As the risk of tariff-related uncertainty persists into the second quarter, the crypto market could face another dip following the recent correction in March, analysts at Nansen say.

As the industry heads into April, Bitcoin (BTC) and the wider crypto market could be staring down another dip as uncertainty surrounding tariffs and U.S. trade policy might cause further volatility.

According to Nansen’s analysts, there’s a chance that the market may face another correction in the weeks after April 2. In fact, the researchers believe there’s a 70% likelihood that another price dip will occur after this date.

President Donald Trump had earlier promised to roll out new tariffs on April 2, calling it a key moment for the economy just weeks after the last round shook up markets and sparked recession worries.

In a recent interview with crypto.news, Aurelie Barthere, principal research analyst at Nansen, shared her outlook on the market, stating that after a brief correction following April 2, she expects the market to stabilize and pave the way for future growth.

“In my main scenario, 70% subjective likelihood, I expect another leg down in crypto prices after April 2 after we reached a local bottom in mid-March. After this second correction, I expect we will be bottoming for the rest of the year (continuation of the bull market and revisit of the ATHs for BTC).”

Aurelie Barthere

However, it’s not all doom and gloom for the crypto market. While another dip isn’t ruled out, Barthere suggests that after that correction, Bitcoin could rebound, benefiting from a supportive macro environment, including the growing adoption of crypto in the U.S. and a lack of recession signals. Still, Barthere remains cautious as for the remaining 30% “it would be if we have already bottomed or if this is just a dead cat bounce for U.S. equities and crypto,” she said.

“For the remaining 30%: it would be if we have already bottomed or if this is just a dead cat bounce for U.S. equities and crypto (in case of a recession, which is not my base case, I think the U.S. is just slowing from 3% to 1.5-2% growth).”

Aurelie Barthere

Uncertainty may last well into Q2

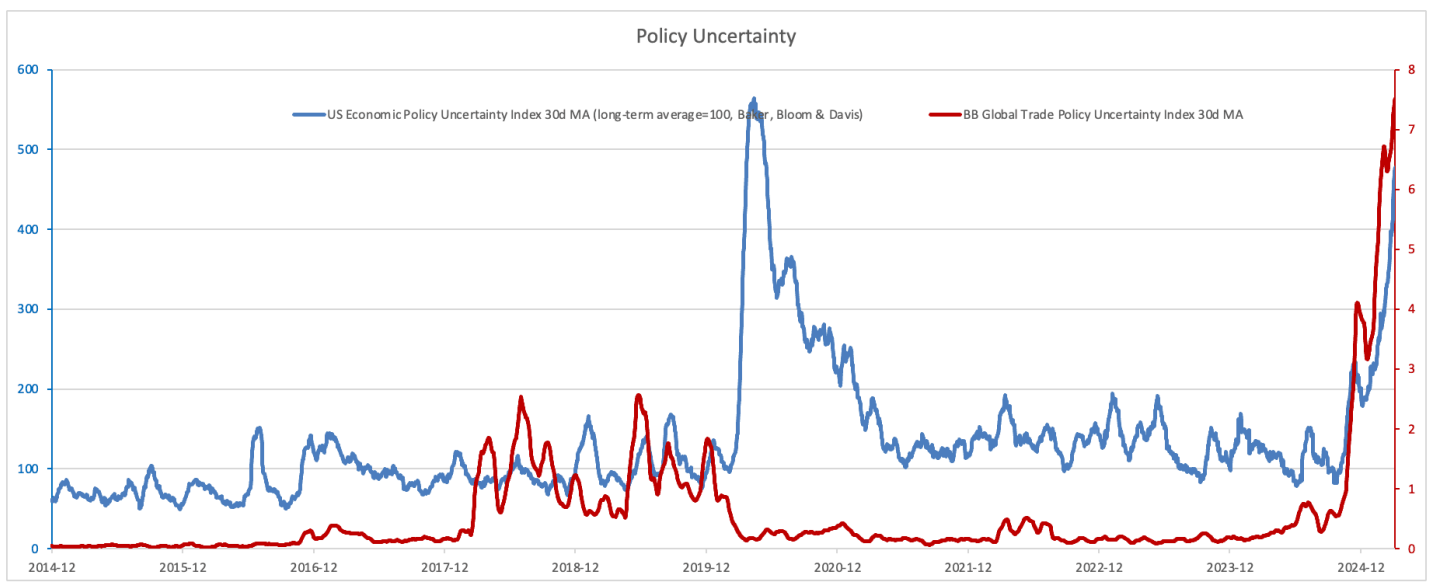

The tariff situation has been a significant driver of market volatility, with the U.S. policy uncertainty index reaching new highs. Trade discussions have become a key source of investor anxiety, but Nansen believes that uncertainty could peak soon.

As Treasury Secretary Bessent recently noted, many of the U.S. trading partners are already negotiating to lower their own trade barriers, which has helped to calm some fears. Even Trump recently hinted at potential tariff “exemptions” in certain circumstances. But as Barthere pointed out, while these talks may result in long-term growth benefits for the U.S., the lingering uncertainty may last well into Q2.

“Right now, I think that we are experiencing corrections within a crypto bull market. Why I see this as a bull market still: 1) Ongoing progress on crypto regulation and crypto institutionalization in the U.S., and 2) U.S. real growth has slowed but is not flashing ‘recession.’ Of course, this is my only main scenario, and I will continue to watch data and markets for signs that this is the correct reading.”

