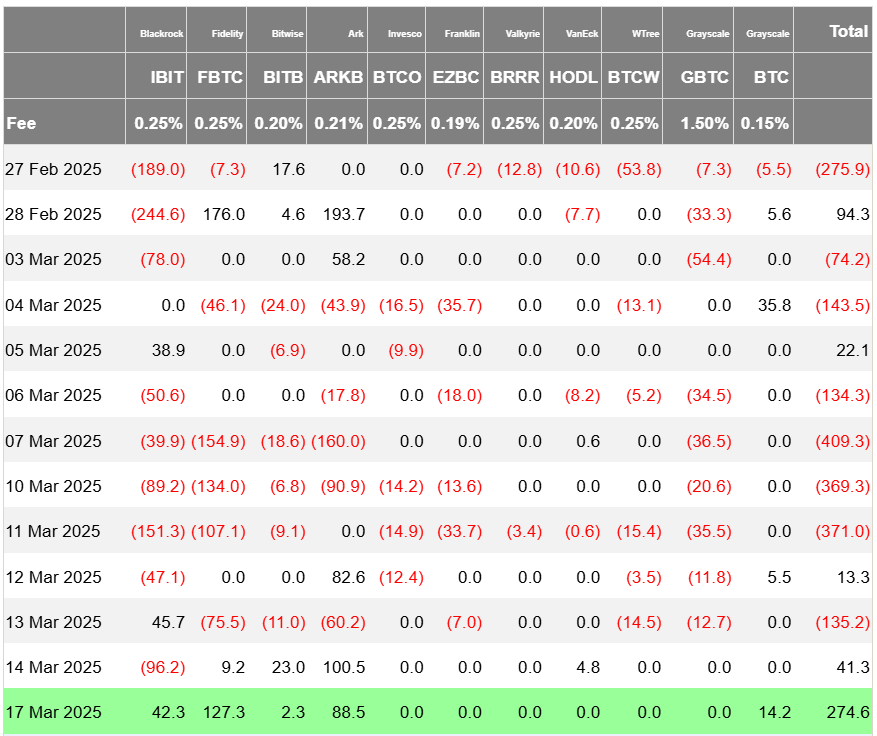

Bitcoin exchange-traded funds recorded $274.6 million of inflows on Mar. 17, sparking speculations of a potential reversal.

Bitcoin (BTC) ETFs have experienced a notable turnaround, ending their streak of outflows with significant inflows totaling $274.6 million on March 17, making it the highest daily inflow since Feb. 4. All of the five Bitcoin funds enjoyed net inflows, led by Fidelity’s FBTC at $127.3 million. ARKB came second, recording $88.5 million of new inflows, followed by BlackRock’s IBIT with 42.3 million, Grayscale’s Bitcoin Fund at $14.2 million, and Bitwise’s BITB at $2.3. None of the funds recorded net outflows on the day.

While these figures look encouraging, it’s important to note that Bitcoin ETFs have just ended their five consecutive weeks of outflows of nearly $5.4 billion, according to SoSoValue data. This was largely driven by the macroeconomic uncertainty ensuing after Trump had introduced tariffs, which offset the positive impact of his efforts to buttress Bitcoin and other assets by including them in the strategic reserve.

Meanwhile, Bitcoin price is currently consolidating around the $83,000 level, currently trading for $82,883 — down by just over 1% for the day. The 20-day exponential moving average sits at $85,559, acting as a dynamic resistance level BTC is struggling to break above. The failure to reclaim the 20-day EMA suggests that bears remain in control. If the price manages to break and hold above the resistance at $85,500, a move toward $88,000 – $90,000 could be on the horizon. However, if it drops below the $82,000 support, further downside toward the next support level at $80,000 might be in store.

However, if we zoom out, the broader trend still suggests long-term bullish potential, so the $274.6 million inflow on March 17 might be a signal of renewed institutional confidence after the prolonged outflow period.

According to trader Coinvo, Bitcoin price has recently broken out of the cup and handle pattern and has formed a bullish flag pattern, signalling a potential rally toward $125,000 in the coming months. So, the bearish consolidation around the $82,000 – $83,000 level could act as a base for the next upward move, provided Bitcoin can reclaim key resistance levels.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.