Aurelie Barthere

As Barthere put it, there’s a “50/50 chance that we’ve passed the peak of trade policy uncertainty,” adding that the true impact of these tariff negotiations might not be fully clear until mid-year. “We still see this peak uncertainty as more likely between April and June, especially with the start of U.S. tax cut package discussions,” she wrote in the research report.

The uncertainty, according to Nansen’s research, could trigger another short-term correction in both Bitcoin and U.S. equities.

No evidence of recession

Still, there’s reason for optimism. The report mentions that technicals are showing encouraging signs. “The dip is being bought, for BTC and for U.S. equities,” Barthere says, adding that spot Bitcoin ETFs recorded a “seven-day streak of net inflows, a first since crypto prices peaked.”

One way or the other, it’s clear that the market remains cautious. A lot of people are questioning whether the crypto bull run is still going strong or if we’re getting close to a peak. If history is any indication, times of economic uncertainty have often lined up with market downturns, making investors even more cautious.

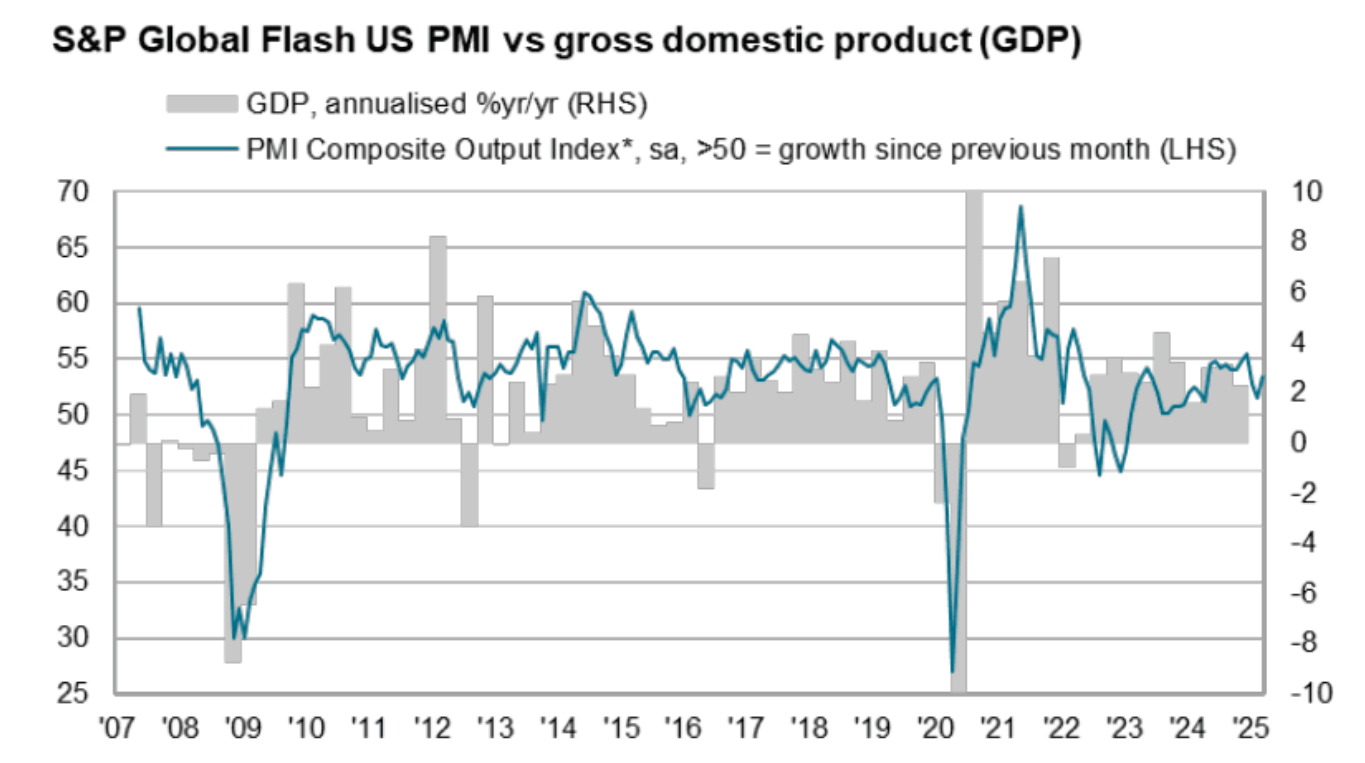

After market sentiment hit extreme fear last week, with some investment banks raising the U.S. recession probability to 40% this year, hard economic data has eased these concerns. The latest U.S. March flash PMI report shows a 53.5 score, the highest in three months, suggesting a 1.9% annual growth rate. However, the growth for the whole quarter is lower at 1.5% due to weaker data in January and February.

Barthere emphasized that so far, there’s no hard evidence of a recession as “most of the data weakness has been in sentiment indicators, while hard economic data has held up.” She added that “there is no evidence of recession at this stage, so no evidence that we have transitioned to a bear market.”

While the coming months may bring more ups and downs, Nansen’s report suggests that the overall bull market is still in play. As Barthere puts it, the market is “likely to see a correction, but then we’ll bottom out for the rest of the year and head towards new highs.”